Bonds hub

Bond yields

Bond yield – the key terms

There are three key terms that bond investors need to get their heads around: yield to maturity (also known as the running, or redemption yield), historic (or annualised) yield, and distribution yield.

Assuming all portfolio coupon payments (the level of interest promised) are made, and the principals on bonds (amount lent) are returned, the yield to maturity of a portfolio is the total annual return of a fund if all bonds are held to maturity. This assumes no portfolio changes. It's a measure that bond fund managers use to assess what their portfolio is forecast to return, including when they get their capital back when a bond matures.

In reality, these figures change as the fund manager is constantly selling and buying bonds, but they are a helpful snapshot about return potential and income distributions.

The annualised, or historic yield, calculates what a bond fund has paid out over the past 12 months, expressed as a percentage based on the current value of the fund.

The distribution yield is an estimate of what a bond fund will pay out over the next 12 months, based on the current unit price and the last month’s coupons.

When looking at bond fund factsheets, the distribution yield is probably the most useful as it gives the best indication of the income payments you will receive, which is one of the main reasons to own bonds.

Calculating the income from bonds

A bond’s distribution (or income) yield is the return an investor can expect to receive as income over the next 12 months expressed as a percentage. There’s a simple calculation to figure it out:

yield = (coupon/price) x 100

It is important to understand that the coupon and the yield are not the same.

The coupon is the rate of interest promised when the bond was issued. The yield is the annual return an investor that has bought the bond after the issue expects to receive as income over the next 12 months. The coupon is fixed and does not change during the lifespan of the bond. The yield, however, will change as the price of the bond changes.

Why do bond yields change?

Bond yields move inversely to bond prices. When bond prices rise, yields fall, and vice versa.

Real world example

A bond issued at £1 with a 5p coupon, has a yield of 5%. However, if the price rises to £2, the coupon is still 5p, but the yield falls to 2.5%. In this scenario those who bought when the bond was issued, can now sell at double the price they paid.

If the price falls to 50p, the coupon remains at 5p, but the yield is now 10%. While the amount expected to be paid in income is now relatively higher, those who bought at issue and decide to sell will be doing so at a loss of 50% on the price paid. For new investors, the higher yield and cheaper price on offer are more attractive.

How does inflation affect bond price?

Bond yields and bond prices are influenced by inflation and the direction of interest rates. Given that bonds pay a fixed income, this becomes less valuable when inflation rises. At the same time, bonds become less attractive when interest rates rise as there is greater competition from cash returns and better deals available from newly issued bonds with higher yields. This results in bond prices falling and yields rising.

When inflation is high and interest rates are moving upwards, long-dated bonds suffer the most as they have a higher 'duration', which refers to the sensitivity of a bond, or bond fund, to any change in interest rates.

Long-duration bonds typically have lifespans of 15 to 30 years. Given that investors have to wait a long time for their capital to be returned at maturity, a higher level of income is demanded to compensate for the greater levels of risk involved. As a result, this part of the bond market is the most sensitive to increases in interest rates.

For every 1% rise in interest rates, a bond’s price will fall by about 1% for every year of duration.

Bonds with a shorter lifespan of five years or less are less risky since there is not as much time for things to go wrong or for the economic environment to change. Therefore, a lower level of income is typically offered.

What do bond yields tell investors?

The higher the bond yield, the greater the levels of risk of lending your money to a government or company.

Those with high credit ratings are referred to as ‘investment grade’. With such bonds, it is unlikely that the government or company will default on their debt obligations, so bond owners are highly likely to get their money back. The trade-off is that the level of interest paid by the bond is usually less than that offered by riskier bonds.

Bonds with low credit ratings are referred to as ‘high yield’ bonds. These bonds typically pay higher income, but there is a greater risk that those payments will not be made. There’s also a greater risk that investors lose some of the principal, the amount they invested.

What do bond yields signal about the economy?

In terms of the wider macroeconomic backdrop, rising bond yields reflect that interest rates are rising, and are expected to rise further. Rising bond yields also reflect that inflation is at high levels. In 2022, bond yields rose across the board for both government and corporate bonds. By extension, bond prices fell.

If moves to increase interest rates have the desired effect in cooling down inflation, then there is a greater prospect of interest rates being cut rather than rising further. If and when this scenario plays out, bond yields would be expected to fall, causing bond prices to rise.

In the short run, rising interest rates are a headwind for bonds – including bond funds. However, rising interest rates can be beneficial for new investors as it offers the chance to pick up higher yields. For bond funds it offers the opportunity for fund managers to switch money from old bonds into new bonds that have higher yields, which can increase the bond fund’s overall return.

What is the bond yield curve?

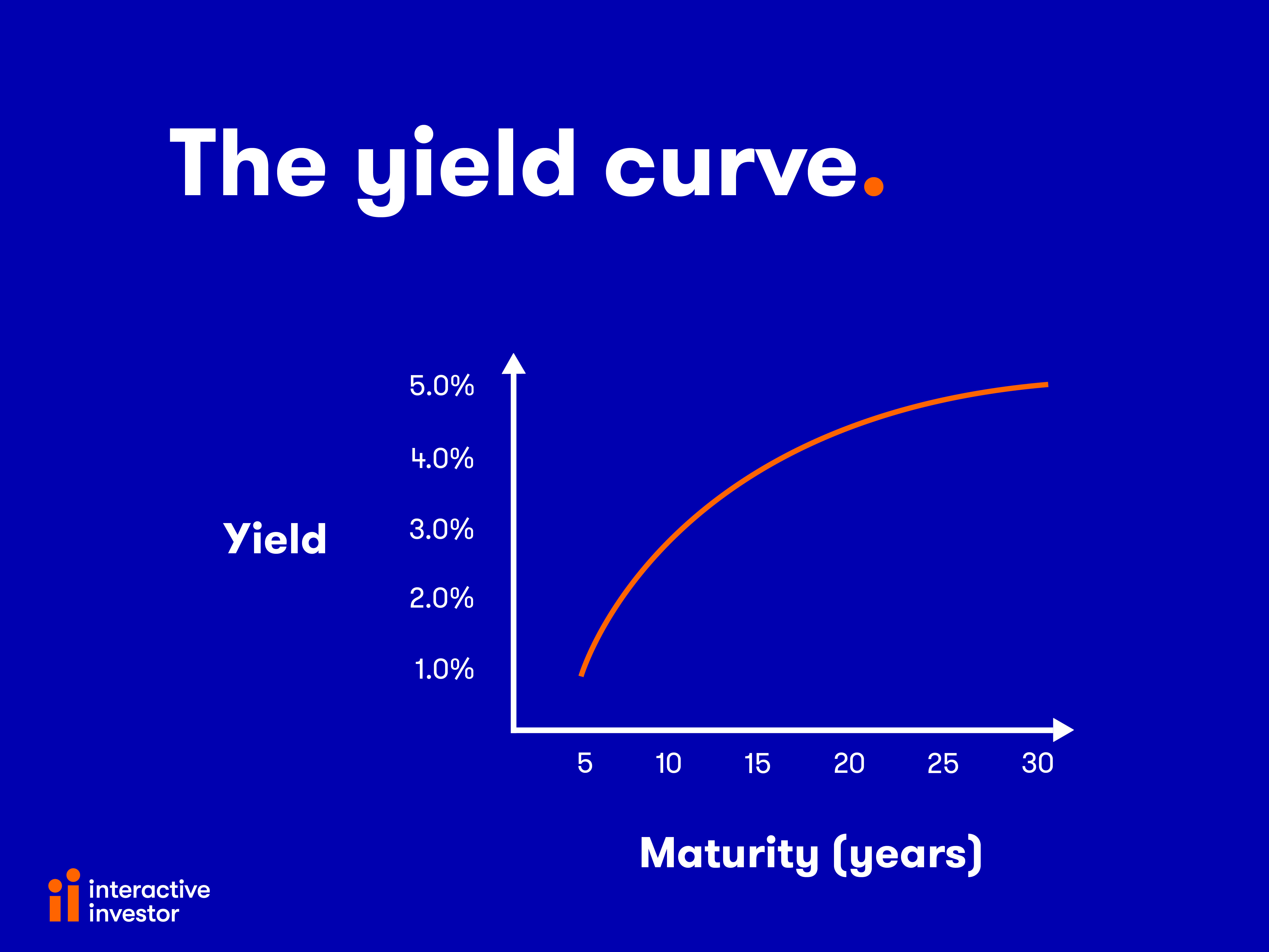

The yield curve is a chart that plots the relationship between yields and maturity dates.

Normally, bonds with longer lifespans such as 30 years have higher yields than shorter-duration bonds that might be just a few years away from maturity.

However, this is not always the case, the yield curve can invert, resulting in longer-term bonds trading on lower yields than short-term bonds.

When this happens, it can reflect investor concerns about the short-term economic outlook, as they are willing to accept less income to lend for longer.

Bond yields typically 'curve' up with increasing contract length. Future inflation expectations are a big driver behind the shape of the yield curve. If inflation is expected to be higher in the years to come, yields will, in theory, rise across the curve.

Are high yield bond investments better than low yield?

Generally speaking, the higher the bond yield, the higher the risk. Bond funds that invest in the riskiest bonds such as high yield bond funds and emerging market bond funds offer the highest yields. Bond funds that invest in the safest part of the bond market UK and US government bonds have the lowest yields. The interest rate set by the central bank also influences bond prices.

As bond prices and bond yields have an inverse relationship, rising bond yields reflect a falling bond price, and vice versa.

How to buy bonds

You can trade a number of bonds and gilts via your online ii account. For any that aren't available online, you can deal over the phone by calling us on 0345 607 6001.

The value of your investments may go down as well as up. You may not get back all the money that you invest. If you are unsure about the suitability of an investment product or service, you should seek advice from an authorised financial advisor.