The Income Investor: dividend stocks still beat bonds and two shares I like

10th July 2023 12:15

by Robert Stephens from interactive investor

Bonds are all the rage for good reason, but don’t dismiss the income-generating quality of equities, urges interactive investor columnist Robert Stephens. Here’s why, plus dividend shares to own.

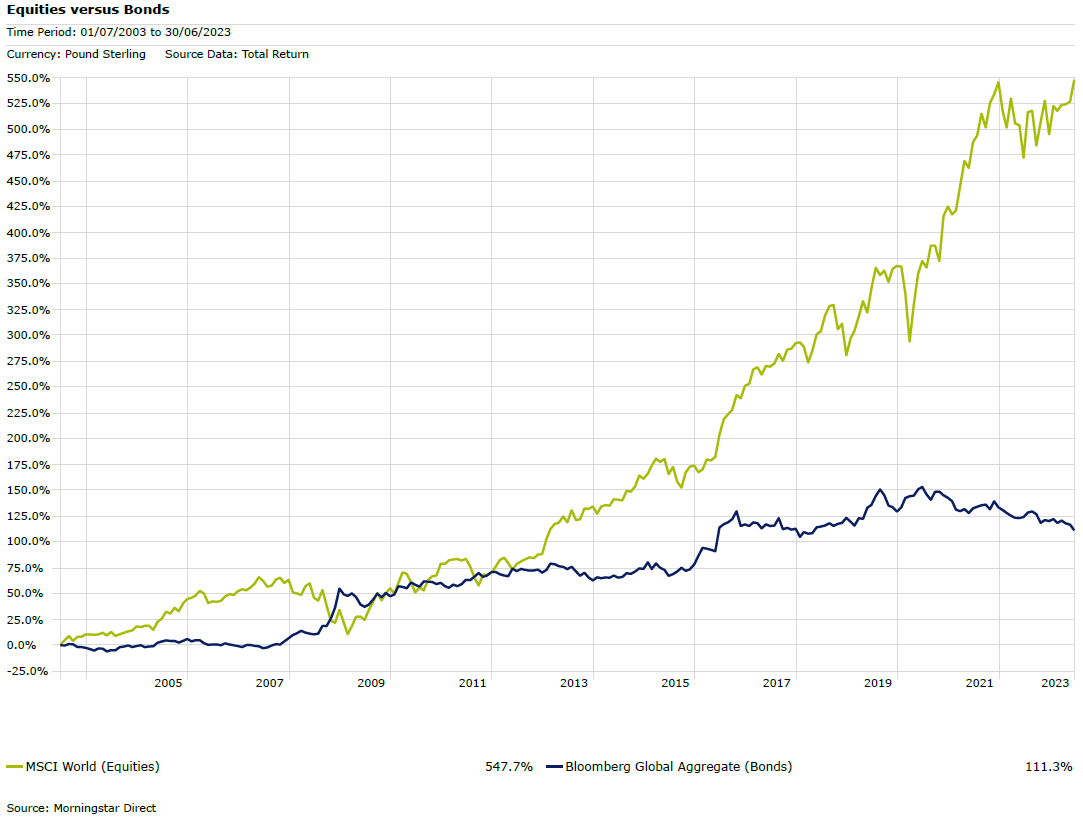

Until recently, investors had scant opportunity to generate a worthwhile income outside of dividend stocks. Ultra-low interest rates implemented during the global financial crisis and maintained until the latter part of 2021, prompted bond yields to reach paltry levels. This meant they were unable to provide a worthwhile income and were therefore hugely unappealing to income seekers.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Now, though, rapidly rising interest rates mean that bond yields rival dividend yields. Indeed, the 10-year gilt yield currently stands at 4.4%, which is higher than the FTSE 100’s yield of 3.9%. Corporate bonds, meanwhile, yield around 4.9%. Although it is possible to unearth stocks that still provide a more generous income return than bonds, investors now have a far broader range of options.

Furthermore, income-seeking investors are generally more risk-averse than their growth-focused peers. Although not true in all cases, typically they wish to obtain a generous income while minimising the risk of capital loss.

Since bonds are inherently less risky than shares, income seekers may understandably contemplate moving from stocks to fixed-income securities at a time when the UK economy’s near-term prospects are highly uncertain. According to the Organisation for Economic Co-operation and Development (OECD), the UK economy is expected to grow by just 0.3% this year in what is a relatively gloomy outlook.

A growing income

However, bonds may not prove to be a superior long-term income option than equities. They do not offer any scope for income growth, since the coupon they pay is fixed. Therefore, even though it may be possible to obtain a higher yield from bonds than shares at the moment, the yield on an initial investment in stocks is set to grow, and even surpass that of bonds as dividends rise in the years ahead.

With inflation currently standing at 8.7%, a growing income is crucial. If an income is static, as per the coupon paid on bonds, it will gradually become worth less in real terms and will ultimately equate to reduced spending power, potentially having a detrimental impact on an individual’s standard of living.

- Bank of England wields sledgehammer to fight inflation

- Merryn Somerset Webb: the scariest chart in the world

- The 13 FTSE 100 shares behind July’s dividend bonanza

Although the Bank of England forecasts that inflation will fall rapidly over the coming months to reach 2% by late 2024, the pace of price rises has thus far proved to be much greater and more persistent than most economists expected. This means that obtaining a relatively modest yield today, but enjoying a rising income over the long run, could prove to be preferable to a higher yield with a lack of growth prospects.

Capital growth potential

Of course, interest rates will not increase in perpetuity. Ultimately, their ongoing rise will act as a drag on economic growth rate and inflation will fall. If inflation declines to its 2% target or below, the Bank of England may even decide to lower interest rates to stimulate the economy’s performance.

While a situation of falling interest rates may currently seem many years away, history shows that economic circumstances can change quickly. Indeed, very few investors would have correctly predicted just two years ago that interest rates would reach 5% by mid-2023.

Since bond prices have an inverse relationship with interest rates, a fall in Bank Rate would have a positive impact on the prices of government and corporate bonds. Although investors who hold bond funds or who decide to sell their fixed-income holdings prior to maturity could benefit from price rises, investors who plan to hold their bonds to maturity would miss out because bonds are redeemed at par.

- Cash or shares? What the data tells us about where to invest

- Sector Screener: a potent mix of growth potential and defensive appeal

Falling interest rates would normally be expected to have a positive impact on share prices. Unlike bonds, which ultimately revert to their par value, stock prices can rise ad infinitum. And since many stocks currently trade at low levels, there is significant scope for them to deliver extremely appealing capital returns in addition to offering a generous yield and a rising dividend.

Yield (%) | ||||

Asset | Current | 5 June | Change (%) | 11 May |

FTSE 100 | 4.07 | 3.89 | 4.6 | 3.86 |

FTSE 250 | 4.03 | 3.69 | 9.2 | 3.57 |

S&P 500 | 2.04 | 2.08 | -1.9 | 2.13 |

DAX 40 (Germany) | 3.38 | 3.29 | 2.7 | 3.27 |

Nikkei 225 (Japan) | 1.85 | 1.86 | -0.5 | 2.04 |

UK 2-yr Gilt | 5.382 | 4.455 | 20.8 | 3.729 |

UK 10-yr Gilt | 4.659 | 4.219 | 10.4 | 3.704 |

US 2-yr Treasury | 4.915 | 4.495 | 9.3 | 3.860 |

US 10-yr Treasury | 4.06 | 3.702 | 9.7 | 3.384 |

UK money market bond | 4.40 | NA | NA | 1.13 |

UK corporate bond | 4.92 | NA | NA | 3.05 |

Global high yield bond | 5.31 | NA | NA | 4.21 |

Global infrastructure bond | 2.25 | NA | NA | 2.13 |

LIBOR | 5.4871 | 4.8927 | 12.1 | 4.6657 |

Best savings account (easy access) | 4.35 | 3.82 | 13.9 | 3.71 |

Best fixed rate bond (one year) | 6.10 | 5.25 | 16.2 | 4.90 |

Best cash ISA (easy access) | 4.10 | 3.65 | 12.3 | 3.50 |

Source: Refinitiv as at AM 10 July 2023. Bond yields are distribution yields of selected Royal London active bond funds at 30 June 2023, except global infrastructure bond which is 12-month trailing yield for iShares Global Infras ETF USD Dist. LIBOR is interest rate that banks lend money to one another (3 month LIBOR as at 7 July). Best accounts by moneyfactscompare.co.uk refer to Annual Equivalent Rate (AER).

Smurfit Kappa

Paper-based packaging manufacturer Smurfit Kappa Group (LSE:SKG) currently yields 4.5% from a dividend that was covered 2.6 times by earnings last year. This suggests that shareholder payouts are affordable at the firm’s current level of profitability despite them rising at an annualised rate of over 17% in the past decade. And with dividends growing by 11% on a per share basis in the company’s 2022 financial year, it has provided a consistently positive real-terms rise in shareholder payouts that could persist over the coming years.

Since the firm’s dividends are paid in euros, investors may wish to consider automatic dividend reinvestment. There could also be a foreign exchange charge to convert any income received into sterling.

The company is well-suited to the current era of sticky inflation. Its vertically integrated business model, which includes recycling operations and forests, means it is better able to cope with rising input costs than many other firms. Indeed, its latest quarterly results showed that its earnings before interest, tax, depreciation and amortisation (EBITDA) profit margin increased by 2.3 percentage points year-on-year to 19.3%. This helped to boost operating profit by 17% versus the same quarter of the previous year.

Demand for the company’s paper-based packaging is set to rise as consumers increasingly prioritise sustainability in their purchases. When combined with an upbeat global economic outlook, with the world’s GDP growth rate forecast to rise from 2.7% this year to 2.9% next year, Smurfit Kappa’s financial performance is set to improve. Despite this, it trades on a price-to-earnings (PE) ratio of just 8.5. This suggests that it offers excellent value for money and significant scope for capital returns over the long run.

Tesco

Similarly, Tesco (LSE:TSCO) offers an appealing mixture of capital growth and income potential over the long run. Its shares currently yield 4.4% from a dividend that was covered twice by profits in its most recent year. Although shareholder payouts were in line with those of the previous year, an improving outlook for the retail sector means dividends are likely to rise over the long run.

A stronger operating environment is evidenced in the firm’s like-for-like sales growth of 8.2% in its most recent quarter. Certainly, the UK’s economic growth rate remains perilously close to a negative figure amid an ongoing cost-of-living crisis and rising interest rates. However, consumer confidence has increased for five consecutive months so that it now stands at its highest level for 17 months. This suggests that consumers are likely to become less price conscious, which may provide a fillip for Tesco’s margins.

- Stockwatch: bonds, equities or cash – my investing tactics

- ii view: Tesco stays confident given laser focus on value

The company’s Clubcard scheme also has the potential to boost profitability over the long run. With 21 million households using a Clubcard, it provides a loyal customer base that may allow the firm to enjoy higher margins versus sector peers. And with its online share of the UK grocery market growing by 0.75 percentage points in the first quarter of the current financial year to 37.5%, the company is well placed to capitalise on an ongoing trend towards digital retailing.

Trading on a PE ratio of 11.3, Tesco’s shares offer a wide margin of safety. This suggests there is capital growth potential on offer in addition to its appealing income prospects. Alongside Smurfit Kappa, it offers a superior long-term income investing opportunity compared with bonds.

The potential for dividend growth and capital returns suggests that, while today’s bond yields may be enticing, there are very good reasons for income seekers to continue owning equities, of which UK stocks are among the most generous.

Robert Stephens is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.