Inflation watch: 30-year high and more to come

16th February 2022 12:53

by Graeme Evans from interactive investor

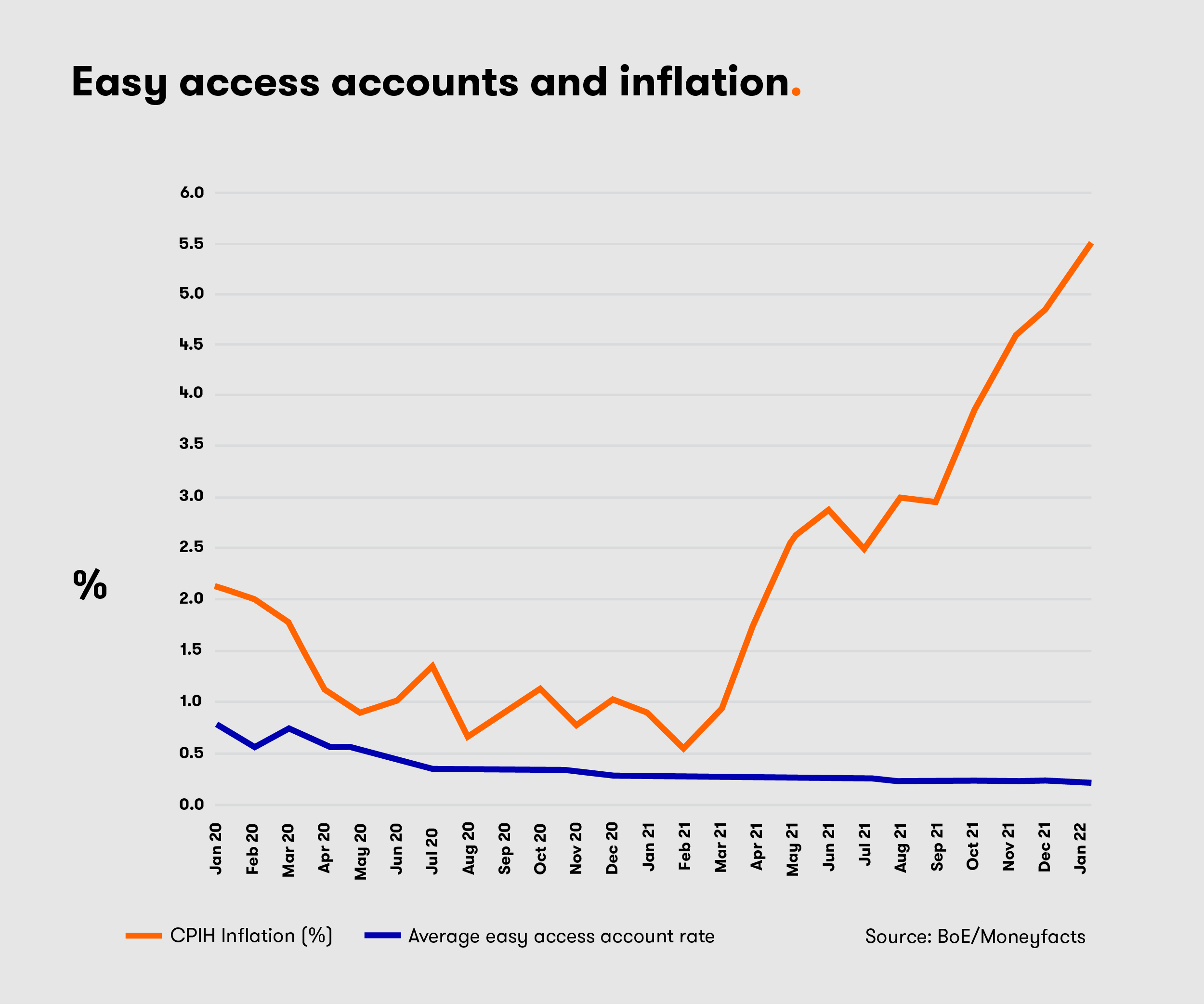

The plight of savers continues to deteriorate after inflation reached a 30-year high of 5.5% in January, with more pain on the way.

Respite for savers appears a long way off after today's inflation figure of 5.5% fuelled speculation that the annual rate could be near to 8% in the coming months.

In contrast to the 30-year high for the consumer price index (CPI) in January, Moneyfacts reports that the current average easy-access rate stands at a mere 0.21%.

This lowly figure is despite the Bank of England raising interest rates from 0.1% to 0.5% at its two most recent meetings and further hikes being priced in by financial markets.

- A guide on how investors can protect against inflation

- ii's ‘Real Returns Ready Reckoner’ reveals ravages of inflation

The best easy-access savings rate on the market remains similar to last month as Cynergy Bank and Investec Bank both offer 0.71%. To make matters worse, the Bank of England's long-term 2% inflation target is only beaten by savers willing to lock into a five-year fixed bond.

Moneyfacts finance expert Rachel Springall said: “There are still savers out there waiting for the December base rate rise to be passed on to them, let alone the most recent uplift of 0.25% a couple of weeks ago.

“Those savers with the patience to wait may wish to reconsider their loyalty, particularly as they will not find a high-street bank featured in the top rate tables.”

- Watch our latest fund manager interviews by subscribing for free to the ii YouTube channel

- Our outlook for 2022: key topics and investment ideas for the year ahead

With the unprecedented squeeze on household budgets set to continue for some time yet, Moneyfacts expects the inflation rate will still be 5.2% by this time next year.

Today's change in the annual rate of CPI was minimal, but at 5.5% the figure still continued the run of upward surprises after the traditional new year sales were less generous than usual.

Clothing and footwear inflation rose from 4.2% to 6.3%, while furniture and furnishings inflation peaked at 12.5% for the highest figure since records began in 1989 as the industry counts the cost of ongoing supply chain pressures.

Easing price pressures from restaurants and hotels and a drop back in fuel inflation helped to peg overall CPI, but this respite will be temporary after oil's recent rise to $95 a barrel.

The 54% leap in utility prices on 1 April has the potential to add an extra 1.7 percentage points to overall CPI.

The scale and timing of this upward impact on inflation is subject to uncertainty as the Office for National Statistics (ONS) has still to decide how it will deal with mitigating measures announced by the government, such as the £200 discount on electricity bills planned for October.

Paul Dales, chief UK economist at Capital Economics, warned: “We now think that CPI inflation will peak at 7.9% in April compared to the Bank of England's forecast of 7.25%.

“We also think wage pressures will linger longer. That's why we think interest rates will rise further than most.”

- Shares to protect against persistently high inflation

- 10 stocks that could protect investors from inflation

- Ian Cowie: inflation-busting income from six investment trusts

If the Bank of England raises rates on 17 March, it will be the first time since 1997 that it has done so at three consecutive meetings. Capital Economics thinks rates will rise to 1.25% this year and to 2% next year.

Investec chief economist Philip Shaw sees inflation peaking at 7.3% in April, with the rate poised to stay above the Bank's 2% target for the next two years or so.

Given the tightness of the labour market, he warns that a firm upward response in pay awards might prompt the Bank of England to apply the monetary brakes somewhat harder.

Shaw added: “Our current forecast is that the monetary policy committee will stand pat at its meeting next month and lift the Bank rate again in May, as it tries to contain ever strengthening rate hike expectations and prevent markets from getting carried away.

“But there is a clear risk that it opts instead to ‘front-load’ tightening to protect its inflation credibility.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.