‘No need to wait for ISA reform’

Interactive investor urges investors to take control, do it themselves, and save thousands of pounds.

5th December 2023 09:43

by Camilla Esmund from interactive investor

- interactive investor urges investors not to wait for full ISA reform – but instead, to take control of their ISAs themselves and look at fees and charges

- Research shows that half of investors (52%)* say fair charges are among the top three most important criteria when choosing who to invest with

Many leading voices in the financial services industry, including those from interactive investor, the number one flat-fee investment platform, have been calling on the government to overhaul the complex ISA system for years. Last month’s Autumn Statement revealed a number of reforms coming down the pipeline for ISAs, but ii urges that investors can take control of their ISAs themselves, now, and ultimately – confidently build their long-term wealth and financial futures without having to wait.

- Invest with ii: Open an ISA | Top ISA Funds | Transfer an ISA to ii

Why wait for the reform, when there are steps investors can take now…

There’s no need to wait for the reforms in last month's announcement to come to full fruition; iiis encouraging consumers to take control now – check ISA fees, consolidate, and ultimately save themselves a lot of money over the long term.

Investors want to be charged differently

ii research showed that half (52%) of investors place fair charges among the top three most important criteria when selecting who to invest with*. In the same research, a staggering two-thirds (67%) think firms should use a fixed subscription fee, rather than charges based on a percentage of their investments*.

Bringing ISA charges out of the dark and into the light

Most investment platforms charge their customers by a percentage of assets, and this adds complexity. It means it’s harder for their customers to figure out exactly how much they are being charged each year. Investors shouldn’t have to get their calculators out.

In fact, and understandably – with charges still ‘in the dark’ for many individual investors, there is still a common misconception that investors are not paying anything in fees.

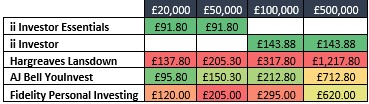

To illustrate the possible savings investors can enjoy by moving to a simple and transparent ISA charging structure, ii asked independent consultancy, the lang cat, to run some comparison figures for ii versus Hargreaves Lansdown, AJ Bell, and Fidelity Personal Investing, using different pot sizes.

The data below demonstrates the real impact charges have on investors’ wealth, with percentage-based charging leading to greater costs over time.

And it’s not just the largest pot sizes where you see the impact. The data below shows that over one year, with a pot of £20,000, investors would be paying 50% more with Hargreaves Lansdown than they would with ii. At £50,000, investors would be paying more than twice as much in fees with Hargreaves. Think of how this accumulates over time.

Annual cost breakdown

Source: the lang cat. Based on a portfolio with 50% funds and 50% direct equities (or investment trusts), with 4 fund trades and 4 equity trades. No regular investing.

With percentage-based charging, the more people grow their investment pots, the more they must pay the platform in fees.

Richard Wilson, CEO, interactive investor, says: “The message from us to investors today is one of empowerment. If you want to build long-term financial strength, you've got to have confidence. And to have confidence, you must have consistency and transparency. Yes, the broader conversations around ISA reform are important – but there are actions investors can take now. This is why we want to shine a spotlight on fees.

“Fee structures matter. It’s like someone being forced to pay a higher license fee because they have a bigger and more expensive TV. If you don't have to pay for something, why pay it? Percentage charging is a legacy of bygone times when platforms made commission on investment products. It’s a shame so many platforms still charge percentage-based fees, which are confusing and, in most cases, more expensive for customers over time. There’s also the common misconception that many people have that they aren’t paying anything at all, but the sad reality is that they are, they just can’t see the fees directly.

“We don’t think this is right. With ii’s fair flat-fee model, customers consistently know what fee they are going to pay each month – and that charge remains the same. Our fees are low, predictable, and controllable.”

Broadened value for investors

Richard Wilson adds: “For many years, the competitiveness of flat fees only really kicked in at investment pot sizes of, say, £50,000 and over. However, following the launch of our Investor Essentials and Pension Essentials products (which cost just £4.99 and £5.99 per month) we’ve broadened the access and appeal of flat fees to the mass market, and we’re now competitively charged at smaller pot sizes.

“Investors just starting out can now benefit from cost savings as well as seasoned investment pros. We might not blow people away on price competition if they invest £5,000 or £10,000 and never contribute again, but for those who want to grow their investments over the long term, we are the home for you. Over time, our fees are only going to get cheaper versus our main rivals as you invest more for you and your family’s future.

Notes to editors:

Research information

*Based on Opinium research conducted by Opinium Research between 15 and 20 December 2022, questioning 1,000 UK adults with money invested outside a pension – ii customers were not specifically targeted.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.