One of IBM’s offspring that investors have forgotten

Set up by ex-staff at the US tech giant years ago, our overseas investing expert spies an opportunity.

3rd March 2021 10:15

by Rodney Hobson from interactive investor

Set up by ex-staff at the US tech giant years ago, our overseas investing expert spies an opportunity.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Selling technology to businesses is one growth area that will continue to flourish however long it takes the world to claw its way out of the Covid-19 pandemic. One company that fits the bill, but is generally overlooked by small investors, is the German outfit SAP (XETRA:SAP). The past 12 months have not exactly been smooth going but this year should see a return to solid growth.

SAP was founded in 1972 by former employees at International Business Machines (NYSE:IBM), the giant technology supplier to businesses worldwide. Although a smaller operation, SAP has grown globally to supply software for managing databases, business information and resources to 440,000 mainly small and medium-sized companies across 180 countries.

Last year was inevitably difficult for SAP, as it also was for so many of its customers, and it is likely that difficult times will continue through 2021. Even so, SAP increased profits for 2020 as a whole, in large part because of reduced costs, and is confident of a further improvement this year.

- Europe’s stock market: an introduction to investing on the continent

- Want to buy and sell international shares? It’s easy to do. Here’s how

The big driver of revenue and profits is currently cloud computing, by far the largest part of the company’s business. This is by no means unique to SAP, and while this phenomenon has been given an extra boost by office staff in many countries working from home during the pandemic, the trend is likely to continue. SAP reported that the backlog of work for cloud computing was up 7% at year end at a healthy €7.15 billion.

Software licence revenue, still a substantial part of the business, has suffered but should bounce back, or at least stabilize.

Total revenue last year was little changed but the figures were rescued by a 17% surge in cloud revenue, with most of the extra sales coming in the earlier months as the pandemic took hold. Software revenue slumped by 20% but again the situation evened out as the year progressed.

The net effect was that operating profit for the full year soared by 48%, with an eight-point improvement in margins that shows no signs of abating yet. Cash flow doubled, beating expectations that had already been raised during 2020.

For the fourth quarter, cloud revenue rose 8% year on year, while software licence revenue slipped back 15%. That left total revenue down 6% in the quarter, although all these figures would have been better but for unfavourable currency movements. More importantly, operating margins improved by 9 points and operating profit jumped 26%.

SAP expects revenue to continue to achieve double digit growth in 2021, although profits will level off as special factors helping margins are phased out. The plan is to accelerate growth in cloud computing and expand areas with more predictable revenue.

A recent acquisition, for €8.7 million, is Signavio from private equity owners. It provides software used to manage complex business processes and should prove a useful addition to the services that SAP provides.

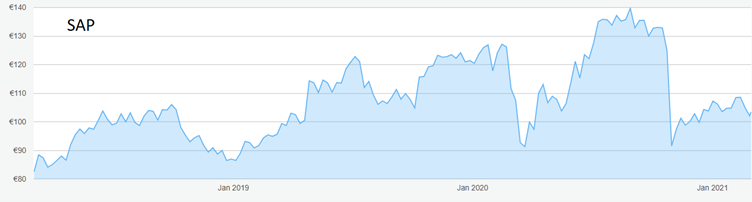

Source: interactive investor. Past performance is not a guide to future performance

The shares have not been for the faint-hearted over the past three years and, in particular, the share price took a premature knock after a comparatively downbeat report on revenue and operating profit in the third quarter.

- Shares for the future: a dozen good businesses

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The roller coaster ride could well continue, with buying and selling opportunities along the way for shorter term investors, and the prospect of an erratic upward journey for those who prefer to hold on for the long term.

At the current €103, the shares are nearer the €80 bottom of the recent range than the €140 peak reached last August.

Hobson’s choice: Buy SAP up to the recent ceiling of €110. The recovery from late October’s sharp fall should continue now that fourth-quarter figures have calmed investors’ nerves.

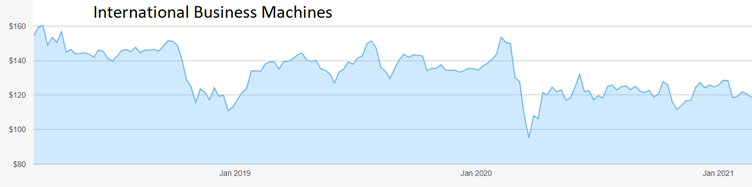

Update: I last wrote on IBM in November 2019 when I suggested that the share price was underpinned at $130. The pandemic knocked a hole in that but, at $120, now the case for buying is more compelling.

Source: interactive investor. Past performance is not a guide to future performance

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.