Next’s worrying statistic and a new share to follow

Our analyst examines big challenges for Next and runs the numbers on an exciting tech share.

17th April 2020 15:27

by Richard Beddard from interactive investor

Our companies analyst examines big challenges for Next in the short and medium-term, and runs the numbers on an exciting tech share.

Next (LSE:NXT) methodical reaction to the coronavirus pandemic resembles its reaction to another big challenge, the Internet. The retailer has won justifiable plaudits for modelling cash flows as High Street sales decline, and its annual report, published this week, models the potential impact of the virus (as best Next can).

What Next?

Fashion and homeware retailer Next initially closed its online business, responsible for more than half of revenue and a greater proportion of profit, as well as its physical stores. Earlier this week, it opened back up for business online - initially supplying a limited range of childrenswear and home items.

It has also limited the quantity of products it will sell in a day, closing the website when it reaches the limit to ensure warehouses are populated by relatively few staff and employees maintain a safe distance from each other.

The impact of the pandemic will go beyond lost sales from closed stores and a reduced online service, the company says, because people buy fewer clothes when they’re not going out.

But Next’s modelling suggests it can withstand a reduction of more than £1 billion in sales (25% of the total) in the year to January 2021 without breaching the terms of its borrowing agreements.

Twenty-five percent of sales doesn’t sound like much, it would be the equivalent of three months of lost sales if sales were spread evenly.

They’re not though. Like many retailers, trading at Next peaks in the run-up to Christmas, so it’s a small blessing the pandemic appears to be peaking in spring.

High levels of profitability have allowed Next to return money to shareholders through share buybacks and special dividends, so Next does not have a hoard of cash.

Survival in the worst-case scenario requires Next to conserve cash by suspending buybacks, delaying capital expenditure, and deferring or suspending the dividend.

It would also need to find new sources of cash, potentially by redeeming a loan to its Employee Share Ownership Trust, by effectively borrowing more through the sale and leaseback of a warehouse and using money owed by customers as collateral for borrowing.

Somewhat reassuringly, Next’s modelling does not assume borrowing from the Government, but presumably the option is there if it needs it.

The pandemic will end!

Even more reassuringly, this subheading is not mine. It’s from Next’s annual report. The company remains committed to evolving into a predominantly online business that uses its diminished retail base as a resource.

This is a strategy that impressed me when I reviewed the company last year and, despite an unanticipated focus on survival in Next’s plans for 2021, it’s still embracing the future. Next says:

“... when the dust settles it will be the work we have put into (1) securing the cash resources of the business and (2) moving the business forward that will make the difference to the long term future of the company.”

Taking a leaf out of Amazon’s playbook, Next believes choice is the most important advantage offered by the Internet, and convenience is secondary.

If Next is to grow as an internet retailer, it says it must offer more choice, which means selling rival brands on its own website, sometimes as stockist but usually on commission, even though these products compete with its own higher margin NEXT Brand.

- Are these retail sector stocks about to run out of cash?

- A checklist for finding dividend shares in a crisis

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Next is giving customers the choice they want, which requires it to open the Next ‘platform’, the website, logistics, marketing, systems, and customer credit facility to rivals.

Having developed these online capabilities, it is also expanding its overseas websites. LABEL sales (third party brands), overseas sales, and online sales (which incorporates the other two) have been experiencing double digit revenue growth for some time.

Profit margins were high in the year to January, even though Next aims to be its partners’ most profitable route to market.

LABEL net profit margins were 15% in 2020, compared to 21% for NEXT Brand.

In the 2020 annual report, Next reveals that it has agreed in principle to provide a cut of the Next platform and serve it up as a third party’s website.

It will be providing a pay-as-you-go operating infrastructure comprising every aspect of the Next platform. Perhaps it will be the first of many instances of “Total Platform”:

I’m in the process of rejigging my spreadsheets. By incorporating data from SharePad, a provider of stock market data and tools, in place of some of the data I have hitherto collected manually, I hope to make them quicker to collate and maintain.

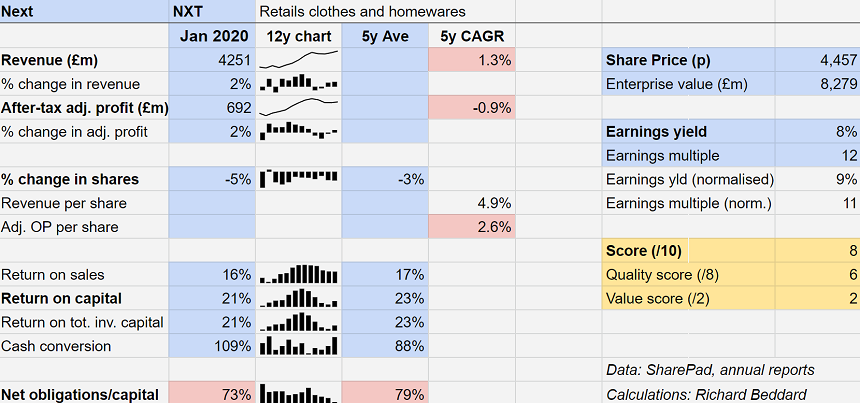

I am also making them easier to read and interpret. This is the summary I have created for Next. It looks like it’s Neapolitan flavoured, I know:

Next has been a tremendously profitable business, and the bits I am less sure about are highlighted in pink.

Over the last five years, the contraction in revenue and profit at retail stores has pretty much nullified growth, although Next has grown modestly on a per-share basis thanks to the buybacks.

Meanwhile, the company’s policy of returning cash to shareholders means a relatively high dependence on borrowings and lease liabilities.

Net financial obligations were 73% of operating capital at the year-end.

That statistic worries me, but I also believe if any retailer can manage its way out of this crisis and come out stronger, Next can.

Perhaps I am in awe of its chief executive, Lord Wolfson, and the strategy he has championed. This is how I score Next:

Does the business make good money?

[2]

- Yes

What could stop it growing profitably?

[0]

- Internet competition has diminished Next’s traditional competitive advantages like the brand, and prime store locations

- Dedication to buybacks and special dividends means Next has scant resources to see it through a crisis barring the capacity to borrow more.

How does its strategy address the risks?

[2]

- Next is creating value from all its capabilities by selling them to rivals

- By using elements of its own online platform, it is growing overseas

- So far it has maintained profitability and avoided shrinking by reducing the cost of retail stores while using them to support online sales.

Will we all benefit?

[2]

- Chief executive, Lord Wolfson, is experienced and a committed shareholder

- The directors are taking a 20% pay cut this year

- The company explains itself well to shareholders

- Staff reviews online are fairly typical for retail

Are the shares cheap?

[2]

- A share price of £44.57 values the enterprise at just under £8.3 billion, about 12 times adjusted profit. The earnings yield is 8%

Next is ranked 7th out of the companies I follow most closely. A score of 8/10 suggests it ought to be a good long-term investment, although there are big challenges in the short and medium-term.

Something new: Computacenter

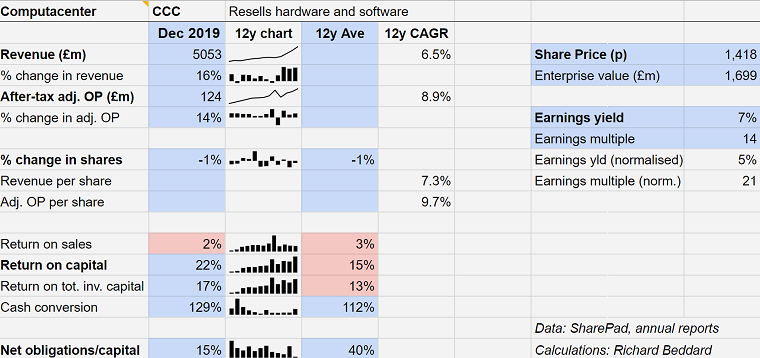

A glimpse of a new share today. I have run the numbers on Computacenter (LSE:CCC), which sells hardware and software to very big companies. I haven’t got round to scoring it yet:

In recent years, Computacenter’s numbers have been improving as technology is embedded at the heart of businesses and companies have been adopting new cloud-based systems.

It is a low margin business, but return on capital has been improving for at least 12 years and, coronavirus aside, it looks like it could be a very good business.

Getting back into the market

I have been corresponding with a potential investor about a company we admire.

Coincidentally she is thinking about buying shares for the first time since the dot.com crash when she lost money, so it’s a delicate time.

My correspondent hasn’t asked for advice on timing the market, which is a good thing as I don’t have any, but the possibility her second experience of the stock market might be as bad as her first 20 years previously prompted me to think about how I would approach investing new money in the stock market.

I would do it gradually, ensuring I retained enough cash to pay my living expenses should my income dry up. And I would write down my reasons for investing in a share before buying it, because the act of writing helps me check I have thought things through. Same as always.

Richard owns shares in Next.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.