Lloyds and other UK bank shares slump after halting dividend payments

Banks will no longer return billions to shareholders. Here’s what our head of markets thinks.

1st April 2020 09:33

by Richard Hunter from interactive investor

Banks will no longer return billions to shareholders. Here’s what our head of markets thinks.

The announcement that banks will be suspending existing and future dividends and share buybacks ticks the boxes of moral duty and an additional capacity to lend, but from an investment perspective it removes a core plank of the case for buying bank shares.

The current yield of the UK banks, soon to evaporate, is testament to the fact that some are core portfolio holdings. Lloyds Banking Group (LSE:LLOY) has a dividend yield at present of 10.5%, Barclays (LSE:BARC) 9.6%, Royal Bank of Scotland (LSE:RBS) 4.4%, HSBC (LSE:HSBA) 9% and Standard Chartered (LSE:STAN) 4.9%.

From a technical perspective, it also begs the question of how or whether these share prices will be compensated for the previous ex-dividend markdowns. On ex-dividend day, share prices are reduced by the amount of the upcoming dividend, which already applies to Barclays and HSBC (both 27 February), Standard Chartered (5 March) and Royal Bank of Scotland (26 March). It is unclear whether this can be reversed.

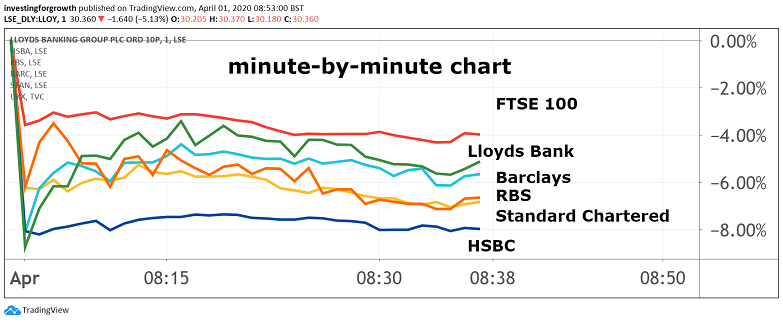

Source: TradingView Past performance is not a guide to future performance

In addition, if the European experience is applied, the announcement of dividend and share buyback postponements had the effect of wiping off the supposed savings from the share prices, and therefore market capitalisation of the banks in question. In early trade in the UK, that seems to have been echoed against a weaker market backdrop.

Already facing the prospects of lower margins, given the historically low interest rate environment, as well as the possibility of an increase in bad loans (impairment losses), banks will face general economic challenges in their quest to keep the wheels of the economy oiled.

However, they are undoubtedly in a significantly stronger capital position to withstand these shocks, following regulatory tweaks to their capital cushions after the financial crisis of over a decade ago.

- A £9 billion dividend windfall now at risk

- 11 UK stocks where experts think the dividend is safe

- A checklist for finding dividend shares in a crisis

The announcement comes at a time when income investors are faced with a rapidly shrinking universe.

As such, the search for dividend income may have to be found in switching to a classically defensive strategy.

Companies such as Unilever (LSE:ULVR) could benefit from the current propensity of consumers to hunker down and currently yields around 3.4%. Similarly, Reckitt Benckiser (LSE:RB.) yields around 2.8%.

Elsewhere, the utility stocks can come into their own in parts of the economic cycle such as these, and examples within the FTSE 100 include SSE (LSE:SSE) (previously Scottish & Southern Energy), where the current dividend yield is 7.1% and United Utilities (LSE:UU.) 4.6%.

An interesting observation would be to look at another such sector in the form of the supermarkets. Investors can expect financial caution here also, particularly given the sector’s tendency to have diversified away from just grocery, but these are clearly reaping some rewards at present.

Not always the highest of yielders, the dividends may be maintained in the face of current trading, with Morrison's (LSE:MRW) presently yielding 3.8%, Tesco (LSE:TSCO) 3% and Sainsbury's (LSE:SBRY) 5.4%.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.