How AB Foods is tackling Primark shutdown

The dividend is cut, but management has lost its biggest revenue generator, reports our head of markets.

21st April 2020 10:00

by Richard Hunter from interactive investor

The dividend is cut, but management has lost its biggest revenue generator, reports our head of markets.

AB Foods (LSE:ABF) has produced a measured response to the effects of the pandemic, battening down the cost hatches wherever possible and consolidating those parts of its business where some sort of earnings visibility is still possible.

Unfortunately, its flagship retail operation cannot be overlooked. Primark represents some 65% of the group’s adjusted operating profit and, since the enforced store closures, any progress has been utterly derailed, leaving a gaping hole in the overall revenue picture.

Previously running at sales of £650 million per month through its stores, that figure has now evaporated entirely. As yet, it is of course impossible to estimate when the stores might reopen – with some of the European ones likely to be the first – and even then, the continuation of social distancing is likely to lead to fewer people in those stores at any one time, which in turn would continue to crimp revenues and profits.

- Are these retail sector stocks about to run out of cash?

- How coronavirus is affecting the different stock market sectors

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Furthermore, the overall numbers have been adversely impacted by an exceptional charge of £309 million, which includes a provision of £284 million on a Primark inventory which currently stands at £1.5 billion. The markdown is based on the fact that there is every likelihood that this stock will need to be sold at lower prices when it becomes possible to do so.

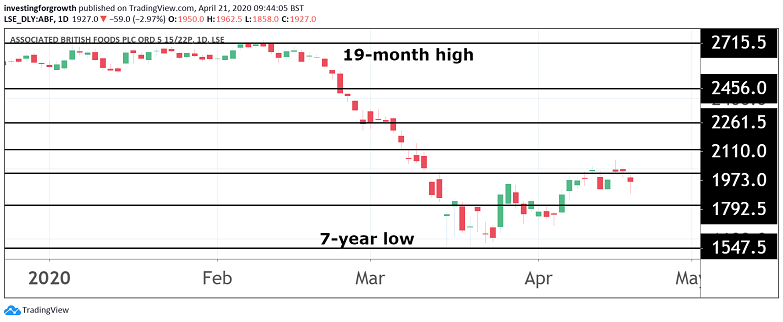

Source: TradingView Past performance is not a guide to future performance

At a group level, available cash is estimated to be £1.5 billion, achieved through a combination of net cash already held, a drawdown of the group’s £1.1 billion credit facility and eligibility for the Covid Corporate Financing Facility. As such, the group’s decision not to declare an interim dividend is of little surprise.

Elsewhere, the government’s furlough scheme, along with the business rates relief programme, means that the cost to the group for Primark stores standing idle has been reduced to £100 million per month.

Up until the outbreak took hold, the business had been performing well, with pleasing progress for Primark in parts of Europe, such as France and Italy and an improving market share in the UK. Aspirations were also high for its fledgling US business, while in other parts of the group higher EU prices helped the Sugar business and the Grocery division contributed a 13% increase in adjusted pre-tax profit.

Indeed, the latter has seen some benefit from the recent crisis as food production was ramped up, particularly during the panic buying phase evidenced in many countries. The Grocery business is AB Foods’ other main contributor to profits, at around 28%, although Sugar is less meaningful at just 2%.

Although AB Foods derives some benefit from product and geographical diversification in other parts of the group, the impact of the loss of Primark income, even if temporary, is a major blow.

The shares have unsurprisingly fallen to reflect this concern, with a 24% decline over the last three months, leaving the performance in stark contrast to the situation in February when the company last reported. At that time, the shares were ahead by 11% over the previous year, whereas the current picture shows a 21% decline over 12 months, as compared to a 23% dip for the wider FTSE 100 index.

Even so, the company’s agility and swift reaction to the monumental challenges currently being faced plays well with investors, where the market consensus of the shares as a buy remains intact.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.