Richard Beddard: an AIM share that just keeps powering higher

27th August 2021 14:27

by Richard Beddard from interactive investor

Our companies analyst examines the books of this small-cap stock that’s doubled in the past year. Does he think it’s worth buying?

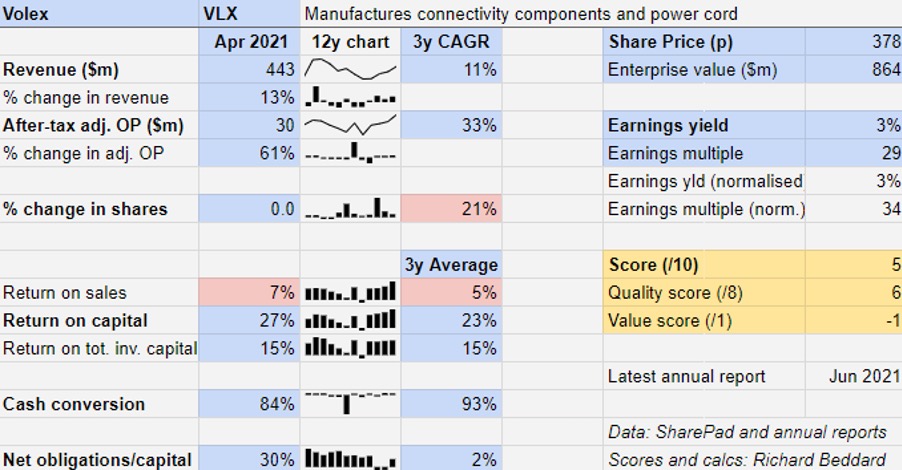

Seven acquisitions in three years has given Volex (LSE:VLX) new capabilities and customers in new markets.

The manufacturer of power cord, cable assemblies and more complex electrical components is busy selling its new capabilities far and wide.

Perhaps the most impressive news in this year’s annual report is that, from a standing start in 2017, Volex has become the leading manufacturer of mains power cords for electric vehicles (EVs). Mains power cords allow people to charge their cars at home, already a big market.

Revenue from EV manufacturers and their suppliers increased 193% from $18 million (£13 million) to $53 million (£38 million), 12% of total revenue.

The other big news in the annual report was the addition of DE-KA of Turkey to the company’s biggest division, consumer electricals. DE-KA is one of Europe’s biggest power cord manufacturers, and a major supplier to manufacturers of domestic appliances.

DE-KA’s contribution in 2021, although confined to six weeks of the financial year, helped the consumer electricals segment to grow modestly. It brought in 37% of total revenue in 2021.

Demand for consumer electricals held up during the pandemic as people working and staying at home bought home office equipment and washing machines.

The other parts of the business serving medical and industrial customers were each responsible for about 26% of total revenue. They make cable assemblies and fully assembled electronic components according to customer’s designs.

A surge in demand for ventilator components almost compensated for a slackening in demand for other medical equipment.

Strong demand for high-speed data cables used in data centres more than made up for reduced demand for other industrial applications.

On Thursday, Volex added Irvine Electronics to this division, bolstering its capability to manufacture printed circuit board (PCB) assemblies.

Benefits of diversification

The results for the year to April 2021 show the benefits of diversification. The company grew revenue 13%, and adjusted profit 61%

Past performance is not a guide to future performance

Profit margins improved and so did return on capital. The company says its contracts allow it to pass increases in raw material prices such as copper through to customers, albeit after a short delay.

Debt, including lease liabilities and the pension deficit, is negligible due to strong cash flow and because acquisitions have sometimes been part-funded by new money from investors.

The company says that it is better to walk away than overpay for an acquisition, and it may well be living up to that rule.

A Return on Total Invested Capital of 15% shows that even after including the value of its acquisitions at cost, it is generating decent returns.

At Volex’s annual general meeting in August the company said it was still experiencing high demand for consumer electricals and EV’s, and a healthy recovery in demand from the medical and industrial customers held back during the pandemic.

Its five-year plan, started in 2019 targets $650 million in revenue and $65 million in operating profit by 2024 through operational improvements and acquisitions.

Scoring Volex

Despite the fact that Volex appears to be getting so much right, I also feel a bit anxious about its prospects.

By targeting markets widely expected to grow rapidly, like EVs and data centres, Volex expects to share in that growth. Rapidly growing markets attract competition though, a scenario the company is prepared for.

Opportunities to differentiate power cord may be limited, which explains the company’s determination to build scale and drive down cost.

- Don't be shy, ask ii...how do I tidy up my investment portfolio?

- Subscribe to the ii YouTube channel for our latest interviews

The company’s strategy is to achieve a global footprint, vertically integrate, automate and centralise procurement, thereby operating more efficiently and improving profit margins.

But competing on cost often turns out better for customers than it does suppliers and if profit margins are thin profitability can be impacted disproportionately if demand slackens.

It has happened to Volex before when massive demand from telecommunications customers during the dot.com boom led to over-investment and the commodification and oversupply of power cord and data cables. The substitution of USB power chargers for mains charging cords also shrank Volex’s market.

This risk probably explains Volex’s diversification into assembling complex industrial and medical products.

There is more opportunity to add value and earn higher profit margins in this kind of manufacturing.

Volex is seeking a balance. The pandemic aside, demand for medical equipment tends to be more stable than the cyclical auto, electricals and industrial markets.

Complex assemblies take time and expertise to design into a product and are often subject to regulatory approval, so these customers are both profitable and sticky.

But diversification comes at a cost, which is that the business becomes more complex to run.

The power cord side of the business wins through efficiency, but complex assemblies require a more bespoke approach. Volex churns out high volumes of power cord products but also uses specialist engineering expertise to build low volume assemblies. It centralises to be more efficient and supply global customers, but gives local managers autonomy so they can best supply local customers.

- Read more Richard Beddard articles here

- Take control of your retirement planning with our award-winning, low-cost Personal Pension

Individually Volex’s strategic goals are good, but they pull the company in different directions. Complexity adds risk, especially when it is overlaid with acquisitions.

Like many acquisitive companies Volex seeks to buy complementary businesses, but actually it is buying two different kinds of complementary business.

Some increase the scale and vertical integration of its power cord divisions, and others give it new capabilities in cable assemblies and box building.

Maybe I am being unfair on Volex, though. My verdict has been informed by very comprehensive annual reports and presentations.

Not all companies provide such detail, and detail often looks complex.

Does the business make good money? [2]

+ High returns on capital recently

+ Strong cash conversion recently

+ Improving profit margins

What could stop it growing profitably? [1]

+ Does not seem to be overpaying for acquisitions

? Most of its end markets are cyclical

? Growing complexity

How does its strategy address the risks? [1]

+ Driving efficiency through scale and vertical integration

? Diversification may reduce cyclicality

? Complexity may necessitate discordant strategy

Will we all benefit? [2]

+ Encourages employees to think like owners

+ Executive chairman is an owner manager, Nat Rothschild owns 26% of the shares

+ Communicates well with investors

Is the share price low relative to profit? [-1]

? No, a share price of 375p values the enterprise at about $443m, nearly 30 times adjusted profit.

A score of 5 out of 9 means Volex may be a good long-term investment.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about my scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.