Record markets, but I’m concerned about these hazards

Saltydog Investor says all the good news is priced into markets and there are geopolitical and economic risks for investors.

20th May 2024 15:35

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Most stock markets had a reasonable first quarter of 2024. Unfortunately, rising tensions in the Middle East and persistent inflation in the West took the wind out of their sails in April. The US was hit particularly hard, with the S&P 500 falling by 4.2%, the Nasdaq losing 4.4%, and the Dow Jones Industrial Average ending the month down 5%.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

Fortunately, we have seen these indices recover and last week they all went on to new highs. The Dow Jones Industrial Average closed above 40,000 for the first time ever.

| Stock market indices | 2024 | |||||

| Index | January | February | March | 1 January to 31 March | April | 1 to 17 May |

| FTSE 100 | -1.3% | 0.0% | 4.2% | 2.8% | 2.4% | 3.4% |

| FTSE 250 | -1.7% | -1.6% | 4.4% | 1.0% | 0.4% | 3.9% |

| Dow Jones Ind Ave | 1.2% | 2.2% | 2.1% | 5.6% | -5.0% | 5.8% |

| S&P 500 | 1.6% | 5.2% | 3.1% | 10.2% | -4.2% | 5.3% |

| NASDAQ | 1.0% | 6.1% | 1.8% | 9.1% | -4.4% | 6.6% |

| DAX | 0.9% | 4.6% | 4.6% | 10.4% | -3.0% | 4.3% |

| CAC40 | 1.5% | 3.5% | 3.5% | 8.8% | -2.7% | 2.3% |

| Nikkei 225 | 8.4% | 7.9% | 3.1% | 20.6% | -4.9% | 1.0% |

| Hang Seng | -9.2% | 6.6% | 0.2% | -3.0% | 7.4% | 10.1% |

| Shanghai Composite | -6.3% | 8.1% | 0.9% | 2.2% | 2.1% | 1.6% |

| Sensex | -0.7% | 1.0% | 1.6% | 2.0% | 1.1% | -0.6% |

| Ibovespa | -4.8% | 1.0% | -0.7% | -4.5% | -1.7% | 1.8% |

Data source: Morningstar. Past performance is not a guide to future performance.

There were a couple of factors that contributed to the April sell-off.

On 13 April, Iran launched a direct attack on Israel. This assault involved more than 300 drones and missiles, including ballistic and cruise missiles, targeting various locations in Israel. The attack was in retaliation for an Israeli strike earlier in the month that killed several senior Iranian military officials in Damascus. It was also seen as a signal that Iran was committed to supporting the Palestinian people in Gaza.

Most of the incoming missiles and drones were intercepted by Israel's defence systems, with assistance from the US, France and the UK. However, this event marked a significant escalation in the already tense Middle Eastern geopolitical landscape, raising fears of a broader regional conflict.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Optimism towards UK improves, but pros are not piling in

The attack, and subsequent warnings from Iran about a more severe response if Israel retaliated, heightened fears of a wider military conflict. That would disrupt not only regional, but also global economic stability, affecting trade routes, investment flows and international relations.

It’s not surprising that it spooked investors.

It also coincided with the US reporting robust economic growth, along with increasing consumer spending in the first quarter, and a strong job market. Although this would suggest that the economy was in good shape, which it probably was, it also raised doubts about whether the Federal Reserve would be in a position to reduce interest rates. The thought of interest rates remaining higher for longer tends to put downward pressure on stock prices.

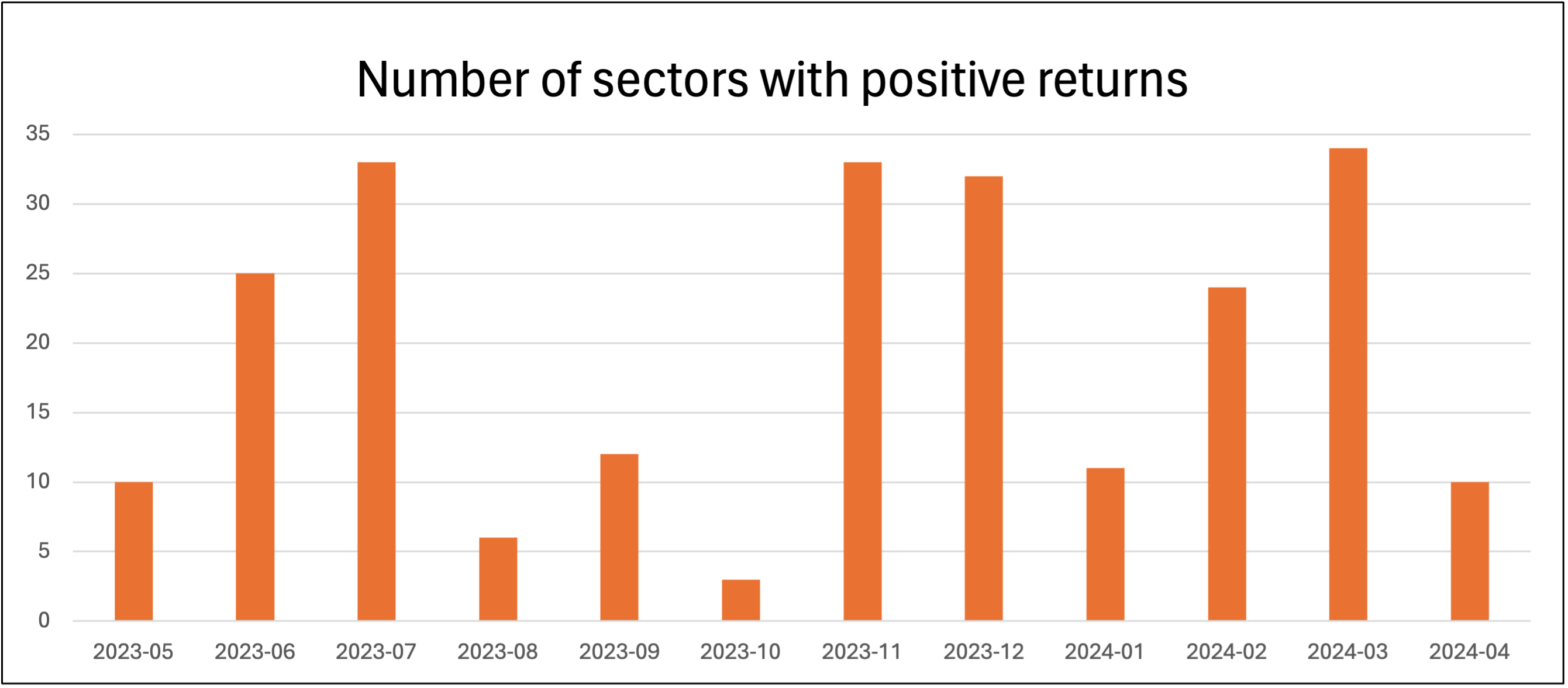

As part of our regular analysis, we look at how many sectors make gains each month. It is a crude measure, but quickly gives a feel for what has been happening in the markets.

In February, 24 out of the 34 sectors we usually report on went up, and in March they all did. In April, only 10 sectors made it over the line.

Past performance is not a guide to future performance.

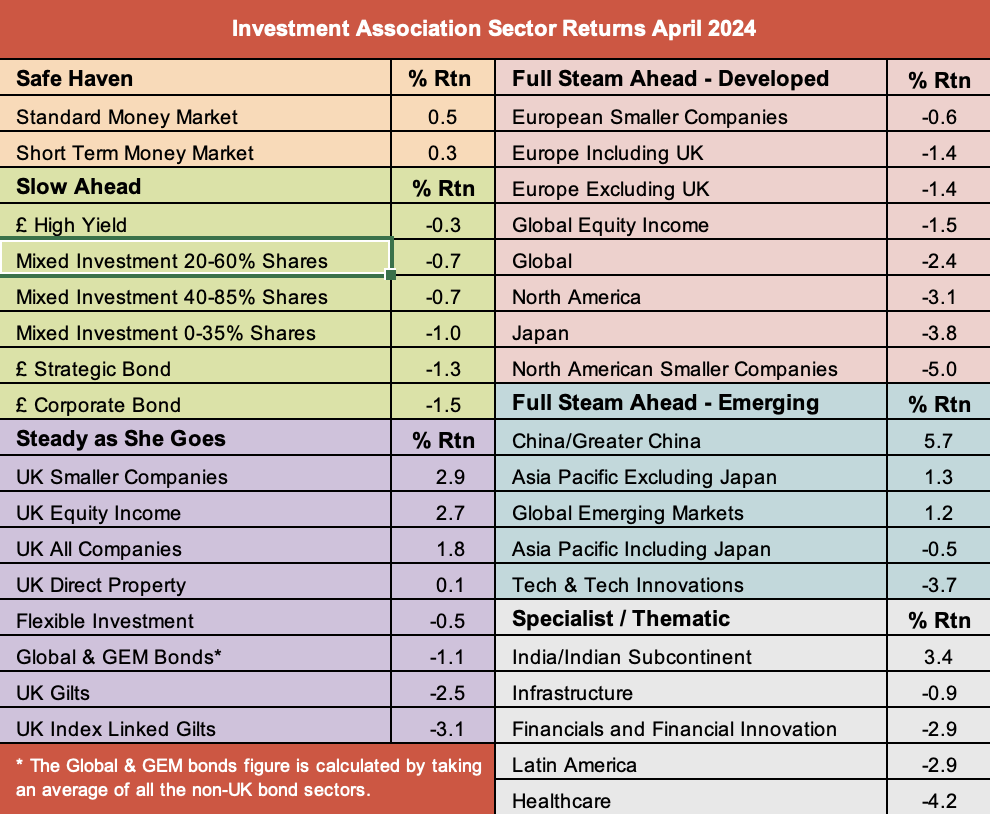

The best-performing sector in March was UK Equity Income, up 4.4%, and it gained a further 2.7% in April. The UK Smaller Companies sector did even better, up 2.9%. However, the top sector in April was China/Greater China with a one-month return of 5.7%.

What was more concerning is that all the sectors in our “Slow Ahead” group fell, as did all the sectors in the “Full Steam Ahead Developed” group. The worst-performing sector was North American Smaller Companies, which went down by 5%. The North America sector fell by 3.1%, and the Technology and Technology Innovations sector, which also invests predominantly in US companies, lost 3.7%.

Data source: Morningstar. Past performance is not a guide to future performance.

I’m glad to say that the beginning of May has been more encouraging, with nearly all sectors making gains.

Although the war in Gaza shows no sign of easing, it hasn’t spread across the Middle East as some feared. There’s also been some encouraging data suggesting that inflation might be coming down as initially expected. Markets have rallied, and in the past week, we have seen stock markets set new record highs in the UK, Europe and the US.

Since the beginning of the month, the S&P 500 has risen by 5.3%, the Dow Jones Industrial Average has made 5.8%, and the Nasdaq is up 6.6%.

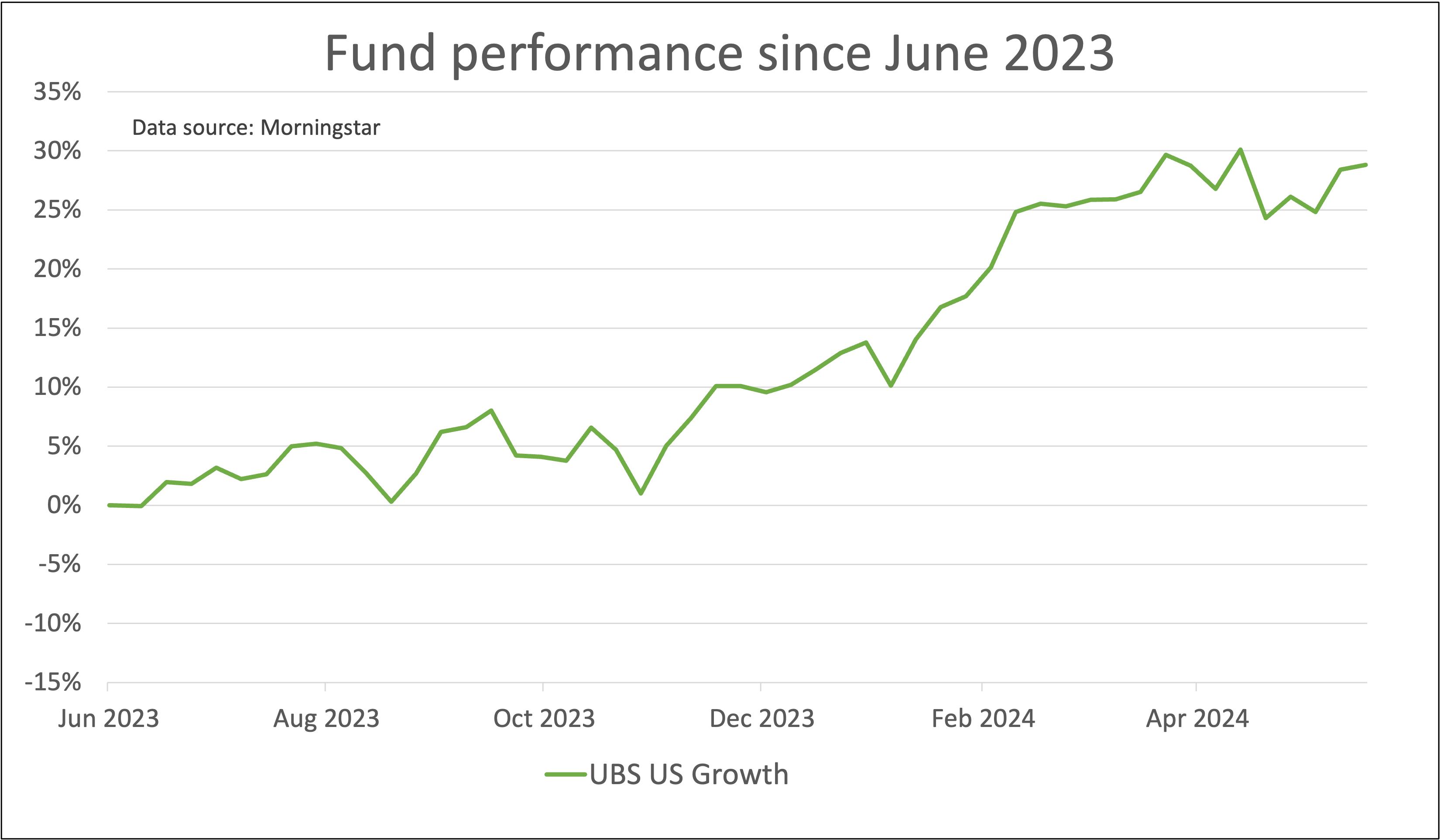

In our demonstration portfolios, we hold only one fund from the North America sector, UBS US Growth. We went into it last June and since then it has gone up by 27%. Like most US funds, it did have a wobble in April, but hopefully is now back on track.

Data source: Morningstar. Past performance is not a guide to future performance.

There are some recurring themes at play here. The global economy appears to be recovering after the Covid-19 lockdowns, record inflation, and the subsequent increase in bank interest rates. Investor sentiment has improved, pushing up stock prices. Countries such as the UK, which did go into recession, have emerged relatively quickly. Inflation rates are still above central bank targets, but appear to be heading in the right direction. There’s an expectation that interest rates in the UK, Europe and the US will start to come down.

All in all, there does seem to be quite a lot of good news around, but it feels as though it is already being reflected in stock valuations.

- Five value funds your portfolio is probably missing (but shouldn’t be)

- Top-performing fund, investment trust and ETF data: May 2024

My concern is that there are still potential hazards ahead. The wars in Gaza and Ukraine could lead to further political unrest, which could have severe economic consequences. There is also no guarantee that inflation will continue to fall.

It feels like it would not take much for the tide to turn, causing another correction. I’m hoping the long-term trend will remain positive but would not be surprised if there are some more setbacks along the way.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.