Richard Beddard: can this stock’s transformation help you clean up?

21st October 2022 14:43

by Richard Beddard from interactive investor

Moving its strategy from turnaround to transformation is encouraging, and this company is in a healthy financial position. Our columnist thinks it could reward patient investors.

Most of us probably use products invented or acquired and manufactured by PZ Cussons (LSE:PZC).

Circumstances have made Carex perhaps its most famous. It was already the UK’s most-popular hand wash brand before the pandemic, and is now the most popular by a bigger margin.

PZ Cussons’ other “Must Win brands” are: Cussons Baby and Childs Farm, which make skincare products for babies and children; Premier and Joy, Nigerian soap brands; Original Source body wash; Rafferty’s garden, Australia’s biggest brand of baby food; Morning Fresh washing up liquid; Sanctuary Spa, a beauty brand; and fake tan, St Tropez.

- Read about: Free regular investing | Opening a Stocks & Shares ISA | Cashback Offers

From turnaround to transformation

Despite the familiarity of many of the brands, revenue and profit have been in decline for many years, a trend the business tried to draw a line under in 2020 when the former chief executive left under a cloud and the company recruited new executives in 2020.

Now the company says it is moving from turnaround to transformation, although the numbers are difficult to interpret.

The long-term decline in revenue and profit has been exaggerated by disposals in recent years, which is one of the reasons PZ Cussons is in a healthy financial position.

The company’s expectation, though, is for mid-single-digit like-for-like growth in revenue and perhaps stronger growth in profit as it becomes more efficient and better at building brands.

But the turnaround has taken place during the pandemic, which had a hugely beneficial effect on one aspect of the business, and generally depressed other aspects.

Extraordinary revenue and profit from Carex, which have subsided, but not completely, were offset by lower revenue and profit from the beauty business, which has recovered, but perhaps not completely too.

Meanwhile, the company is having to contend with cost inflation.

- Where to invest in Q4 2022? Four experts have their say

- Stockwatch: analysing market forecasts and the sudden interest in bonds

These forces outside the company’s control may have had a bigger impact on the results so far than self-help, although management has got to grips with the company’s over complicated patchwork of businesses in Nigeria, turning Africa into its biggest source of revenue once again, and perhaps more importantly, a source of profit instead of losses.

Even that development is bittersweet though. PZ Cussons’ Nigerian businesses are different from its other main territories, the UK, Indonesia and Australia, where it only sells fast moving consumer goods.

In Nigeria it also sells electrical goods and, through a joint venture, refines palm oil. These businesses tend to earn lower profit margins, and their resurgence has contributed to lower group margins.

Overall, sales and profits declined modestly in 2022 as the company contended with an 11% increase in the cost of sales due to rising employee and raw material costs.

On a like for like basis, ignoring the lost revenue from five:am an Australian yoghurt business it disposed of during the year, a sliver of revenue from Childs Farm, which was acquired two months before the year end, and foreign currency movements, the company says revenue increased by 2.9%.

The profit figure is open to interpretation.

In addition to bewildering impairments and subsequent reversals due to changes in accounting policy, PZ Cussons would prefer us to ignore £4.3 million of costs relating to transformation projects including a new human resources IT system.

Such adjustments are probably justified to give a better indication of how the company is trading, but executives can be tempted into overstating them because ignoring costs improves profit, which makes management look better (and allows them to pay themselves more).

We can look to average cash conversion to give us confidence in the profit figure. It compares operating cash flow less capital expenditure to adjusted profit.

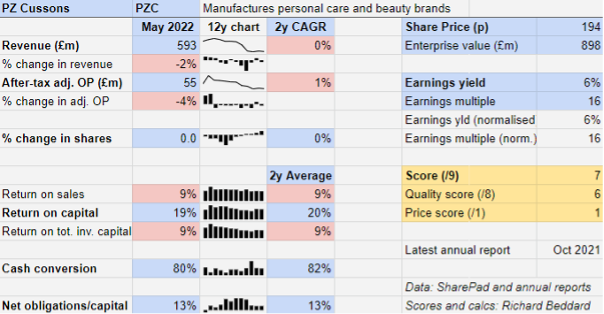

PZ Cussons 12-year cash conversion of 67% is below my arbitrary benchmark of 75%, but in the two years since the company introduced its new strategy, it has achieved 80% or more, which is a good sign.

Betting the farm

Though I cannot tell from the numbers that PZ Cussons is moving from turnaround to transformation, I believe the company is taking the right steps.

It is simplifying itself, and becoming more sustainable.

The number of Must Win brands has been reduced, and PZ Cussons has converted some holy cows into cash cows by demoting brands like famous but dated Imperial Leather to portfolio brand status. These will fund the development of the Must Win brands.

As well as simplifying operations in Nigeria by consolidating suppliers and warehouses and disposing of surplus property, it has removed layers of management between the head office and local offices in all territories, sharpened its focus on its main four geographic territories, consolidated marketing agencies, and divested, principally food subsidiaries, in favour of brands in markets where it is easier to stand out in: health, beauty and baby.

The acquisition of Childs Farm in March 2022 is a test for PZ Cussons’ “Growth wheel”, which it describes as a repeatable formula for developing and marketing brands.

On one hand the price tag of £44 million is considerably less than a year of profit or cashflow for PZ Cussons, so it has staked a modest amount.

Childs Farm has a distinctive story too. It was founded by Joanna Jensen in 2011. She developed natural, home grown skincare products initially for her daughter, who suffered from eczema.

The company has slotted Childs Farm straight into its portfolio as a Must Win brand. On the face of it, as a collection of natural hygiene products, it fits PZ Cussons’ aspirations.

On the other hand, considerable investment may be required for the growth wheel to turn it from a modestly loss-making and UK only brand in 2021 to a profitable one in, the company expects, 2024.

PZ Cussons also has ambitions to sell Childs Farm abroad.

Costs and competition

Two things challenge the growth wheel. The first is costs. Staff and raw material costs have risen, which the company seeks to mitigate through efficiencies and by building strong brands that people are prepared to pay enough for to earn the company decent margins.

This is a delicate balancing act. PZ Cussons does not want to compromise the quality of the product or people will not value it as much, and in recent years it has struggled to achieve double-digit after-tax profit margins as it has in the past.

The second concern is competition from discount and online retailers, due to the proliferation of challenger brands and own-label brands that in many cases are little more than knock-offs of more famous products.

The company is attempting to rise to this challenge by becoming a better brand builder through the growth wheel, and its newfound focus on hygiene, baby, and beauty, products people may be more picky about.

Just B good

There is one other benefit to acquiring Childs Farm. Childs Form knows what it takes to become certified as a B-Corp because it became one in July.

PZ Cussons hopes to have attained B-Corp certification by 2026, which requires it to demonstrate high social and environmental performance and change its corporate governance structure to be accountable to all stakeholders.

Currently there are no B-Corps listed in the UK, although some, like Unilever, and now, PZ Cussons, own subsidiaries that are B-Corps.

The company says B-Corp status will be self-funding, and profitability should not decline as it balances profit and purpose.

With a heritage of ethical sourcing, replacing plastics, developing reusable packaging, and involvement in local communities, PZ Cussons has good environmental and social credentials. It is hoping to improve them by becoming a B-Corp and reducing carbon emissions.

This makes commercial sense because customers are willing to pay for products that harm the environment less, and it might also be a beacon to staff.

The company monitors employee attitudes and well-being, it says it fosters leaders at all levels, and it pays well. The median total pay of UK employees is slightly over £50,000.

All these factors should help with recruitment and retention, which in turn should contribute as PZ Cussons builds its “high performance” culture.

High pay though also extends to the boardroom. Chief executive Jonathan Myers earned more than £1.1 million in 2022 and more than £1.5 million in 2021. That is 23 times and 29 times the pretty well paid median employee in each year.

Those ratios may not seem excessive by the standards of other businesses, but they do not yet include share options from the Long Term Incentive Plan, because Mr Myers has not been there long enough for them to vest (become available for him to exercise).

Once the first share options vest next year, the multiple will increase.

Scoring PZ Cussons

Does the business make good money? [1]

? Decent return on capital, but declines yet to be reversed

? Profit margins have declined below 10%

+ Cash conversion has improved to reasonable levels

What could stop it growing profitably? [1]

+ Financial obligations substantially reduced

? Competition from discount/internet retailers and other brands

? Rising cost inflation

How does its strategy address the risks? [2]

+ Simplification reduces costs

+ Improving brands should grow revenue

+ B-Corp status should differentiate the business

Will we all benefit? [2]

? New management is facing up to challenges

+ Company is fostering leaders at all levels

+ Key Performance indicators monitor long-term financial metrics and employee wellbeing

Is the share price low relative to profit? [1]

+ Yes. A share price of 194p values the enterprise at about £900 million, 16 times normalised profit.

A score of 7 out of 9 means PZ Cussons probably is a good long-term investment, although shareholders may need to be patient.

It is ranked 28 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in PZ Cussons

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.