Prudential or M&G: Which shares are best?

M&G is spun off from Prudential in just a few days. Here's where analysts are putting their money.

16th October 2019 12:55

by Graeme Evans from interactive investor

M&G is spun off from Prudential in just a few days. Here's where analysts are putting their money.

Prudential shareholders have plenty to contemplate this weekend as they await Monday's long-awaited split of the insurance giant into separate FTSE 100 index companies.

The demerger will leave them holding two very different investments, with the solid and higher-yielding UK insurance and asset management arm M&G a sharp contrast to the pursuit of faster-growing Asia and US insurance markets at the ongoing Prudential (LSE:PRU) business.

While shareholders will get one new M&G share for every Pru share they already own, there's a high degree of uncertainty about how the respective shares will perform next week.

Deutsche Bank has just analysed the respective businesses and concluded that Prudential offers the better long-term growth potential, with "no clear investment case" for M&G. The bank is particularly worried by the outlook for M&G's asset management division, which accounts for 45% of profits but is expected to require significant investment.

This uncertainty prompted the bank to cut its target price for the whole Prudential business by 12.5% to 1,750p. This is made up of 300p for the standalone M&G operation and 1,450p for the remaining Prudential business.

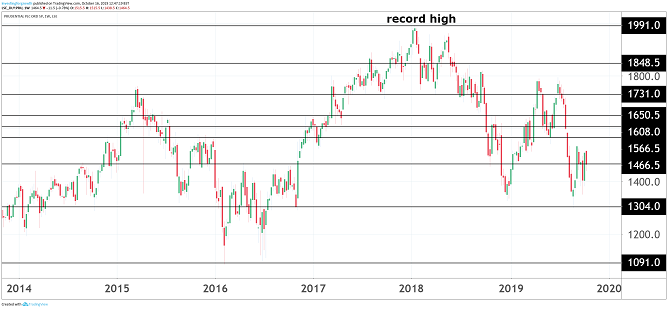

Source: TradingView Past performance is not a guide to future performance

Prudential combined was trading today at 1,460p, compared with around 1,800p in March 2018 when the 171-year-old group first announced the separation plan, and when breaching the 2,000p threshold looked a distinct possibility. Last year, analysts were talking about a potential combined value of more than 2,400p for the two businesses.

That was before the escalation of the US-China trade war and the recent Hong Kong protests, which knocked sentiment towards the Pru's investment story of growing Asian wealth fuelling demand for life and health insurance. The company's exposure to an ageing US population should also not be overlooked, with 10,000 people retiring every day for the next 20 years.

As well as asset management, the M&G operation is based on with-profits businesses split between the open Pru Fund and traditional policies now in run-off. There are two further “heritage” businesses, with the annuities arm particularly significant as it is capable of throwing off capital as liabilities run down.

- It's not just UK stocks that pay big dividends. Check out these ii Super 60 recommended income funds

When Deutsche first looked at the M&G investment case in April, it noted the potential for a high dividend pay-out from the annuities division alongside the benefits of long-term growth from asset management and the Pru Fund.

Its analysts appeared less convinced this week, particularly as the group will start life with £3.2 billion of debt:

"In reality, the story is far less clear-cut with the outlook for cash flow and dividend growth muddier than we had expected, and high debt levels looking set to remain in place for longer than we had hoped."

Deutsche expects M&G shares to trade at a wider discount than peers Aviva (LSE:AV.) and Legal & General (LSE:LGEN), with a dividend yield at or above that seen for L&G at 7.2%.

It is more bullish about Prudential, which is well placed to benefit from a strong position in developing Asia markets. The bank said: "With 85% of the valuation being geared to Asia, we believe it will actually be the Asian growth rate (at more like 13% per annum) that should drive the share price performance."

In a recent note, analysts at UBS said the market was discounting this growth potential, with the implied valuation of the Pru's Asia operations at a significant discount to rival AIA Group. The bank had a group-wide price target of 1,900p at the end of September, although this was reduced by 5% due to factors such as short-term uncertainty over Hong Kong trading and the rebasing of the dividend after the demerger.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.