On the hunt for quality insurance shares

Richard Hunter suggests three UK stocks to watch in one of the world's largest insurance markets.

31st October 2019 12:05

by Richard Hunter from interactive investor

In his FTSE Sector Watch column, Richard Hunter suggests three UK stocks to watch in one of the world’s largest insurance markets.

Insurance may not be a topic to set the pulse racing, but it is nonetheless a vital part of any economy. Behind the US, China and Japan, the UK insurance market is the fourth largest in the world – and the largest in Europe – with an estimated total premium volume of just under $220 billion (£178 billion) in 2017, according to the Association of British Insurers.

As defined by the London Stock Exchange (we are limiting the scope of this article to the FTSE 100 companies), insurance is split into two sub-sectors, life insurance and non-life insurance.

Life insurance

Aviva (LSE:AV.) is a leading provider of insurance, savings, and asset management products and services. The company offers life, health, and general insurance along with savings products.

Legal & General Group (LSE:LGEN) sells insurance products and other financial services. It transacts life assurance and long-term savings business, investment management and general insurance and health business.

Phoenix Group Holdings (LSE:PHNX) is a specialist closed life and pension fund consolidator. It manages closed life funds by protecting and enhancing policyholders’ interests.

Prudential (LSE:PRU) is a financial services group that offers life insurance, long-term savings and protection products, retirement income solutions and asset management services throughout Asia, the US and the UK.

St James's Place (LSE:STJ) provides investment and wealth management services to individuals, trustees and businesses. It also provides life insurance and offers trustee services.

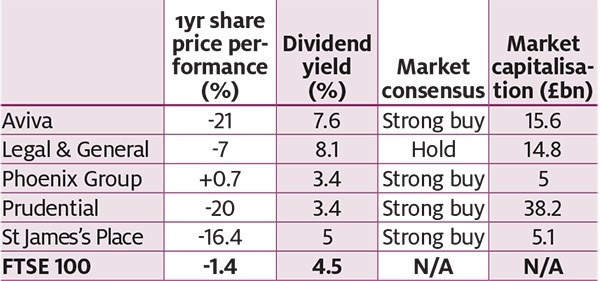

Life insurance performance

Source: Share price move and consensus Digital Outlook (Sharecast); yield and capitalisation ProQuote (Iress Market Data)

Non-life insurance

Admiral Group (LSE:ADM) is a property and casualty insurance company. It sells and administers private motor insurance and related products. The company also operates price comparison websites.

Hiscox (LSE:HSX) provides insurance and reinsurance products and services. It offers coverage for commercial and personal insurance, technology, aerospace, marine companies, fire, fraud, hacking, terrorism & political risk, among others.

RSA Insurance Group (LSE:RSA) is a property and casualty insurance company providing offerings across the globe. It provides personal, commercial and speciality insurance products and services.

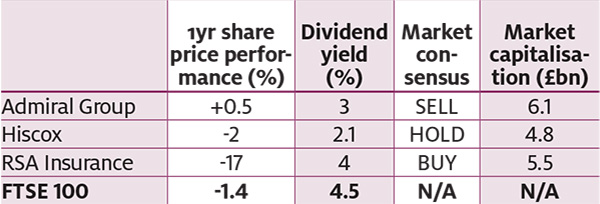

Non-life insurance performance

Source: Share price move and consensus Digital Outlook (Sharecast); yield and capitalisation ProQuote (Iress Market Data)

The UK has for many years been a significant exporter of insurance and financial services. In 2017 the UK exported approximately £18.5 billion of insurance and pension services, equivalent to 31% of the UK's financial services exports. Furthermore, with a total insurance and pensions import figure of £1.8 billion, the UK is left with a trade surplus of around £16.7 billion; according to World Trade Organisation figures, this is the largest trade surplus among the major insurance economies by quite some margin.

Ties with Europe are also a consideration, and a significant number of insurers and brokers have indicated that they are considering moving or have decided to move operations for a post-Brexit world, whatever that might be.

Equally pressing are the immediate challenges the industry faces, such as the rise in claim costs. For example, the fact that cars are increasingly complex and sophisticated tends to result in a reduced number of claims – but when those claims come, they can be more expensive due to the cost of repair or replacement of damaged parts. Sterling’s weakness has also become a factor, with imported parts becoming costlier. Even with a higher technology car specification, there is also the relatively new problem of car theft involving keyless fobs, as the criminals intercept the signal between car and key.

Any number of traditional claims also remain. Extreme weather of any kind is costly to the insurers, with anything from the 'Beast from the East' (frozen/cracked water pipes, for example) to a summer heatwave (subsidence) causing problems.

Meanwhile, trade credit (think the Carillion collapse) and air travel insurance (holidaymakers stranded abroad due to the collapse of an airline or operator, Thomas Cook being a topical example) are, literally, accidents waiting to happen.

So much for today - what of tomorrow?

Inevitably, technology is playing a major part and the industry is adjusting to stay in step with the demands of an ever-evolving world. Agility is key. With the rapid expansion of real-time data, the insurer's relationship with its policyholders can no longer afford to be static. This is quite apart from new questions, such as the implications of people increasingly working from home (raising issues of business versus personal insurance) or being part of the gig economy, potentially with different insurance requirements; and the headache of cyber-crime for financial companies as a whole.

Yet there have already been advances the sector can benefit from, such as in health insurance, where wearable technology can measure fitness. Cars fitted with trackers are increasingly popular in reducing insurance premiums, as the driver's habits are monitored. Meanwhile, the 'internet of things' has helped in the field of property insurance (through real-time surveillance). These and other innovations help move the industry towards what has been called the Holy Grail of "detection, intervention, prevention".

Space precludes our covering the other traditional staples of insurance companies, such as retirement income solutions, savings and asset management products; we will examine those in a future article. Our three stocks to watch, however, allude to some of those prevailing themes.

Three stocks to watch

Aviva

There have been mixed fortunes as the company has transformed. A reduction in net earned premiums, flat operating profit and challenging market conditions have made for difficult reading as far as Aviva's life insurance and asset management businesses are concerned. The Asian business, which should be an exciting source of opportunity, remains insufficiently tapped and exploited.

More positively, the financial stability and cash-generative ability of the company is ever-present. The capital cover ratio stands at a still highly impressive 194%; combined operating ratios in the UK, Canada and Europe are also on the right side of 100%; pre-tax profit spiked sharply; and the company remains focused on £300 million annual cost savings by 2022 (see jargon buster box).

The market has not been impressed, however, and the shares dropped 21% in the past year. Even so, within the investment community there is clearly a majority willing to accept Aviva's strategic aspirations, and the market consensus is a strong buy.

Legal & General

The resurgence of the annuities market and the emergence of Pension Risk Transfer (as firms look to mitigate final salary pension schemes) play into L&G's hands. The lifetime mortgages division, which focuses on equity release, is back in vogue, while the company is also enjoying the benefits of geographical diversification, with its Asian and US operations showing promise.

There are some areas requiring attention, such as the cost/income ratio which recently ticked slightly higher. Operating profit in the insurance unit dropped by some 13% at the half-year results in August, while group debt costs also showed an increase of 11%.

Even so, the muted reaction to a strong set of numbers was symptomatic of the difficulty the company has in convincing the market of its longer-term potential. Even as it lessens its reliance on the UK market and spreads the risk geographically, the consensus of the shares as a hold could yet remain in place.

Prudential

The main focus is currently the planned de-merger, expected to complete before the end of the year – M&G becoming the company's UK & Europe business, with Prudential focusing on Asia, Africa, and the US following the split.

The recent political turmoil in Hong Kong, coupled with concerns around Chinese economic growth – not least due to the current trade spat with the US – have taken the wind out of the company’s sails of late. After a promising start to the year, the shares have dropped 17% since their 2019 high back in July.

However, hopes remain high, particularly for the "new" Prudential, where the increasing demand for health, protection and savings across the Asian region continues to flourish given the backdrop of an emerging middle class.As such, the market consensus for the shares is a strong buy.

Jargon buster

Capital cover ratio: Insurance companies are required to hold own funds at least equal to their SCR (Solvency Capital Requirement) at all times, in order to avoid regulatory/supervisory intervention; this must be at least 100%.

Combined operating ratios: a measure of general insurance underwriting profitability, the COR compares claims, costs and expenses to premiums. If the costs are higher than the premiums (ie the ratio is more than 100%) then the underwriting is unprofitable.

Pension Risk Transfer: a defined benefit pension provider may offload some or all of the plan's risk. This may involve offering vested plan participants a lump-sum payment to voluntarily leave the plan early (buying out employees' pensions) or negotiating with an insurance company to take on the responsibility for paying those guaranteed benefits.

Cost/income ratio: This is seen as a measure of efficiency and does what it says on the tin – comparing costs to the operating income. The lower the figure, the more profitable the company.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.