Why Genedrive shares are up 3,200% in just six weeks

The boom in demand for tech stocks involved in Covid-19 research continues with gusto.

5th May 2020 13:15

by Graeme Evans from interactive investor

The boom in demand for tech stocks involved in Covid-19 research continues with gusto.

The investment frenzy that has just turned minnow Novacyt (LSE:NCYT) into the interactive investor platform's fourth most-popular stock, has propelled another Covid-19 testing firm - Genedrive (LSE:GDR) - into orbit.

The Manchester-based firm's shares are up by more than 3,200% since late March 2020, driven by the progress of two SARS-CoV-2 tests to detect people with Covid-19 infections. The first of these is a high through-put laboratory test, which is about three weeks from market, while a point-of-care instrument-based test should be ready in December.

High levels of diagnostic testing to determine whether a person has the virus, alongside contact tracing, are a critical part of providing key intelligence on the spread of the virus.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

As well as its progress on Covid-19 testing, Genedrive has also been buoyed by news that its HCV ID kit for diagnosing hepatitis C infection in low and middle-income countries has World Health Organisation (WHO) pre-qualified status. It is the first portable point-of-need device to be included on this list.

CEO David Budd yesterday called it an “important milestone” in the evolution of the company, which until July 2016 was known as Epistem Holdings. It has been on the AIM market since 2007.

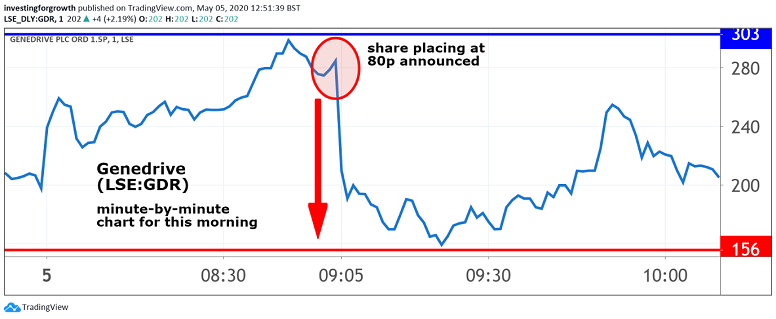

To support the rapid development of the Covid-19 testing, Genedrive today tapped investors for £7 million in a share placing priced at 80p. That is a significant discount on the share’s spike to 300p in the opening minutes of trading prior to the fundraising being announced at 8.50am.

Source: TradingView. Past performance is not a guide to future performance

It is also planning to raise an additional £1 million through a broker option where 1.25 million shares will be open for retail investors to participate in the fundraising.

The offer price is still sharply higher than the 8p-20p range for the stock earlier in the year, and prior to the Covid-19 pandemic causing an investor frenzy over stocks with the potential to develop life-saving vaccines, treatments or testing equipment.

The shares ended the day at 9p each as recently as 24 March, only six weeks ago.

Source: TradingView. Past performance is not a guide to future performance

One of the most remarkable of these coronavirus firms is diagnostics testing company Novacyt (LSE:NCYT), which was sandwiched between BP (LSE:BP.) and Royal Dutch Shell (LSE:RDSB) as the fourth most-bought stock on the interactive investor platform in April. Its shares have risen by more than 2,500% this year after receiving millions of pounds worth of orders for its CE-Mark and research-use only coronavirus tests.

As we revealed last month, others to look out for on the London market include Synairgen (LSE:SNG), Byotrol (LSE:BYOT), Open Orphan (LSE:ORPH), Scancell Holdings (LSE:SCLP), GlaxoSmithKline (LSE:GSK) and AstraZeneca (LSE:AZN). US-listed stocks include Novavax (NASDAQ:NVAX), Inovio Pharmaceuticals (NASDAQ:INO), Moderna (NASDAQ:MRNA), Regeneron Pharmaceuticals (NASDAQ:REGN), Gilead Sciences (NASDAQ:GILD) and Johnson & Johnson (NYSE:JNJ).

Where multinational companies are working in collaboration in order to find not-for-profit solutions to the pandemic, the crisis can be a game-changer for many smaller listed stocks.

Oxford BioDynamics (LSE:OBD) shares are up 50% in just a couple of weeks after the company was selected to take part in a Scottish government-funded trial on Covid-19. Its technology should be able to identify individuals that will progress to a severe form of Covid-19, and those that will respond to anti-viral therapy.

- Why Omega Diagnostics shares are up 700% in April

- 12 coronavirus stocks: another AIM share rallies 90%

- The AIM share that just made investors an 8,500% profit

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

But as Genedrive points out in today's placing document, investors need to realise there is huge uncertainty over the eventual total demand.

For example, the introduction of breakthrough therapeutic drugs or vaccines could reduce the requirement for widescale diagnostic testing of Covid-19 and the importance of contact tracing.

In the meantime, however, many millions of people will need to be tested, with high throughput central molecular testing of the kind being developed by Genedrive set to play a central role.

Its tests have a high-volume manufacturing capability of 10,000 per hour.

Genedrive announced a significant development milestone on Friday with the completion of pilot manufacturing runs with life sciences business Cytiva. Its final version, which is expected to launch later this month at between £8 and £10 a test, only requires the addition of a patient sample, with no other user preparation required.

Budd said he was confident that it will make a “significant contribution to the testing market”.

Genedrive's focus is on clinically verified assays that are easy to use and can be manufactured and delivered in high volume. It expects revenues of about £1 million in the year to 30 June.

The company's other tests on the market or close to launch include a field-deployed bio-warfare testing system for the US Department of Defence, as well as an assay for screening children for a genetic defect causing life-long deafness from certain antibiotics.

The company also has a tuberculosis test in development expected to be launched in 2022.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.