The price is right for this derailed share

16th March 2022 09:35

by Rodney Hobson from interactive investor

What’s twice as big but costs half as much as it did? The answer to this riddle will give you the share that our overseas investing expert still thinks is a buy.

Picture credit: Alstom/TOMA - Richard Nourry

The business has doubled in size and continues to grow but the shares have halved in value. What on earth is going on at French rail giant Alstom SA (EURONEXT:ALO)?

Alstom provides equipment and services for railways, mainly rolling stock and also signalling and maintenance. It has long been a major player in Europe, but it doubled in size early in 2021 through the acquisition of Canadian rival Bombardier and now has operations in 70 countries across the globe.

Its figures for the September-December period, the third quarter in Alstom’s financial year, met with a mixed reaction. Boosted mainly by strong growth in Europe, sales rose 6% to €3.92 billion on a proforma basis that adjusted for the Bombardier acquisition, while orders were up 5% to €4.58 billion. The integration is going well and there will be no further provisions for troublesome contracts inherited from Bombardier.

However, there will be no decline in the level of unprofitable business being carried out over the second half as a backlog of previously-signed contracts is cleared.

Undaunted, Alstom is firmly on the expansion track, preparing to meet rising demand on the back of a record order book totalling €77.8 billion at the end of last year. It plans to increase its 72,000 staff by more than 10%, hiring 6,000 engineers and managers plus 1,500 other workers including technicians to cope with various projects involving rolling stock, signals and services.

- A buying opportunity at the world's biggest food company

- How to invest for difficult times

- Shares, funds and trusts for your ISA in 2022

- Want to buy and sell international shares? It’s easy to do. Here’s how

This good news is widely spread: Alstom is recruiting 3,900 people in Europe, 1,700 in the Asia-Pacific region, 1,500 in North and South America and 400 in Africa, the Middle East and Central Asia.

Among recent contract wins are one for €1.8 billion to supply up to 200 regional trains to Norway, starting with an initial firm order for 30 trains worth €380 million, €355 million for a signalling system, 37 trains and 20 years of maintenance in Santiago, Chile, and a £49 million contract with Network Rail in the UK for new signalling, level crossings and track on the London Waterloo to Portsmouth line over the next three years.

The company is not entirely immune to the impact of the Russian invasion of Ukraine, and it has now suspended all deliveries to Russia and will not be investing there in future. Alstom owns 20% of Moscow-based rail equipment manufacturer Transmashholding but does not carry out any joint operations with it. The stake is purely a now worthless investment.

Discussions on forming a partnership with Ukraine rail operator UZ have been suspended but, all in all, Alstom is escaping lightly compared with many international companies.

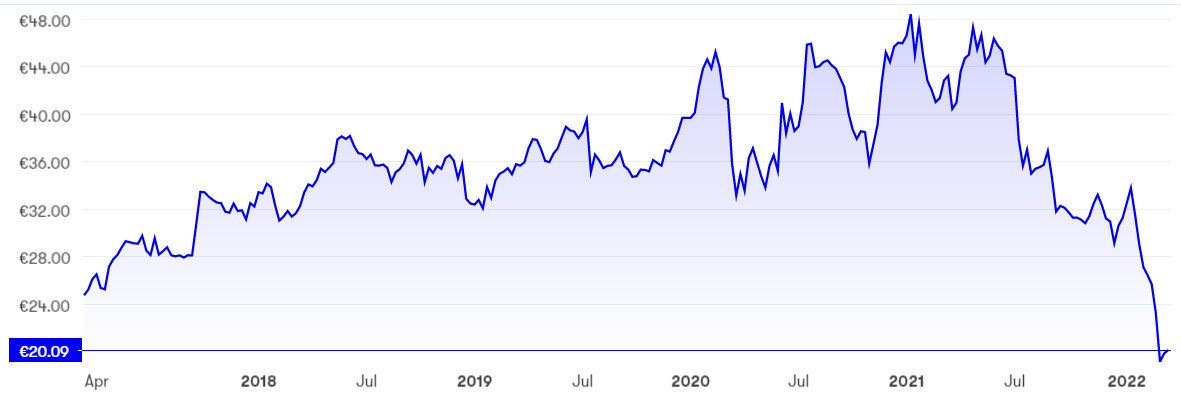

The stock market has been extremely hard on Alstom since the shares peaked at €48 just 14 months ago. They now stand at €20, less than their value five years ago, and may not have bottomed out yet, such is the ferocity of the fall. However, when they start to recover the rebound could be equally sharp.

Source: interactive investor. Past performance is not a guide to future performance.

One barrier will be the hefty price/earnings ratio of around 140, which suggests that the stock is still expensive. Slightly less of a worry is the lowly yield at 1.26%, which should improve as Alstom carries out its promise of a progressive dividend policy.

- Energy independence: shares to benefit from green energy boom

- Stockwatch: is now the right time to buy the oil majors?

- When markets fall heavily, here's what to avoid doing

Hobson’s choice: There is no denying that Alstom has been a major disappointment since I tipped the shares at €46 in May last year, feeling that the fallback in the price had opened up a buying opportunity. I stuck to my guns at €30 in December, mercifully with a warning about the dangers of trying to catch falling knives, and feel there must be light at the end of the tunnel. l may be encouraging investors to throw good money after bad but still believe that the shares will bounce back and still rate them a buy.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.