Reasons to own the world’s top chip firm

Releasing results early was embarrassing, but investors won’t be red-faced buying this giant.

27th January 2021 09:41

by Rodney Hobson from interactive investor

Releasing results early was embarrassing, but investors won’t be red-faced buying this giant.

Results from the world’s largest computer chip maker continue to slip, but they are still beating expectations in tough circumstances. It is tempting for investors to concentrate on the negatives but that could be wrong.

Fourth-quarter results from Intel (NASDAQ:INTC) were announced a few days early by mistake, but that was the only major embarrassment, as the company was able to announce a 5% increase in the quarterly dividend to an annual total of $1.39, starting with 34.75 cents early in March.

Revenue hit $20 billion in the three months to the end of December, down 1% year on year but $2.6 billion better than guidance issued at the end of October. Cash generation remained strong at $9.9 billion, easily covering the $1.4 billion paid in dividends.

- US stock market outlook 2021: boom or doom?

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Investing in the US stock market: a beginner’s guide

The figures mirrored those for the third quarter released in October, which showed revenue down 4% year-on-year at $18.3 billion, but actually better than indicated three months earlier. While data-based revenue was down 10% at that point, there was a real ray of hope in a 1% increase in PC-related revenue. Earnings per share was down 22% at that stage but again that was better than expected.

With the sales of chips for personal computers boosted by the spread of working from home, Intel rode out the earlier part of 2020 pretty well. So, despite the later slippage it was able to report that full-year revenue set a new record for the company at $77.9 billion, up 8% on 2019 despite all the restrictions caused by the Covid-19 crisis. This is the fifth consecutive year of record revenue.

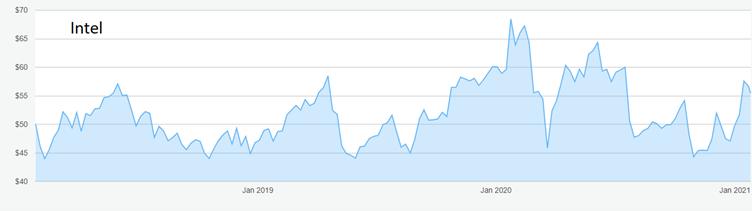

Source: interactive investor. Past performance is not a guide to future performance

Cash generation of $35.4 billion was also a company record and it meant that $5.6 billion could be paid out in very well-covered dividends and $14.2 billion in buying back stock.

Intel’s current guidance is for revenue of $18.6 billion and earnings per share of $1.39 in the current quarter, but past experience suggests that this will be erring on the side of caution. Outgoing chief executive Bob Swan says the demand for superior performance from computers remains very strong and Intel is concentrating on areas where there are opportunities for growth, such as notebooks. Production of a new generation of processors is being ramped up from the start of 2021.

The company’s caution comes from fears that events surrounding Covid-19, including possible tightening of restrictions by various governments, will continue to disrupt production and distribution not only of Intel’s products but of those of its customers. One gets the feeling that management is assuming the worst-case scenario.

Keeping ahead of the game admittedly does not come cheap. Last year $13.6 billion was invested in research and development and $14.3 billion in capital expenditure. The sale of Intel’s NAND memory and storage business to SK Hynix, a South Korean memory chips maker, for $9 billion, announced three months ago, is still pending but projections for this year assume that it will go through soon, providing cash to be ploughed into expanding the core businesses.

- What is earnings season?

- Your 50 most-popular US stocks

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

New chief executive Pat Gelsinger, a technologist who previously spent 30 years working for Intel, disappointed some investors by not announcing a drastic change of course, such as outsourcing more production to Taiwan Semiconductor Manufacturing (NYSE:TSM), but it must be to Intel’s advantage to keep as much production as possible in house and under full control.

The shares have moved erratically over the past three years between $44 and $68. They currently sit in the middle of that range just above $55. The proposed dividend increase puts the yield at 2.5% while the price/earnings ratio is an undemanding 11.2.

Hobson’s choice: Buy below $60, where there has been resistance recently. It should be possible to get in clearly under that level.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.