Recovery prospects not reflected in price of this stock

Its sports fashion gear and underwear are selling well, notes our overseas investing expert.

14th October 2020 12:24

by Rodney Hobson from interactive investor

Its sports fashion gear and underwear are selling well, notes our overseas investing expert.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Any company that has kept its sales rolling, has a breadth of sales channels, has nimble management seeing opportunities in adversity and can benefit from the misfortunes of rivals, is worth a look. One such is underwear and sportswear manufacturer Hanesbrands (NYSE:HBI).

The company makes underwear, including socks, plus leisurewear and sportswear. These are, on the whole, items that people buy regularly, and they will continue to do so no matter what effect Covid-19 or any other crisis inflicts on the world’s economies.

Based in North Carolina, it was spun out of the Sara Lee Corporation in 2006 and has performed well as a stand-alone business rather than as an incongruous part of a food group. It now employs 63,500 people.

The company sells direct to consumers, but also wholesale to a wide range of retailers from discount stores to department stores. Its brands include Hanes, Champion, Playtex, Bali and Bonds, brands that can be found in North and South America, Europe and Asia-Pacific.

- Smithson Investment Trust: tactics to play US election

- US election: will US equities get a government spending boost?

- Use our helpful calendar to find out when the world's largest companies are reporting

Champion is currently the best of the bunch. It seemed to be going out of fashion, but the “athleisure” lines designed for those who like to look sporty without having to undergo too much actual physical activity have found a new niche with millennials and generation Z, those born since around 1980.

Hanesbrands produces 70% of its products in company factories in more than 30 countries. Crucially, it sources little of its products from China, and sells comparatively few garments there, so is not susceptible to any escalation of trade tensions between Washington and Beijing.

It is admittedly possible that sales will suffer in any economic downturn, especially if the second wave of Covid-19 provokes further lockdowns, but the lines Hanesbrands produces will still be sought after. The company came through the worst of the first wave by adeptly switching design and production to personal protection equipment such as face masks, so it has a track record of spotting where there is demand.

Of potentially greater concern is that mass-market retailers such as Walmart (NYSE:WMT) and Target (NYSE:TGT), where Hanesbrands makes a quarter of its sales, have pushed their own brands in direct competition.

However, this has made little dent so far in Hanesbrands’ sales, which are in any case set to improve further if customers of Victoria’s Secret, where sales have been falling, can be enticed to come on board. Victoria’s Secret is closing 250 stores across the US and Canada, it has cancelled its fashion show, run since 2001, and it has gone into administration in the UK.

Hanesbrands is more resilient. It remained profitable during the last big crisis, the financial collapse in 2008, and came out of that downturn quickly. It is likely to do the same again notwithstanding the fact that profits will inevitably be lower this year than in 2019.

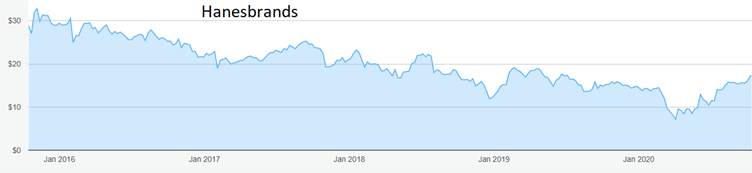

Source: interactive investor. Past performance is not a guide to future performance.

The shares ran up too fast and too far after the 2008 crisis, peaking well above $30 towards the end of 2014. Equally, though, the subsequent downward trend lasting for four-and-a-half years ran on too long, even before the general stock market slump this spring that took the stock as low as $7.17.

They now stand just above $17, where the well-covered dividend gives a yield of 3.5%. The company is sensibly reducing debt but still has sufficient cash for the dividend and share buybacks. Analysts are generally positive, with target prices of $20 or higher.

- Why this tech boom is not a bubble

- Baillie Gifford American: owning Tesla and more top stocks

- Want to buy and sell international shares? It’s easy to do. Here’s how

Hobson’s Choice: Hanesbrand is now back above the pre-coronavirus level but, at around $17, is still little more than half its level at the start of last year. That does not reflect recovery prospects. Buy at up to $19, where the shares could run into resistance.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.