Q1 ii customer voting trends

6th April 2022 09:43

by Jemma Jackson from interactive investor

interactive investor breaks down DIY investors’ biggest bugbears around AGMs.

Voting at Annual General Meetings has never been easier for interactive investor customers since the platform opted in customers to its voting and information service in November 2021, where previously customers had to proactively opt in.

But there is more to do. In each month of Q1 this year, the percentage of votes made on interactive investor has been consistently around 10% of the total voting opportunities amongst those enrolled into ii’ s voting service.

Of the total votes made in Q1 2022, the percentage of enrolled customers making at least one vote was 11%.

Some 15,947 votes were processed on behalf of ii customers in Q1, with Centrica (LSE:CNA) the most voted holding by number of votes processed, followed by abrdn (LSE:ABDN) and Imperial Brands (LSE:IMB).

Q2 ii data will be likely be particularly illuminating because it will cover off the annual results for so many big companies.

Watch your language

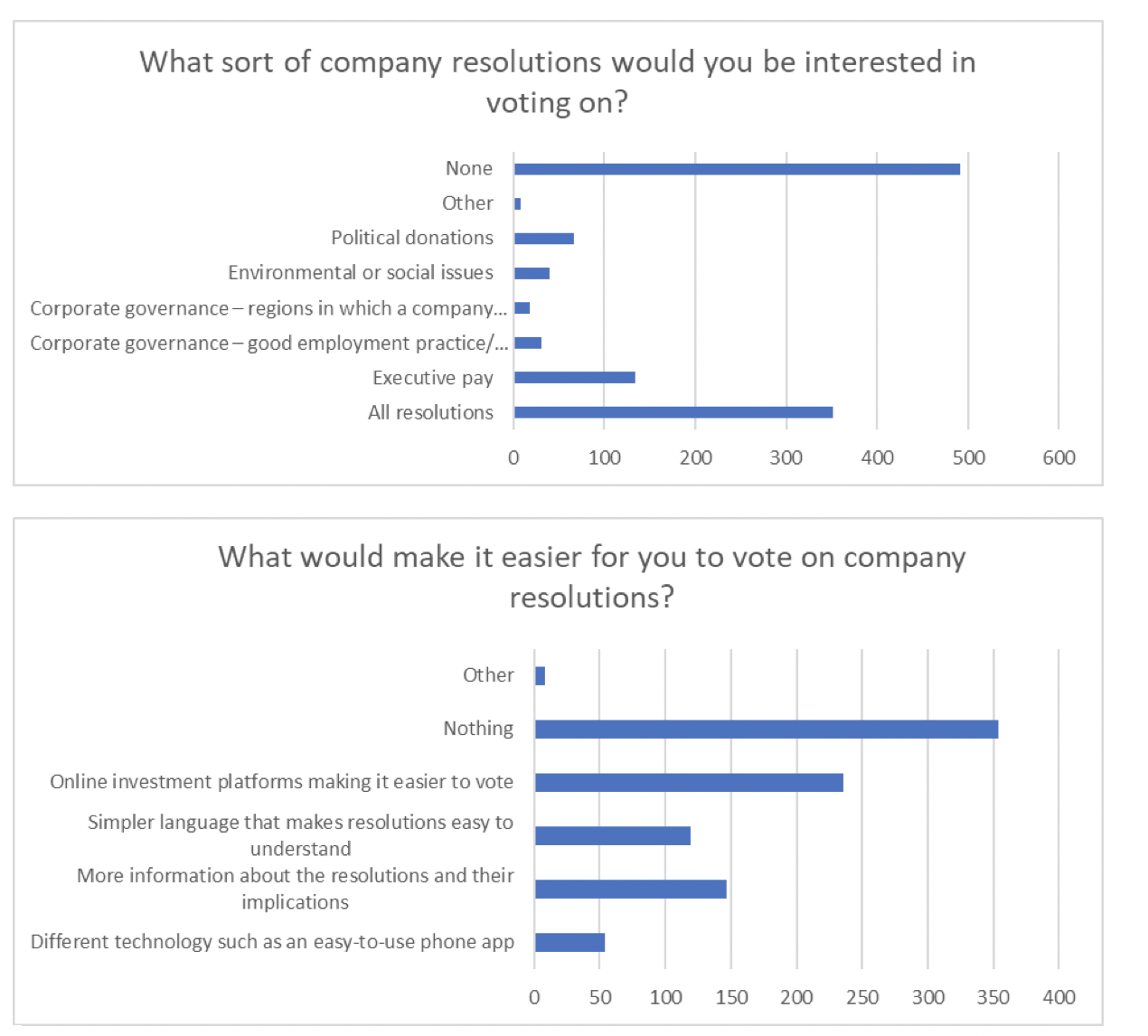

In a flash poll conducted on ii’s website between 30 March – 01 April, over 1,000 people were asked what would make it easier to vote at AGMs. Over a quarter of respondents (26%) believed online investment platforms should step up and make it easier to vote.

A further 26% of respondents felt that listed companies themselves need to start communicating better to help investors understand the issues: ‘more information on the resolutions themselves’, and ‘simpler language to make resolutions clearer’, got 16% and 13% of the vote, respectively. Some 6% said voting by app would make things easier.

Richard Wilson, CEO, interactive investor, says: “There’s more work to be done to make voting more private investor friendly, and we’ve done more than most. Investment platforms might be the gateway, but we don’t hold they keys. It’s also up to UK PLC to start speaking in plain English.

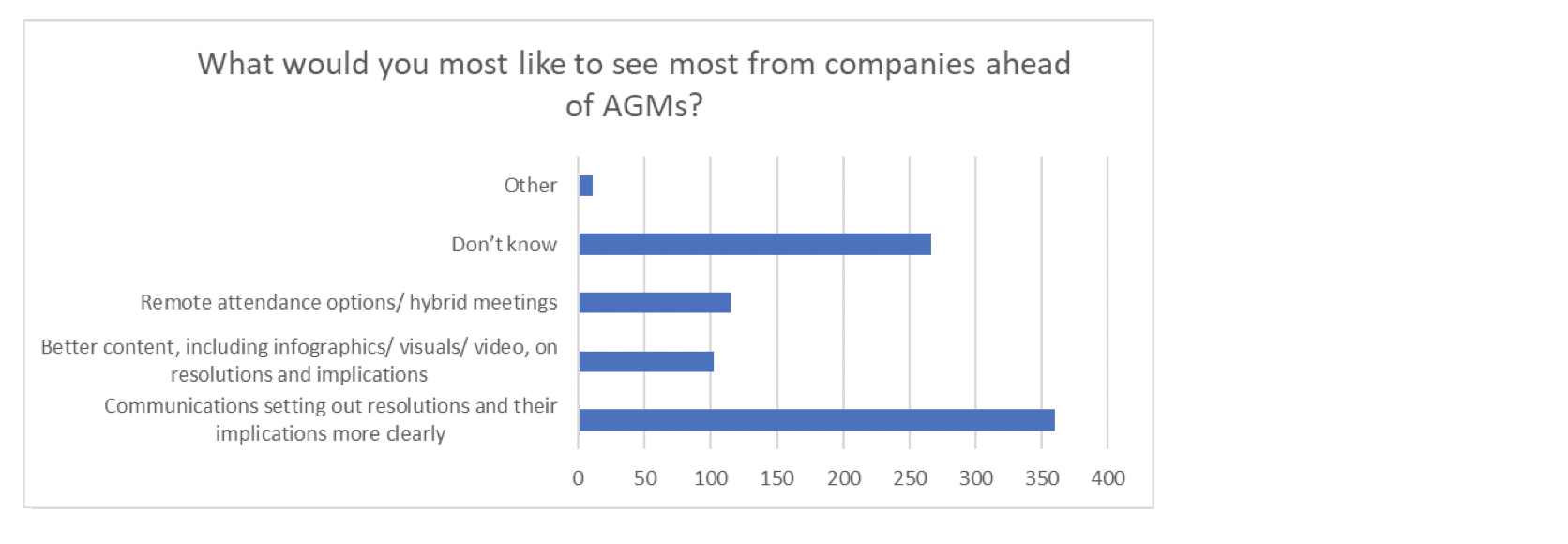

“We also think that this engagement needs to be managed more actively by issuers. For example, asking shareholders to table questions in advance. It’s great when investors get a platform to challenge bosses, but questions submitted in advance give more people the chance to get involved.

“We also stand behind recent calls for more hybrid meetings, and our own customer research backs that up. But the number one message from our customers is for clearer communication, so investors understand what they are voting for.”

Top 10 AGMs ranked by number of customers voting in Q1 2022 – and with a column showing % of enrolled ii customers voting

AGM Meeting Q1 2022 | % of enrolled customers voting |

CENTRICA PLC - Ordinary General Meeting | 7.56% |

ABRDN PLC - Ordinary General Meeting | 9.91% |

IMPERIAL BRANDS PLC - Annual General Meeting | 11.58% |

BHP GROUP PLC - Ordinary General Meeting | 11.27% |

EASYJET PLC - Annual General Meeting | 7.27% |

BHP GROUP PLC - Scheme Meeting | 9.81% |

FINSBURY GROWTH & INCOME TRUST PLC - Annual General Meeting | 9.07% |

Source: interactive investor

Where are there still barriers to participation?

When asked, what sort of company resolutions would you be interested in voting on? ‘All resolutions’ got just over 30% of the vote, followed by executive pay, which had just under 12% of votes, political donations (6%) and environmental or social issues (4%). 43% of the respondents voted for ‘none.’

Richard Hunter, Head of Markets, interactive investor, explains: “It’s interesting to see that 30% of respondents are interested in ‘all resolutions’ – and it certainly means that there is less chance of important issues being lost to the small print. Executive pay is always high on shareholders’ agenda, what is more surprising is the lower profile of social and environmental issues than we might expect, especially at a time when they are dominating many AGM resolutions, and rightly so.

“We think this reflects the fact that investors are currently facing more issues than they possibly have in years, from shifting geopolitical sands, wider political issues, Covid uncertainty and much more. That doesn’t mean environmental issues are going anywhere – it just means investors have a lot to think about. So, it’s no wonder that so many are looking at all resolutions on an equal footing.

“AGM engagement matters. Not only can investors make an impact in shaping the future of that company, but they also leave each meeting with a much better understanding of the business they are invested in. Ultimately, the more that shareholders engage, the greater the influence they can have.”

Lee Wild, Head of Equity Strategy, interactive investor, says: “Whether you’re an oil company drilling for oil, a mining company digging huge holes in the ground, or a bank investing billions overseas, shareholders are becoming ever bolder and demanding that the companies they own start listening to them.

“Companies have spent years paying lip service at best to shareholder’s climate demands and opinions of pressure groups demanding that corporations put the environment before profits.

“Now, we’re finally seeing companies tackle the big questions on a public stage. The next step in this process is for shareholders to keep the pressure on. Large corporations are not known for their dynamism and there is a big risk of heal-dragging even if votes go in favour of climate action.”

With the impact of the Covid-19 outbreak, virtual AGMs have become much more common place – and perhaps this has helped even the playing field for private investors wanting to attend an AGM, but do not have the means to, or do not wish to, attend in person. Equally, a move to all virtual meetings poses another potential problem; it risks isolating those without the technological means to participate – so a hybrid approach is a great way of keeping these meetings more openly accessible for all shareholders.

Find out more about how to vote, here.

If a customer has multiple accounts, they’ll all be included in the numbers.

** Poll conducted on ii’s website from 30 March-1 April – with a total of 1,142 responses.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.