Holding our nerve with volatile energy funds

16th May 2022 15:49

by Douglas Chadwick from ii contributor

Saltydog analyst explains why he is continuing to back a trio of adventurous funds that have suffered sharp falls of late.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

At the beginning of last week, three of the funds that we hold in our demonstration portfolios fell by more than 4% in a day.

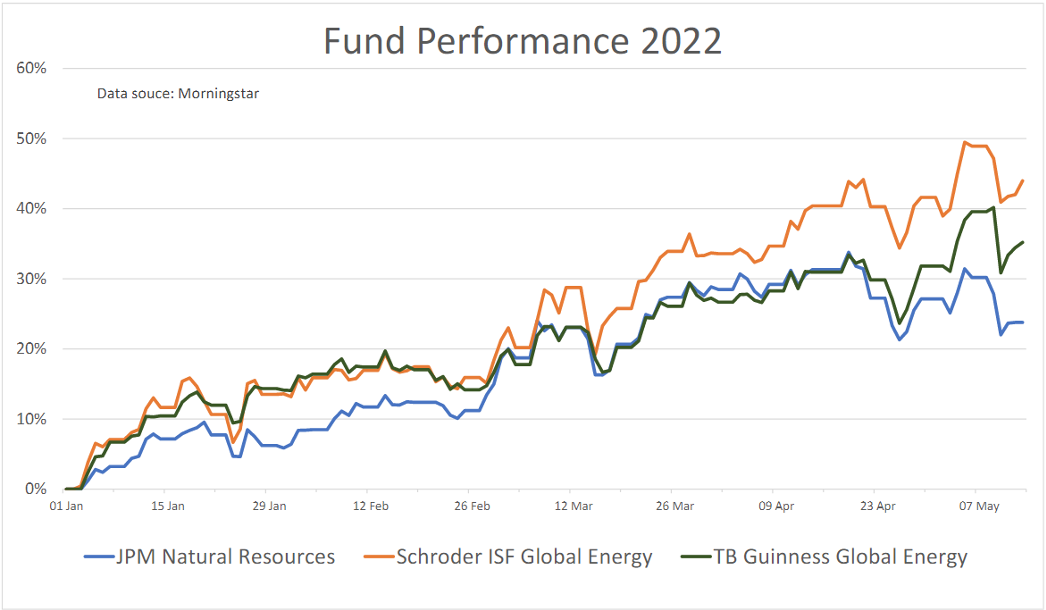

Between Monday 9 May and Tuesday 10 May, the Schroder ISF Global Energy fund went down by 4.2%, JPM Natural Resources declined 4.6%, and TB Guinness Global Energy fell by 6.6%. For our relatively cautious portfolios, these are big drops.

It was a concern because these funds account for a significant proportion of what we currently have invested. However, we do not have much invested at the moment.

So far this year, nearly all the Investment Association (IA) sectors have gone down, which means we have been struggling to find funds worth investing in. In situations such as this, we tend to hold a lot of cash. At the moment, the cash allocation in our Tugboat portfolio is 73%, and in the Ocean Liner portfolio it is 53%.

The best-performing funds so far this year have been the ones investing in commodities and natural resources, especially energy. During the global lockdown, demand for energy plummeted. Factories stopped working, planes were grounded at airports, ships were docked in port, and people stayed at home. The Brent crude oil price, which was around $70 per barrel at the beginning of 2020, briefly dropped below $10 and then spent most of the rest of the year somewhere between $40 and $50. When demand drops, companies cut back production and reserves are reduced.

- How Saltydog invests: a guide to its momentum approach

- The top 20 funds so far this year

- This fund sector is bouncing back: how best to take advantage

As the world started to get back to business, demand began to rise and it became clear that it might take some time for production to catch up. Then came the war in Ukraine. To choke Russia’s income, the West has put sanctions on the use of Russian oil and gas, and this has pushed prices even higher. In March this year, Brent crude briefly went above $120.

This trend has been evident in the Saltydog numbers and explains why we are currently holding the Schroder ISF Global Energy, JP Morgan Natural Resources, and TB Guinness Global Energy funds in our portfolios. At the moment, the Tugboat has nearly 14% invested in these funds. In the more adventurous Ocean Liner, it is just over 25%.

With nothing else doing particularly well at the moment, it could be argued that we should have more invested in these funds. However, it is dangerous to have all your eggs in one basket. We also limit the amount we invest in the most volatile funds.

I am not exactly sure what triggered the fall last week. It could be the prospect of the US releasing more of its oil reserves or OPEC agreeing to increase oil production, but I think it is more to do with concerns over weakening demand.

Although the effects of the coronavirus are diminishing in the UK, it continues to wreak havoc around the world. China is experiencing its worst outbreak for two years, forcing Shanghai and Beijing back into lockdown. This is now threatening the global recovery.

Elsewhere, in the US, the number of cases has been rising in recent weeks and more than one million Americans have now lost their lives.

Overall, infections are still rising in more than 30 countries and the total number of reported deaths is more than six million.

- One in three funds have posted double-digit losses so far in 2022

- A tactic to ride out the inflation storm using these funds and trusts

- Why it’s important to avoid being overexposed to one fund house

Global economies are not rebounding as many had hoped. In the US, inflation at 8.3% is still hovering around a 40-year high, stock markets are struggling, interest rates are rising, and growth is shrinking. The US central bank, the Federal Reserve, has just raised its interest rates by 0.5%, its biggest rise in 22 years. Further increases of 0.5% are expected and some suggest we might see a 0.75% rise. The Commerce Department has also reported that the US economy fell at a seasonally adjusted annual rate of 1.4% in the first three months of this year, at a time when most analysts were expecting a gain.

In the UK, the Bank of England has recently raised interest rates by another 0.25%, its fourth increase since December. It is now at 1%, a 13-year high. The Governor of the Bank of England, Andrew Bailey, went on to say that inflation could be running at more than 10% by the end of the year. In the first three months of the year, the economy grew by 0.8%, but only because of January. It was flat in February and went down in March.

If the world economy is not growing as quickly as originally thought, energy demand will not be as high as forecast, and so prices will drop.

The graph below shows that the energy funds suffered similar corrections in January, March and April. On each occasion, they bounced back and went on to set new highs, but there is no guarantee that they always will. That is the problem with volatile funds. Although they can give the best returns, they can also suffer the largest losses. Because they naturally fluctuate a lot, a downturn like we saw last week does not necessarily mean that the upwards trend has ended. These funds are not for the faint-hearted.

The way we manage the risk, and ensure that we can sleep at night, is by not being greedy and getting overcommitted.

Past performance is not a guide to future performance.

There are a couple of ways we judge the volatility of the funds.

Each fund is in a sector determined by the IA. We then group the sectors together based on their historic volatility. The least-volatile sectors are in our ‘Safe Haven’ Group, then it is ‘Slow Ahead’, then ‘Steady as She Goes’, and finally, ‘Full Steam Ahead’ and the ‘Specialist’ Groups.

However, within the sectors there could be a few funds with much higher (or lower) volatility than the Group average. That is why we also give each fund a Volatility Index (Vindex) rating.

The Vindex just gives some further information about which funds may be giving better/worse risk-weighted returns than their sectors may suggest. We started by adding standard deviation information to our weekly decile history report. We calculate the standard deviation for each fund relative to all the funds in our analysis over the last 12 weeks using the individual daily returns. Initially, we just published the actual standard deviation for each fund, but we soon changed it to a decile ranking system, with decile 1 being the funds with the lowest standard deviation and decile 10 being the funds with the highest standard deviation.

The JP Morgan Natural Resources and TB Guinness Global Energy funds have a Vindex of nine, and Schroder ISF Global Energy fund is a 10. We expect them to be volatile, and have decided to hold on to them for now to see if they recover as they did in previous months.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.