Investor poll: here’s where you’re investing your ISA allowance

With the clock ticking, we asked you about your plans for any remaining ISA allowance for the 2023-24 tax year. This is what you told us.

8th February 2024 09:32

by Lee Wild from interactive investor

There are just two months of the current tax year left, and time is running out for investors who plan to make use of their £20,000 annual ISA allowance.

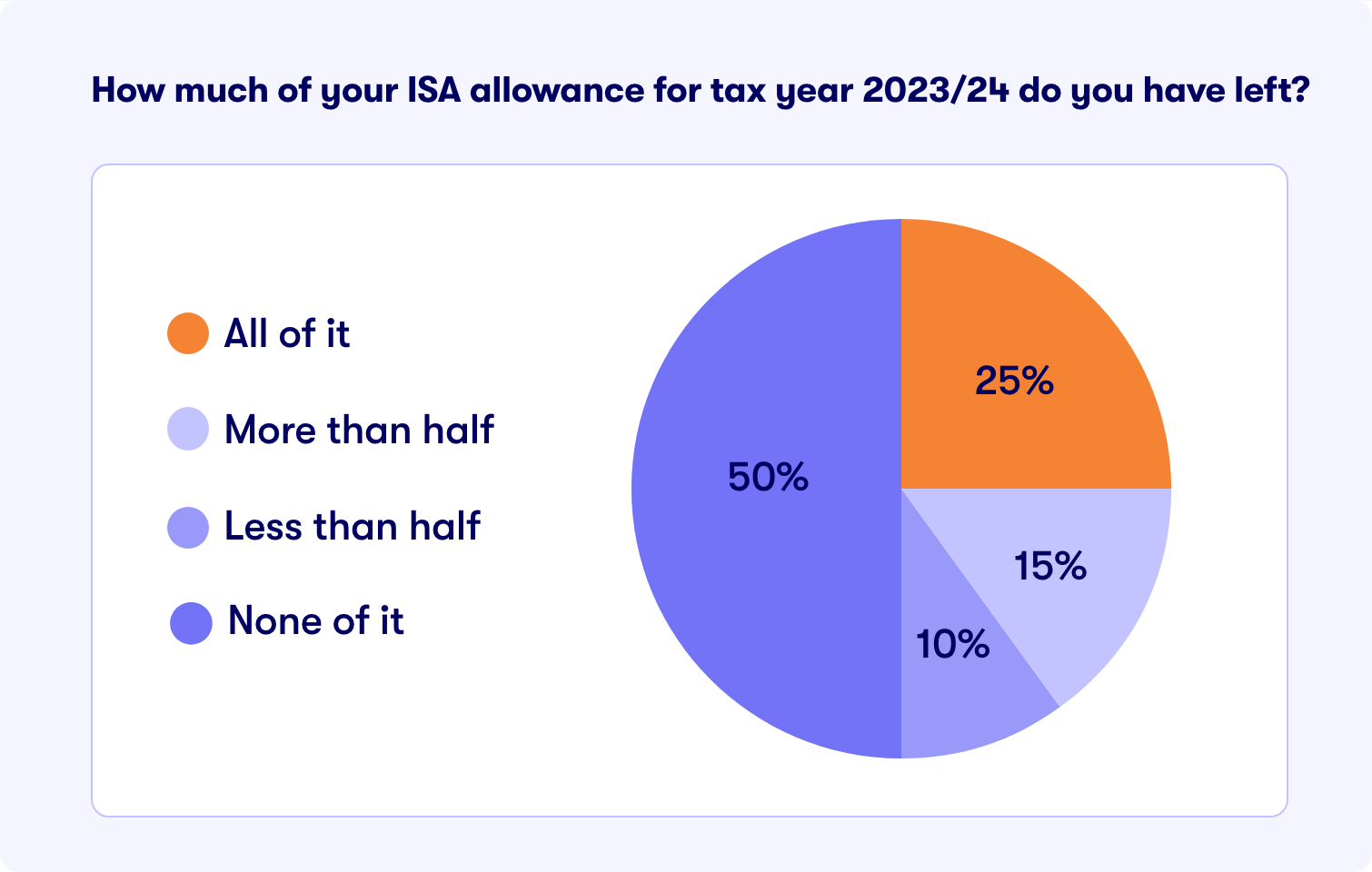

We asked customers and visitors to the interactive investor website how much of their ISA allowance they had left for the 2023-24 tax year. Half of those who responded to our poll, which ran on 23-24 January, had used the full £20,000 already and 10% had less than half remaining. But 40% had more than half their allowance at their disposal, with 25% having the full amount.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

1,863 respondents

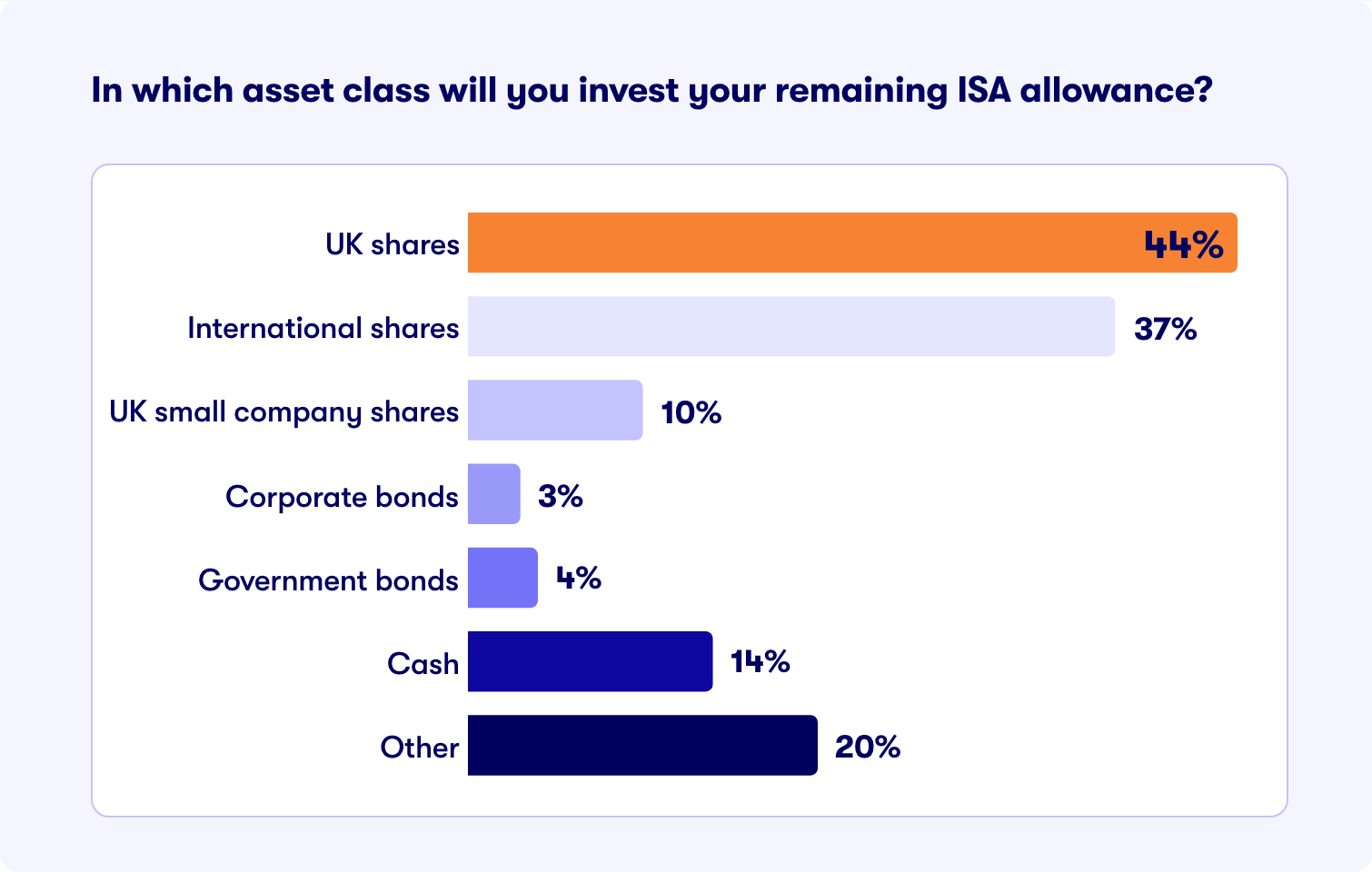

Of those investors with money left to invest in this year’s ISA, 44% told us they planned to buy UK shares. That’s a vote of confidence in their home market, which has largely underperformed rivals for a number of years. While dividends beef up total returns among the larger UK companies and some of the smaller ones, there are exciting growth prospects here, too. Things will hopefully pick up when interest rates start to fall.

But many investors aren’t waiting around for whichever catalyst is needed to revive UK Plc. International shares are the second-most popular destination for ISA cash, and close behind the UK with 37% of respondents looking for opportunities overseas.

UK small company shares have had a rough couple of years, but plenty are convinced that valuations are too low, and potential is not currently factored in.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- My first five years as an ISA investor

- How I plan to invest my ISA allowance in 2024

10% of respondents to our poll agree and will be buying them this ISA season. A decline in interest rates should aid a more sustained recovery as growth stocks become more attractive, and we have seen shares prices improve since November.

Elsewhere, and with interest rates yet to be cut from elevated levels, 14% of respondents are sticking with cash for their remaining 2023-24 ISA allowance, 7% like bonds, while 20% say they’ll pick ‘other’ investments.

1,161 respondents

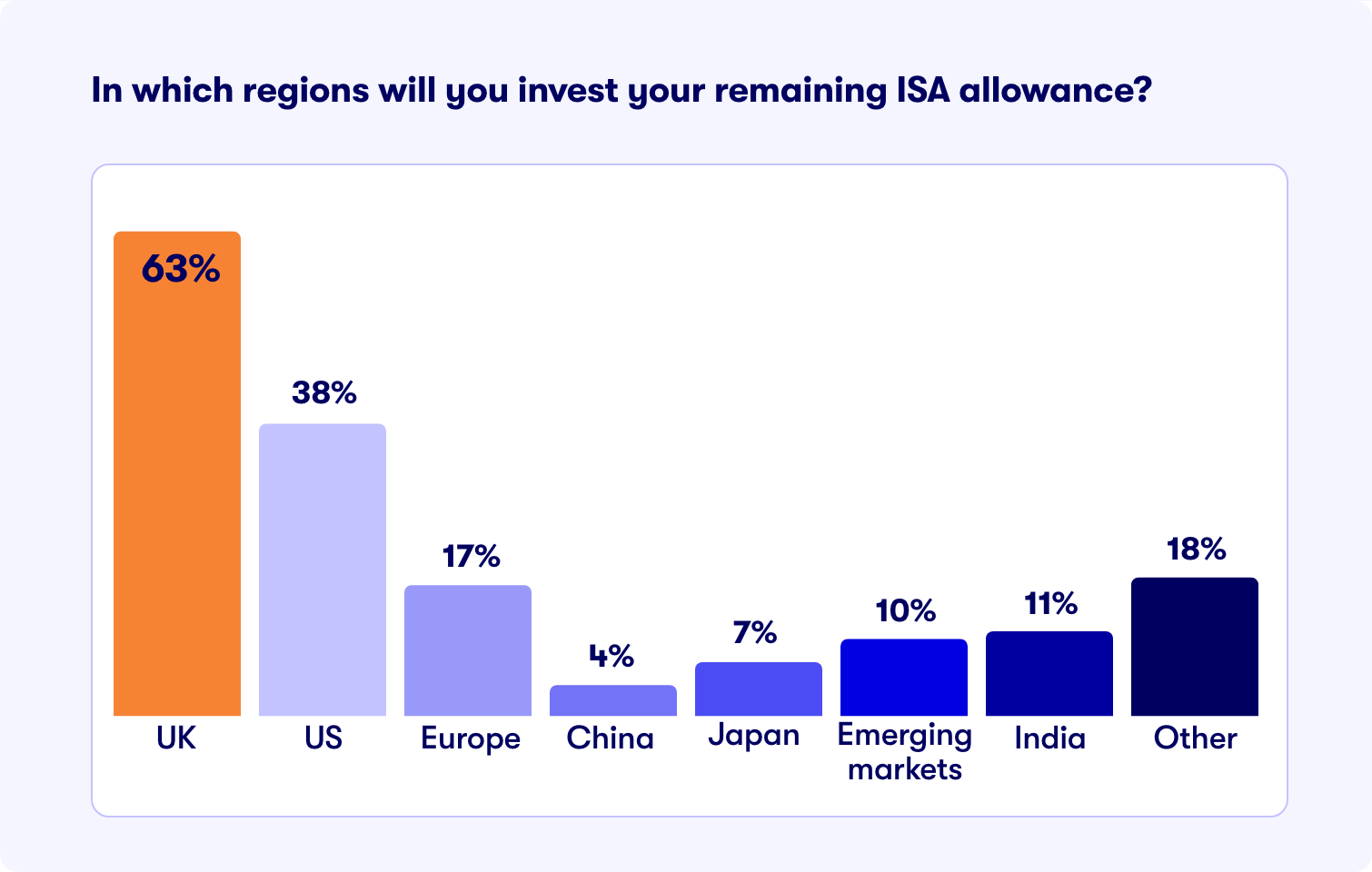

As you would expect, when asked about which regions they’ll be investing their ISA money in, the results more or less reflected the splits between international shares and UK in the question about asset classes.

Almost two-thirds of respondents (63%) said they’ll be investing in the UK in the final few months of this tax year, while 38% are heading for the booming US stock market. Both those numbers are an improvement on the 57% and 31% recorded in our previous poll just before Christmas.

Europe has become more popular, too. Markets there have outperformed the UK, and 17% of respondents to our poll say their ISA money is heading to the Continent. Before Christmas it was 12%. Demand for India exposure (11%) is down from 16% last time, and emerging markets (10%) is down from 14%.

1,050 respondents

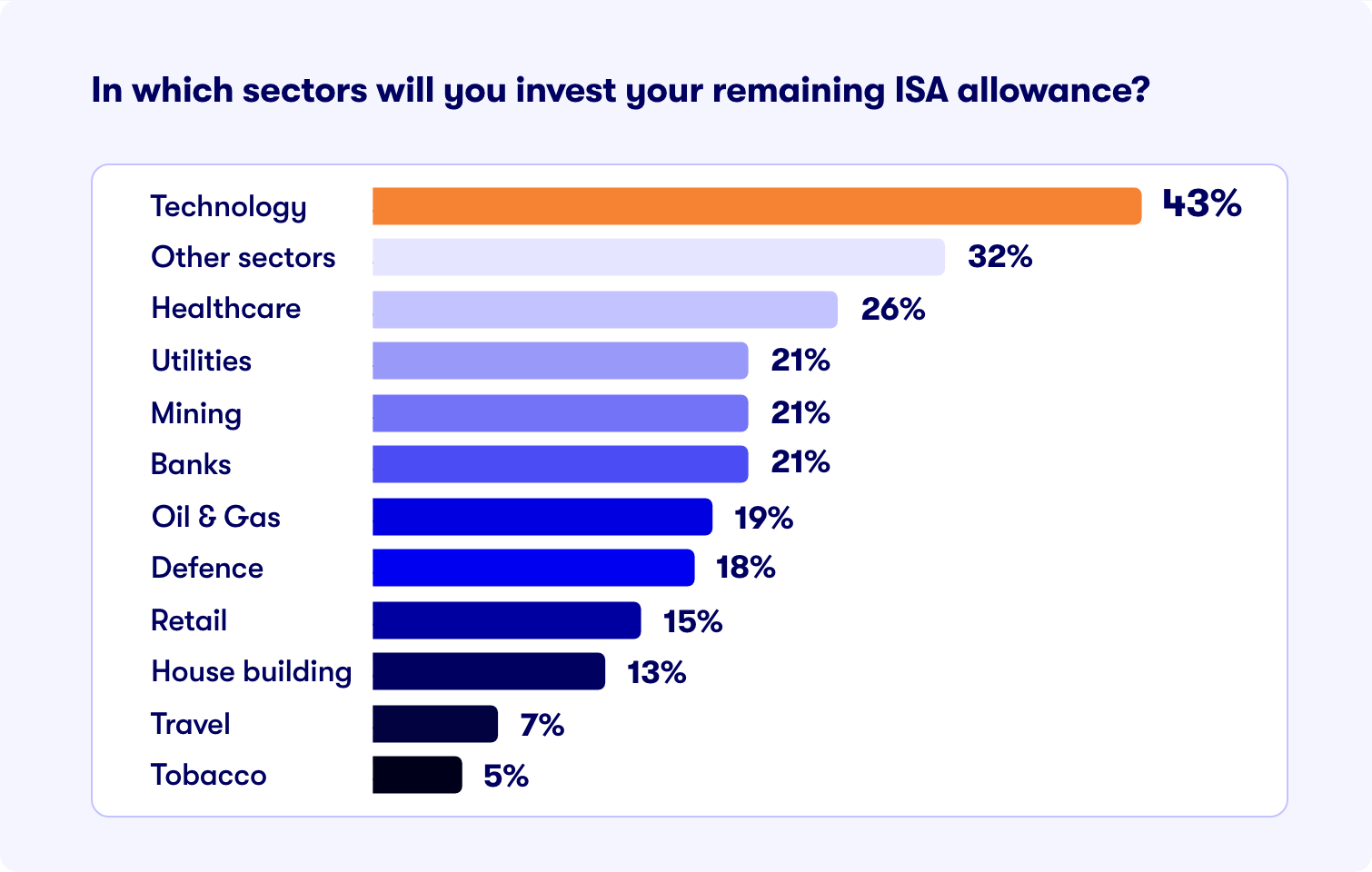

Unsurprisingly, 40% of respondents told us they would be mostly investing in the tech sector, at least for the rest of this tax year. That’s more than the 36% who said the same late last year.

America’s Nasdaq Composite tech index is up 33% in the past year, driven largely by the Magnificent Seven - Apple Inc (NASDAQ:AAPL), Microsoft Corp (NASDAQ:MSFT), Alphabet Inc Class A (NASDAQ:GOOGL), Amazon.com Inc (NASDAQ:AMZN), Tesla Inc (NASDAQ:TSLA), Meta Platforms Inc Class A (NASDAQ:META) and NVIDIA Corp (NASDAQ:NVDA). Eager to gain exposure to the artificial intelligence theme, investors have chased these mega stocks to record highs.

- Bed and ISA: the handy tax trick to boost your wealth

- Stockwatch: time to sell Meta and Amazon or hold on?

Amazon and Microsoft are up 70% and 55% respectively in the past year, and Facebook owner Meta Platforms is up 156%. Nvidia shares are up 215% in the past 12 months at over $700. Only last May people were wondering if it could break above $400.

Healthcare (26%) continues to attract interest, up from 19% before Christmas, while around a fifth of those polled said they’d be buying bank stocks. It was roughly the same percentage for mining, oil & gas, defence and utilities. The last two saw significant shifts in interest, with utilities up from 12% in December to 21%, while defence fell from 28% to 18% in this poll.

855 respondents

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.