The only fund that we are holding onto

Saltydog analyst’s portfolio was 65% cash before today’s crash. This is now the only fund he owns.

9th March 2020 12:35

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog analyst’s portfolio was 65% cash before today’s crash. This is now the only fund he owns.

Cash is king

At the beginning of last week global stock markets had a temporary boost when the US Federal Reserve announced its first emergency interest rate cut since 2008. It is the only unscheduled move since the Financial Crisis, and also the largest, reducing rates by 0.5%. It was hoped that it would offset the market’s concerns about the coronavirus outbreak.

US stock markets had anticipated the move, and last Monday the Dow Jones Industrial Average went up 5.1%, its largest one-day point gain ever. Other markets followed, but to a lesser extent, and the rebound soon ran out of steam.

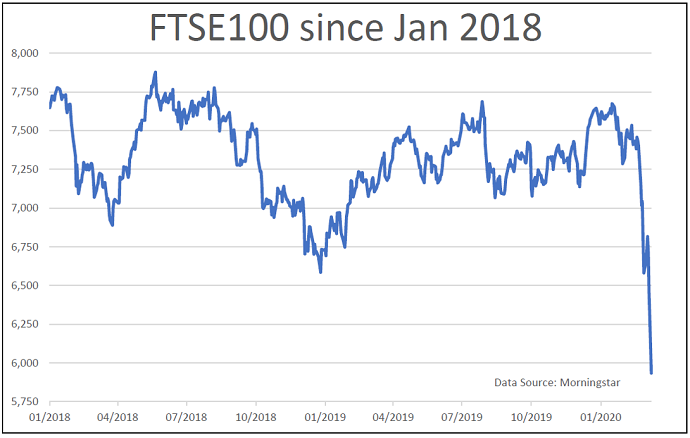

Stock markets fell at the end of last week and haven’t started well today. The FTSE 100 index opened more than 8% lower than its close on Friday, and there has been only a minor bounce since. At one point the index dropped below 5,900, a level we haven’t seen since the beginning of 2016.

Past performance is not a guide to future performance

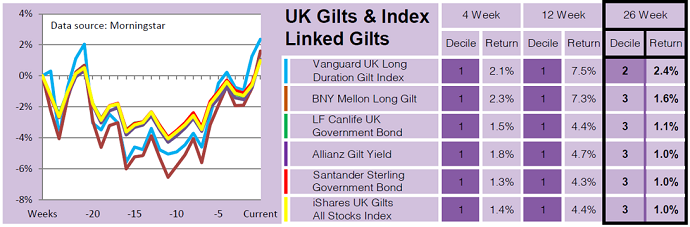

When we reviewed our Saltydog sector reports last week, which covered the 26 weeks up until the end of business on Friday 28th March, they didn’t look pretty.

Only two sectors had gone up in the previous week. The combined UK Gilts & Index Linked Gilts sector gained 1.8% and Global & Global Emerging Market Bonds made 0.1%. The worst performing sector was North America, including North American smaller companies, which had gone down 11.8%.

I’m expecting this week’s reports to be even worse.

We had already increased the cash holding within our demonstration portfolios to over 65% and have now gone a stage further. The only fund that we are holding onto is Investec Global Gold.

When equity markets struggle it’s not unusual to see the price of bonds and gilts start to rise, and this is reflected in our numbers.

Past performance is not a guide to future performance

If stock markets continue to fall, then these funds could add to their recent gains.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.