Imperial Brands shares: still a buy after dividend slashed?

Our head of markets discusses whether Imperial remains attractive to income investors.

19th May 2020 09:27

by Richard Hunter from interactive investor

Our head of markets discusses whether Imperial remains attractive to income investors.

At the end of March, tobacco giant Imperial Brands (LSE:IMB) stated that there had been “no material impact” on trading from the Covid-19 pandemic, but the group has been forced to change its tune for the remainder of its financial year in these six-month results.

To this end, the supply chains seemed to have held up reasonably well and the company saw stockpiling some of its products in anticipation of a slowdown, but it cannot accurately factor in the material effect on sales through its travel retail and duty-free lines, let alone any impact on consumer buying habits, such as trading down, given the inevitability of global recession.

Regulation and retrospective litigation have cast long shadows on the sector over recent years, and this shows few signs of slowing. The current issue with the US Food and Drug Administration has been vapour cigarettes, especially those of the flavoured variety.

- Three ideas for income in the dividend drought

- Stockwatch: Why you must keep an open mind on dividend income

Imperial’s £95 million write-down on this part of its Next Generation Products (NGP) during the half-year to 31 March, comprises “flavour write-downs” of £48 million, a slow-moving inventory provision of £28 million and a reduction to the value of the brand amounting to £19 million.

As such, NGP net revenues fell 43%, contributing to a decline of 8% in adjusted operating profit. As a consequence, investment into these products has been reduced.

That NGP decline caused a drop in group net revenue at constant currency of 0.9% for the half year, helped by growth in tobacco sales. Adjusted operating profit fell 7.7% to £1.47 billion and adjusted earnings per share fell 9.2% to 103p.

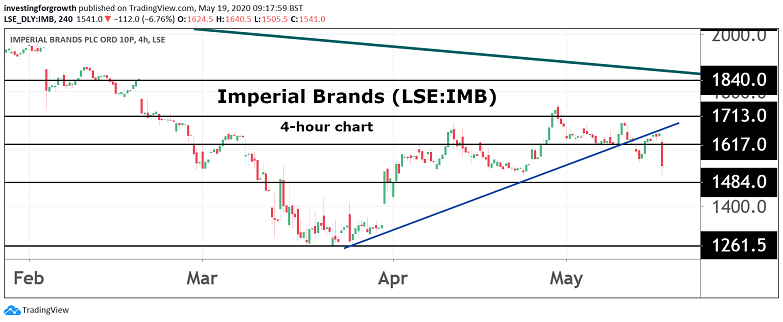

Source: TradingView. Past performance is not a guide to future performance.

Alongside the disappointment of what could have been a new and successful product line, is the unrelenting growth of net debt, which increased by almost 6% in the period to over £14 billion.

Reducing this debt has become a key priority, which will be helped by the sale of its Premium Cigar business for around £1 billion, the focus on cost containment and a reduction of the dividend by a third, which had been the subject of some debate among investors given the debt situation.

Even so, the implied annual dividend for 2020 of 137.7p per share is still equivalent to a yield above 8%, which remains a significant attraction to income-seeking investors, given the double whammy of historically low interest rates and the evaporation of dividend payments from many reporting companies.

At the same time, the aim is for a progressive dividend policy from this rebased level which, given Imperial’s cash generation, should prove comfortable even if capital allocation is further reduced to concentrate on debt.

- Vodafone dividend decision gives big boost to income seekers

- FTSE 100 dividend stars step in after Shell shocker

- Lloyds and other UK bank shares slump after halting dividend payments

By its own admission, it has been a disappointing time of late for Imperial, and the renewed focus of concentrating on its strengths is possibly overdue.

Its products give its stock a strong defensive quality, including the generous dividend yield, market share has been nudging higher in its main lines, and margins remain strong given lower production costs, now entrenched after some years of focus.

The shares have borne the brunt of the company’s own disappointment, having declined 24% over the last year, as compared to a drop of 18% for the wider FTSE 100 index.

Nonetheless, the stock’s defensive attributes remain in demand, particularly during the current crisis, with the market consensus of the shares remaining a ‘strong buy’.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.