Funds and investment trusts: how small is too small?

We look at the pros and cons of investing in funds and trusts that fly under the radar.

10th February 2021 10:59

by Kyle Caldwell from interactive investor

We look at the pros and cons of investing in funds and trusts that fly under the radar.

There are thousands of funds and around 400 investment trusts for investors to pick from – is there ever an argument for going against the crowd and investing in the tiddlers?

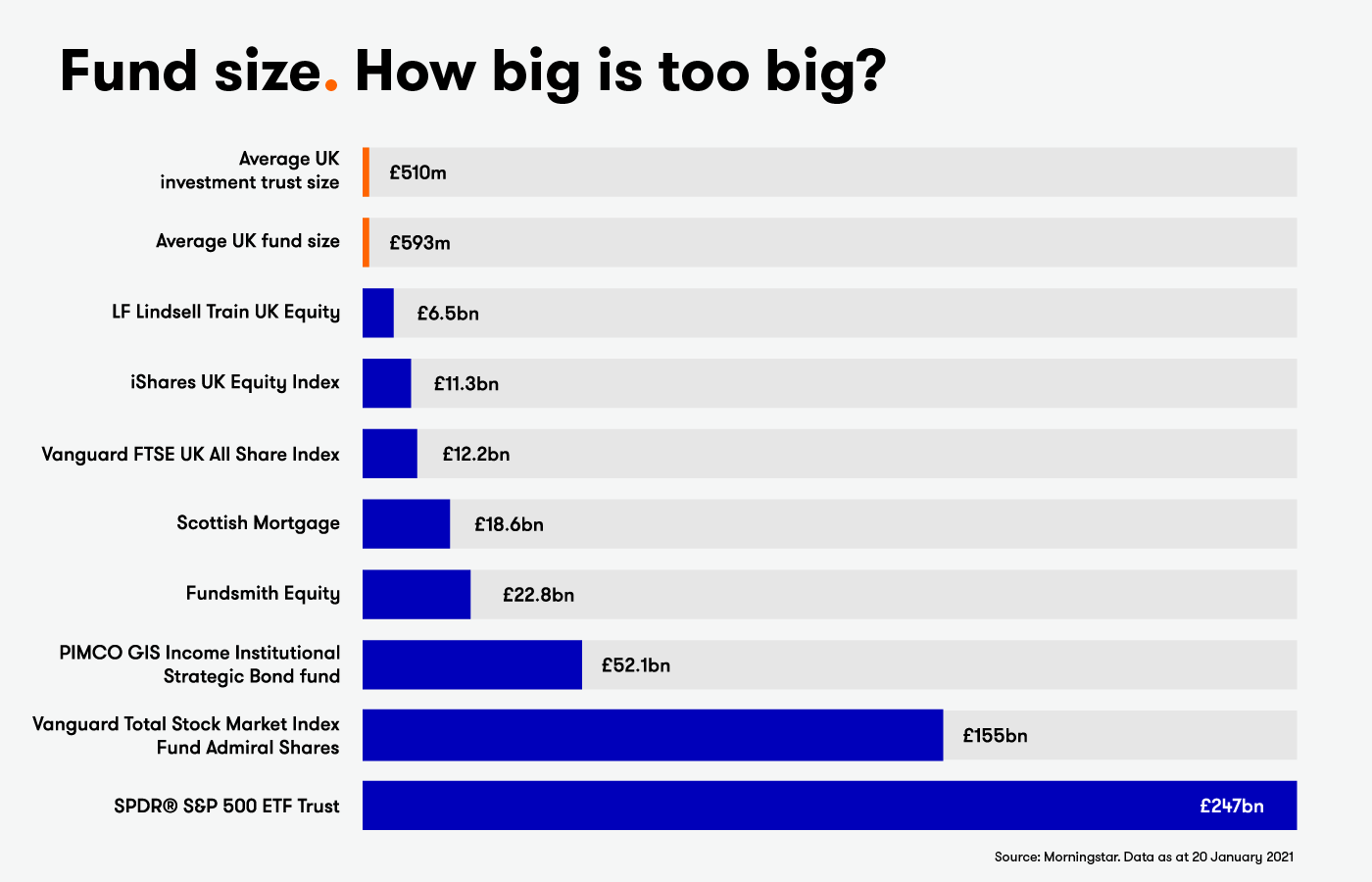

There are advantages and disadvantages to choosing a small fund. First, investors should not immediately write off an under-the-radar fund or trust. While ‘small’ is subjective, as a rule of thumb a fund or trust considered small or sub-scale has assets of less than £100 million.

Small can be a virtue

Smaller funds are nimbler and more flexible than large funds with billions of pounds of assets under management. This is because the pool of stocks that big funds can invest in shrinks the bigger it becomes. Dealing with large sums means a fund manager can only invest in the largest and most liquid shares. But smaller funds are not constrained by size and are able to move in and out of shares quicker. Therefore, small funds are deemed more efficient in exploiting opportunities. This can be a tailwind that helps boost performance.

- Find out why funds can become too big and the potential problems for investors

- Check our latest Funds Fan podcast

Some small funds are overlooked due to being managed by boutique asset management firms. These firms spend little or nothing on advertising and instead let their performance do the talking. Boutique fund management groups usually stick to one area – emerging markets or smaller companies, for example – rather than attempting to be a jack of all trades across various asset classes and sectors.

Backing a boutique has the advantage of the fund manager’s interests being more directly aligned with fund performance. This is due to the fact that he or she has a bigger stake in the overall business.

Another potential benefit is that boutiques usually have more independence in the way they manage assets. In contrast, in larger management groups there can be pressure to toe a corporate line.

Of course, greater freedom is not always healthy. Particularly if there is a lack of oversight on how the fund manager invests and the manager is not being challenged appropriately.

Just as acorns grow into great oak trees, small funds can become large. For example, the CFP SDL UK Buffettology fund had a size of £42 million in 2016. But, on the back of its consistently strong performance, the fund assets grew to £144 million a year later and £328 million in 2018. Today, the fund has £1.5 billion in assets. The fund is one of interactive investor's Super 60 choices.

- Will fund managers cash in on more favourable backdrop?

- Fund sales are booming, here's what investors are buying

But some funds and trusts are small for a reason…

Some funds and trusts are subscale due to performance failing to stand out from the crowd, which has led to low investor demand.

A fund with a small amount of assets that has been around for several years and is run by a big asset management company should set the alarm bells ringing. This is a sign the fund has struggled to get on the radar of investors and may be a persistently weak performer. Or perhaps a once-big fund has suffered a notable period of underperformance, which has led to investors throwing in the towel.

It’s not just funds that you need to be wary of; the investment trust industry has faced criticismfrom commentators and analysts over the years for having too many small, sub-standard trusts with assets worth £100 million or less.

Research last summer by Winterflood found 88 trusts with a market capitalisation of less than £100 million and most trade on discounts of 10% plus. As there are around 400 investment trusts in total, this is a relatively high proportion.

- Three ways trusts are broadening their appeal to private investors

- Read more of our funds and trusts content

While investment trust discounts can be a useful tool for private investors to take advantage of, the risk is that a discount remains static or widens further. A trust with a small amount of assets under management, and in low demand, will be unlikely to see its discount narrowing.

James Carthew, head of research at QuotedData, notes: “Small trusts find it harder to grow – it is one of those Catch-22 situations where small trusts just don’t have the budgets to promote themselves and so, if they are trading at a discount, this may become entrenched.”

A big part of the Catch-22 situation is that small trusts are ruled out on the grounds of being too illiquid (not easy to buy and sell quickly) by large wealth management companies. These firms prefer to invest in large trusts (typically those over £200 million), so they can trade quickly and efficiently. Owing to this, small trusts can remain small and in a low demand, which is reflected in them trading on a persistently wide discount.

Carthew adds that the board of a small trust with substandard performance “should be thinking seriously about whether a combination with a larger, more successful peer could provide shareholders with a better long-term outcome”.

Other drawbacks with small funds and trusts

Another disadvantage is that small funds run by boutique fund managers tend to be more expensive than funds managed by large asset management companies. This is down to boutique fund managers having more overheads, which makes achieving economies of scale more difficult.

The average ongoing charge figure for a fund investing in shares or bonds in a developed market is around 0.85% a year, so £85 on a £10,000 investment. A boutique fund firm would typically charge above 1%.

In the case of investment trusts with a small amount of assets, the charges can be much higher and above 2% is not unheard of.

A few percentage points of fees may not seem like much over one year, but over 20 or 30 years it can have big impact if the fund or trust fails to add value in terms of outperforming peers and the index.

Ben Yearsley of Shore Financial Planning points out: “It really depends on the fund group behind the fund. The reason I say that is because small funds are only a problem due to high levels of fixed costs making the fund charge prohibitively expensive and this eating into returns.

“A ‘one fund’ group will need a higher level of assets under management to cover the costs of back office, compliance, managers, etc. They will probably need £250 million as a minimum to break-even. Whereas a small new fund at a big group won’t have those issues.”

In the case of investment trusts, the same trend plays out and trusts with a small amount of assets tend to charge higher fees. In addition, there is the added correlation between size and the bid-offer spread on trusts, which tends to be higher on small trusts due to them being less frequently traded.

So don’t rule out minnows from your portfolio, but be mindful of these traps if you decide to invest.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.