Reasons for investors to reflect this Christmas

23rd December 2022 11:33

by Lee Wild from interactive investor

It’s been a difficult year for most investors, but our head of equity strategy is optimistic as the City downs tools for the Christmas holiday.

It’s never easy predicting what will happen next to share prices and financial markets more generally. The decade-long bull market, fired by a post-financial crash recovery and era of ultra-cheap money, was as good as it gets. Now, we all have to work a lot harder to turn a profit on our investments.

The month of December has been about as close to a sure thing as investors can get. It’s always been an historically good time to own shares, and both the FTSE 100 and FTSE All-Share have fallen just four times in December in the past 22 years, and only six times since 1986.

- Invest with ii: Top UK Shares | Free Regular Investing | Open an investment Account

Both have risen in each of the past three Decembers, but with just two and a half trading days left of 2022, this year looks like a tough ask.

The FTSE 100 ended November at 7,573. At the time of writing, the index is at 7,495, down 1% for the month so far. But remember, it’s up 11.7% from a six-month low mid-October at 6,707, and the index is still within striking distance of a year high at 7,687, registered just before Russia’s invasion of Ukraine in February.

At 7,495, the FTSE 100 is up 1.5% in 2022 versus 7,384 at the end of 2021 (see dotted red line on the chart below).

Source: TradingView. Past performance is not a guide to future performance.

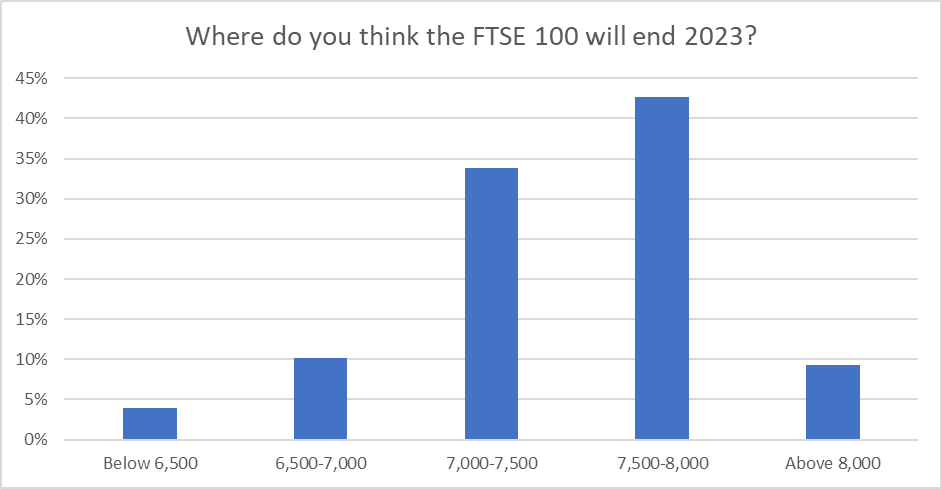

A poll conducted by interactive investor in December when the FTSE 100 traded just above 7,500, found that over half of the 1,500 respondents believe the FTSE 100 will be higher in a year’s time and more than three-quarters believe the FTSE 100 will finish 2023 between 7,000 and 8,000.

Source: interactive investor. Poll conducted on ii’s website between 5-7 December, with 1,500 respondents.

Last year, when we asked investors the same question, more than three-quarters said the index would finish 2022 above 7,000 - almost 45% said 7,000-7,500, and 21% reckoned 7,500-8,000. The remaining 10% thought 8,000-plus was possible.

Few will be surprised that we’ve ended up where we are, but it’s been a hairy ride.

What about 2023?

We’ve published lots of articles, features, interviews, videos and podcasts over the past month looking ahead to 2023, and there’s more to come.

Fund managers, City analysts, economists and industry experts all have a view on what will happen to interest rates, inflation and the economy over the next 12 months and what impact they will have on equity valuations and share prices.

Many of these wise heads do not share the same opinion, and some are less positive than others.

For me, the big takeaway from 2022 is that regular investing is a powerful tool in market conditions like this. You can argue that it doesn’t work as well in a rising market, but given none of us know what’s around the corner - and we could be in for much of the same next year - investing money on a monthly or other regular basis just makes sense.

Diversification is another of the investing rules that’s demonstrated its worth this year.

- Why these could be 10 of the most reliable shares for investors in 2023

- Visit our YouTube channel to view our experts’ tips for 2023

- Watch our video: Richard Hunter's a blue-chip stock to watch in 2023

- Watch our video: Lee Wild's an AIM share to own in 2023

Most of the world’s major stock markets are deep in the red in 2022 – the AIM All-Share index is down 31%, the S&P 500 and FTSE 250 are down 20%, and the Japanese Nikkei 8%. But the FTSE 100 is up 1.5% and yielding around 4%.

Most UK investors will have a high level of exposure to the top performing UK blue-chips, but my guess is that not many American investors will. This lesson is one for them and anyone else who didn’t spread their investments across assets and geographies in 2022.

After one of the worst years for stock markets in living memory, and despite a likely global recession for at least some of the next 12 months, you wouldn’t expect them to have a shocker on this scale in 2023. If they do, regular investing and diversification will numb the pain. If they don’t you can rest easy in the knowledge that you’re following good practice that will see you through thick and thin and deliver positive returns over the long term.

Remember also that markets typically overshoot on the upside and on the downside. Be alert. Like Warren Buffett says, market sell-offs can be a great time to pick up good companies at low prices, and equities typically do well over time. Good luck.

Wishing all our readers a very merry Christmas and a happy, healthy and prosperous New Year.

The team at interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.