A monumental money-spinner worth an extra $100 a share?

7th December 2022 08:13

by Rodney Hobson from interactive investor

It could be the discovery of the century and generate billions of dollars of profit. Our overseas investing expert explains what he thinks the future holds for this high-profile company.

A major breakthrough in the treatment of the most common form of dementia has excited interest in pharmaceutical company Biogen Inc (NASDAQ:BIIB). Alzheimer’s sufferers and investors alike should beware of getting too carried away.

Lecanemab , developed by Biogen and Japanese counterpart Eisai, has been widely acclaimed as “a triumphant turning point” and “momentous” in the treatment of Alzheimer’s disease. The new drug has been shown in tests to slow down the sticky plaque, called beta amyloid, that clings to neurons in the brain and stops them from working properly.

- Discover more: Buy international shares | Interactive investor Offers | Most-traded US stocks

Until now, drugs used to treat Alzheimer’s are designed to manage the symptoms. Lecanemab offers a genuine prospect of treating the disease itself. There is great need for it, as 55 million people suffer from Alzheimer’s and, as people live longer and the elderly population grows, that is projected to reach 140 million in the next 30 years.

The excitement greeting Lecanemab has been sparked by a history of disappointments in possible treatments for Alzheimer’s but it needs to be kept in proportion. There is as yet no reason to believe that this will be a monumental money-spinner for Biogen.

Firstly, it is not a cure. It has been shown to merely slow down the progression of the disease. Secondly, it has been shown to work only in the early stages of Alzheimer’s and does not seem to be suitable for those in the later stages. Thirdly, it may have only a limited impact even where it does work, since the progress of the disease was slowed by only a quarter over a trial period of 18 months.

This may be the end of a beginning littered with 100% failures, but it is far from being the beginning of the end in the quest to treat one of the cruellest diseases to inflict human beings.

Data from what was quite a largescale trial involving nearly 2,000 patients is already being assessed by US regulators, and the approval process will be started in several other countries next year.

However, bringing a new drug to market is a very expensive and time-consuming process and much can go wrong in later stages of gaining approval. It is worrying that 7% of patients on the latest trial had to stop taking Lecanemab because of side effects.

- Five ‘outrageous’ stock market predictions for 2023

- These two regions are tipped as winners in 2023. Here’s how to profit

There is a lot of work ahead for Biogen’s new chief executive officer Christopher Viehbacher, who took over just a month ago. He has the right credentials, having spent 20 years at GSK (LSE:GSK) followed by six challenging ones as global CEO of Sanofi SA (EURONEXT:SAN), reviving its portfolio of drugs.

Biogen develops and makes a range of drugs to treat neurological, rare and autoimmune diseases. It has had some notable successes with treatments for multiple sclerosis.

The company reported weaker revenue in the third quarter, down 9.7% year-on-year to $2.51 billion, but profits nearly doubled even after deducting a $503.7 gain from the sale of a building. It has raised its revenue forecast for the full year slightly although the figure will still be down on 2021.

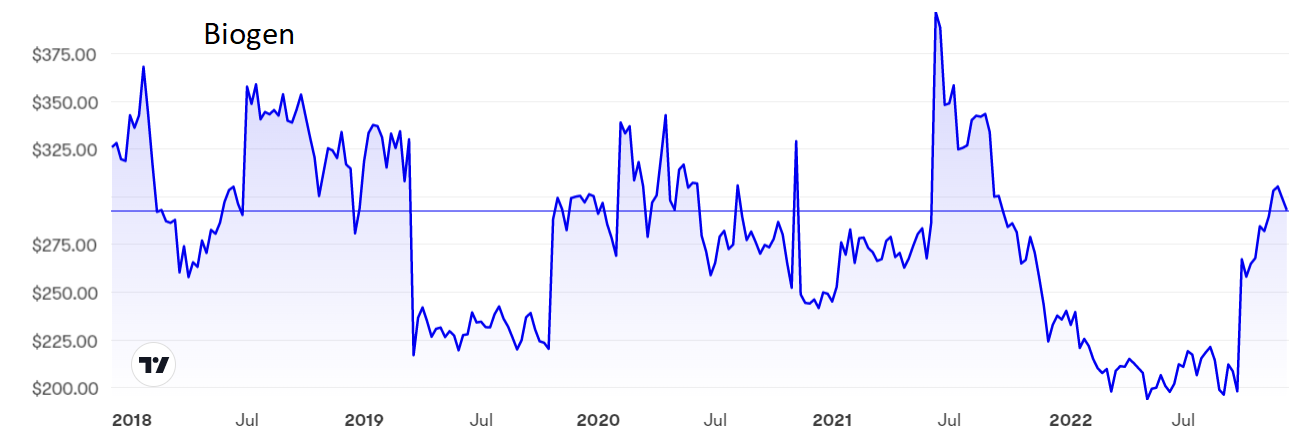

Source: interactive investor. Past performance is not a guide to future performance.

Biogen shares have swung wildly over the past five years, peaking at just under $400 and hitting a low of $200. In response to its Alzheimer's data published at the end of September, the shares soared from under $200 to over $300 in November, a gain of over $100 a share. They are currently around $291, giving a price/earnings ratio of 15, roughly around the stock market average.

There is, however, no dividend, so at the moment investors are entirely reliant on an upward share price movement to make any gain. Developing drugs is an expensive business so any profits are likely to be ploughed back into further research rather than being distributed to shareholders.

Hobson’s choice: Hold around current levels. Sell at $330. Buy at $250. If you want income, look elsewhere.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.