An iconic food brand still growing fast

23rd June 2021 13:02

by Rodney Hobson from interactive investor

It’s time for a reassessment of this share after growth plans took the market by surprise. Hear what our overseas investing expert thinks of prospects.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Expansion at home in the United States and shrinkage overseas looked to be the policy of fast food chain McDonald’s (NYSE:MCD) during the Covid epidemic. That view has been turned on its head by a decision to open 50 new outlets in the UK and Ireland over the next 12 months. Time for a reassessment of the shares.

McDonald’s is looking to recruit 20,000 new staff on top of the 130,000 already employed in the British Isles, and it says these will be in addition to re-employing staff furloughed through the enforced restaurant closures during lockdowns. The new outlets will be opened through new franchises added to the 200 existing British and Irish franchises already running 1,400 stores.

This is a bold but risky strategy, given that British High Streets were already struggling before the pandemic, but new franchisees may be able to take advantage of lower shop rents and the return of consumers desperate to eat out after being forced to dine at home for the past 12 months.

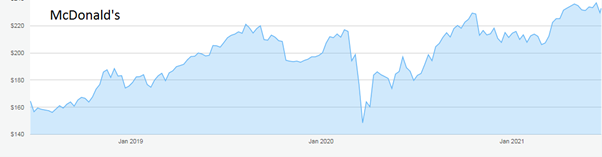

Source: interactive investor. Past performance is not a guide to future performance

Another risk is finding recruits. The pandemic has not created mass unemployment, and the UK hospitality sector is facing a staff shortfall because of travel restrictions and immigration rules arising from Brexit.

Recruiting staff is also a problem in the United States, where the re-opening of the economy spurred by rising consumer demand is causing big companies to sign up new employees quickly. Hospitality, involving constant contact with large numbers of customers, is seen as riskier while the pandemic lasts. McDonald’s has raised US wages by 10% as it seeks another 10,000 employees and finds itself competing with other food chains also raising hourly wages.

This is a widespread problem for all large companies. Amazon (NASDAQ:AMZN), for example, is offering $1,000 signing up bonuses. This pressure will not ease until the $300 supplementary unemployment benefit ends in September. Enacted as part of President Joe Biden’s Covid-19 relief package, the benefit has been widely criticised by employers as making staying at home more attractive than going to work.

- Where has the value rally been strongest?

- Bill Ackman: I think this could be the Black Swan event of 2021

However, the franchising model has worked well for McDonald’s as it throws the cost of expansion onto franchisees, who have a vested interest in making their outlets highly successful. More than half of the chain’s total revenue comes from franchise royalty fees and from lease payments made by franchises operating out of company-owned buildings.

Worldwide, McDonald’s does seem to be coming out of the pandemic slump well. It reported net income up 39% in the first quarter of 2021 on revenue 6.4% higher despite lingering outbreaks of Covid-19 around the globe.

Admittedly, comparisons were with a particularly weak first quarter last time but the fact that sales beat those in the comparable period of 2019 is particularly encouraging, especially as many territories in which McDonald’s operates suffered from eateries being closed or operating with restricted numbers that could be seated within the restaurants.

Figures for the second quarter should show continued improvement, despite persistant restrictions in many countries, especially as last year’s comparative figures were particularly badly hit by the pandemic. McDonald’s could even announce a small rise in the dividend – it does not pay one in the first quarter so there is no real guidance on this yet.

The shares have doubled over the past five years from around $120 to a peak of $237 in May and again in June, but have come off the boil a little. The chance to buy in may not last long. At the current $234, the yield is 2.2%.

Hobson’s choice: I advised buying below $200 in May last year and in the previous November. Anyone who did so is comfortably ahead and has pocketed dividends in addition. Buy up to the previous peak at $237. If that ceiling breaks the shares could shoot higher quickly.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.