Market reaction to new US inflation data

Latest data shows the world’s largest economy still battling inflation, but many analysts believe that costs will fall more rapidly in the months ahead. Some see a similar pattern playing out in the UK.

12th October 2023 15:32

by Graeme Evans from interactive investor

A reminder the fight to bring inflation back under control is not yet won today punctured some of the optimism that US interest rates may have peaked.

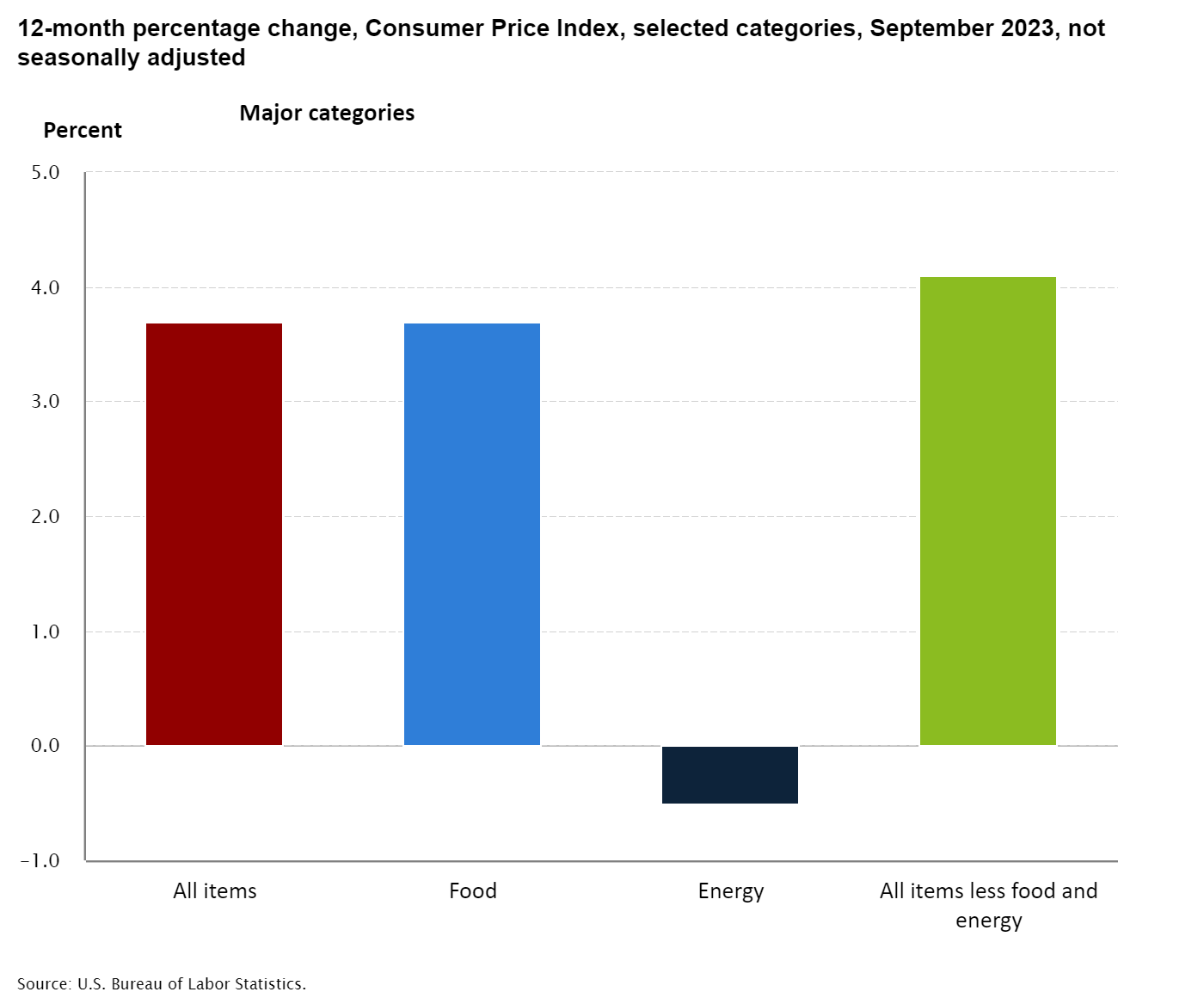

The US inflation reading for September had been forecast to ease to 3.6%, but instead came in unchanged on a month earlier at 3.7%.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

The rate, which had been as low as 3% in June compared with 7.7% in October 2022, was impacted by a smaller-than-expected decline in energy prices. Excluding fuel and food, core inflation fell to a two-year low at 4.1% from 4.3% previously.

The S&P 500 index opened at a lower level than had been expected before the inflation reading, while the FTSE 100 index came off its high for the session.

Markets have calmed in recent days after dovish comments by some policymakers suggested that the Federal Reserve may decide not to raise interest rates any further.

The stance follows a recent jump in long-term US bond yields, which could act as an effective alternative to actual increases in the policy rate. Members have also highlighted the danger that the Fed overtightens on interest rates.

Prior to today’s inflation reading, futures markets priced the likelihood of a hike at the end of the Fed’s next meeting on 1 November at 10%. This compared with 31% last Friday after monthly non-farm payroll figures came in at double the expected level.

Overall, Capital Economics believes there is nothing in the September inflation data that will convince Fed officials to hike rates at their next meeting.

- What Arm and Birkenstock tell us about state of global IPO market

- US bank sector earnings season: high expectations for these big players

- Buy this solid $200bn stock when it does this

The consultancy added: “We continue to expect a more rapid decline in inflation and weaker economic growth to result in rates being cut much more aggressively next year than markets are pricing in.”

In the UK, inflation figures are due on Wednesday as investors look for further signs of progress after last month’s surprise slide in August’s figure to 6.7%.

Deutsche Bank today said it forecast a slight drop in the headline rate to 6.6%. It added: “After sizeable upside surprises through the first half of the year, we see inflation continuing its descent largely unabated in the second half of 2023.

“By year-end, we think headline CPI will have slowed to around 4.5% year-on-year, firmly below the government's pledge to halve inflation from the start of the year.”

Deutsche Bank thinks it will take until 2025 to get to the Bank of England’s 2% target but that the risks are “skewed to an earlier landing”.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.