Gilead Sciences is not just a Covid-19 play

It’s fighting coronavirus, but there’s more to this US drug giant, including a decent dividend yield.

24th June 2020 09:42

by Rodney Hobson from interactive investor

It’s fighting coronavirus, but there’s more to this US drug giant, including a decent dividend yield.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Cold water has been poured on the possibility of a takeover bid for vaccine maker Gilead Sciences (NASDAQ:GILD) but the US company is worth considering in its own right.

After nearly five disappointing years, the future is looking brighter, a fact that is not yet reflected in the share price.

A report earlier this month suggested that UK-listed AstraZeneca (LSE:AZN) would offer £200 billion for Gilead in what would be the biggest pharmaceutical merger so far. The idea was promptly played down and, although it might make economic sense, it looks unlikely to happen.

AstraZeneca is one of several companies racing to create a vaccine for Covid-19 and will probably not want the distraction of merger talks until the goal is achieved. It is only after a vaccine is found to work, or Covid-19 dies out, that talks could happen, and that could be a long wait.

Picking companies in the hope they will be taken over is a dubious tactic for investors to follow. However, choosing companies with a promising future is at the heart of investing – and if the company is subsequently taken over it will need a knock-out bid to succeed, giving shareholders icing on the cake.

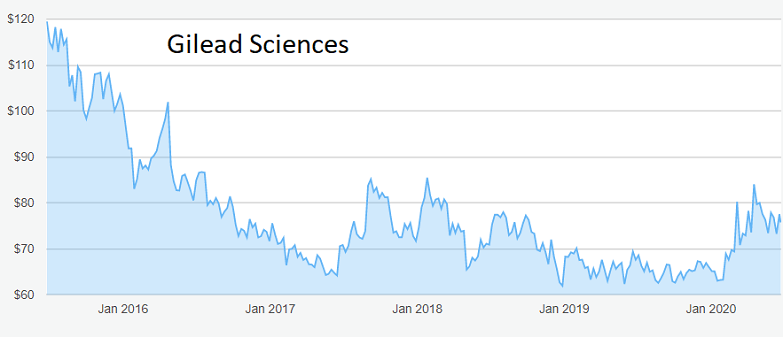

Source: interactive investor. Past performance is not a guide to future performance.

Meanwhile, Gilead has its own Covid-19 project: it is testing its antiviral treatment remdesivir as a treatment for children from babies to adolescents with moderate to severe Covid-19.

While the coronavirus affects older people disproportionately, especially those with underlying health problems, children and young adults have been hospitalised with Covid-19, and this age group has been generally neglected by the pharmaceutical industry.

If remdesivir is shown in the tests to be effective and well tolerated, Gilead could corner the market for this age group.

It is already providing the treatment to pediatric patients with severe Covid-19 under its “compassionate use” programme. The kudos could be worth as much as the revenue.

- The Ian Cowie portfolio: a healthy return on this investment

- Why Genedrive shares are up 3,200% in just six weeks

- Want to buy and sell international shares? It’s easy to do. Here’s how

Among other treatments are its portfolio of drugs for HIV and hepatitis C. The older ones are out of patent protection and are fading as users switch to newer and cheaper alternatives. Truvada faces competition from generic alternatives in the US from this year.

Gilead does, however, have some newer drugs: Biktarvy should lead the way in helping to stabilise or even increase revenue from HIV drugs, which are overall expected to generate strong cash flow.

Another hopeful is Yescarta, which is awaiting US regulatory approval for treating mantle cell lymphoma. While this is a rare form of cancer, there is scope for successful sales as competition to provide treatment for such illnesses is less intense.

US regulatory approval is also awaited for filgotinib, a treatment for rheumatoid arthritis that could also be effective in treating a wide range of other immunology ailments. Even if filgotinib has limited uses, Gilead will still have a blockbuster on its hands.

- Coronavirus cures: This stock is the current front-runner

- Apple: how the world’s biggest company can get much bigger

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Investors should bear in mind that most drugs fall at one of several hurdles in the race to regulatory approval. However, success in finding any new treatment is potentially highly lucrative while patents last.

Gilead shares were $120 five years ago, but they plunged on fears that its drugs were running out of patent protection with no new blockbusters on the horizon. They have bumped along at little more than half that level for much of the past three years despite solid dividend payments.

Excitement over the possible use of remdesivir as a Covid-19 treatment propelled them to $84 at the end of April, but they currently languish at around $75, where they yield 3.6%.

Hobson’s choice: Buy up to the recent peak of $84. There is a solid floor around $61, but I believe that is unlikely to be tested again. In recent weeks $73 has held.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.