FTSE for Friday: index analysis and stocks to watch

31st December 2021 09:17

by Alistair Strang from Trends and Targets

As we reach the end of another tumultuous year, independent analyst Alistair Strang assesses possibilities for the UK's leading shares index.

Thursday, the last full day on the markets before New Year dawns, managed to pass virtually un-noticed. We shouldn't really have been surprised thanks to volumes being lower than public expectations of politicians. The media appear to be enjoying a feeding frenzy, telling anyone who'll listen Covid-19 cases are at record numbers, but the stock market appears to be taking a sceptical stance.

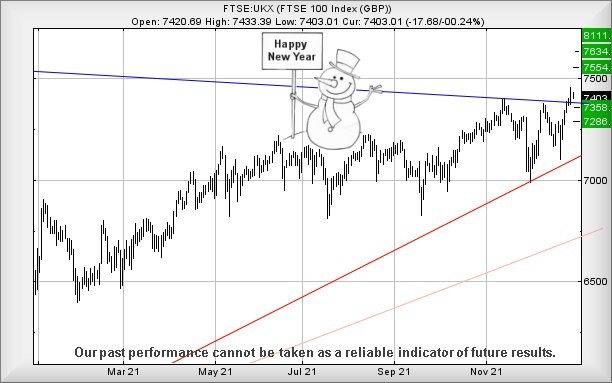

The harsh reality is of a market requiring above 7,459 to trigger some useful recovery, now pointing at the potential of movement to an initial 7,554 points with secondary, if bettered, recalculating at 7,634 points.

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

- Why reading charts can help you become a better investor

If everything intends to go wrong, below 7,380 looks slightly troublesome, allowing weakness to an initial 7,358 points with secondary, if broken, now working out at 7,286 points. Such movement obviously risks undoing the recent upward trend break, effectively parking the index until such time the state of the nations health becomes clear.

Source: Trends and Targets. Past performance is not a guide to future performance

This time of year is always fascinating, many pundits giving tips for shares and markets to watch next year. Scanning the US financial press currently reveals a bias toward coming growth in the financial sector and, somewhat humorously, the UK financial sector is mentioned as "one to watch" as it's been underperforming for years. Who knows, maybe 2022 shall prove to be the year this prediction actually comes to fruition?

For now, our best wishes for the coming year. We're not inclined to throwing "tips" at readers but do suspect, quite strongly, the travel industry and its associated components in aviation shall be one capable of disproportionate movements, should a belief in Covid-19 retreating gain credence.

Shares such as Rolls Royce (LSE:RR.), IAG (LSE:IAG), even easyJet (LSE:EZJ), should accelerate pretty fast if things ever start to return to whatever passes as normal.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.