Interactive investor launches £200 SIPP cashback offer

An early Christmas cracker for new customers.

20th November 2023 09:44

by Alice Guy from interactive investor

- New Customers who open a Which? recommended ii SIPP before the end of 2023 will receive £200 cashback

- The offer follows ii’s launch of ‘Pension Essentials’ in October, the incredible value SIPP for those with a pot of more than £15,000

- Fees can take a big chunk of pension savings over time but ii’s 2023 ‘Show Me My Money’ pension report revealed that 74% don’t know what fees they are paying to their pension provider

- Offer comes before annual CGT and dividend tax allowances halve from April 2024.

interactive investor (ii), the UK’s biggest flat-fee investment platform, is offering new customers a chance to treat themselves this Christmas with the offer of £200 in cashback if they open a pension between 20 November and 31 December 2023.

- Invest with ii: Open a SIPP | Best SIPP Investments | SIPP Cashback Offers

The sizeable cashback offer comes at this expensive time of the year with the holidays fast approaching. However, the offer is only part of the equation.

Using the power of ii’s predictable flat fees, customers who make the most of the offer will likely be saving much more than £200 over the medium and long term. That’s because ii’s self-invested personal pension (SIPP) can be substantially cheaper than its platform rivals which charge customers a percentage of money invested, rather than a simple flat fee.

ii’s flat fee structure is the gift that keeps on giving. It helps customers take control and keep a lid on their fees as their investments grow, potentially saving thousands over the years.

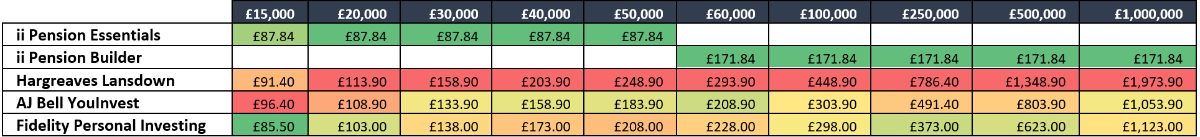

Customers with £30,000 in their pension could save at least £45 each year compared to other pension providers, rising to at least £95 each year for customers with £50,000 in their pension and more than £125 per year for customers with £100,000. The table below demonstrates how excessive fees can persistently eat away at investments.

Fees paid per year by pension value:

Source: the lang cat. The yearly costs in the table assume portfolios of 50% funds and 50% equities with 2 fund trades and 2 equity trades per year, as well as 12 regular equity trades and 12 regular fund trades.

Alice Guy, Head of Pensions and Savings at ii says: “Christmas can be an expensive time, so receiving £200 cashback for moving your pension to the best-value provider in the market is a great way to treat yourself both now and in the future.

“ii is a recommended SIPP provider by Which? – a fantastic endorsement of the overall value and service to our customers, so you’ll know your money is in safe hands. Between this cashback offer and the compelling savings customers receive on our fees, we think we offer the perfect place for people to save for their retirement.”

“At interactive investor, the way we charge provides an extra boost to pension savings. Because we charge a simple, flat fee and our predictable, low costs can mean more of customers’ money is working for them, not their platform provider. With other platforms, their percentage-based fees mean charges become more and more costly as investments grow over time.

“Our 2023 Show Me My Money pension report revealed that 74% don’t know what fees they are paying to their pension provider. But how much we pay in pension fees can vary significant between providers and can take a big chunk out of your pension wealth over time.

“The offer comes at a time when pension saving has never been more important. Changes to capital gains tax and dividend tax thresholds mean it is vitally important to protect your assets from tax by using either a pension or an ISA. The benefit of pension saving is that you’ll also get an additional boost from the taxman for amounts you pay into your pension, making pensions one of the best ways to boost your long-term wealth.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.