Where to invest in Q4 2022? Four experts have their say

19th October 2022 10:07

by Jim Levi from interactive investor

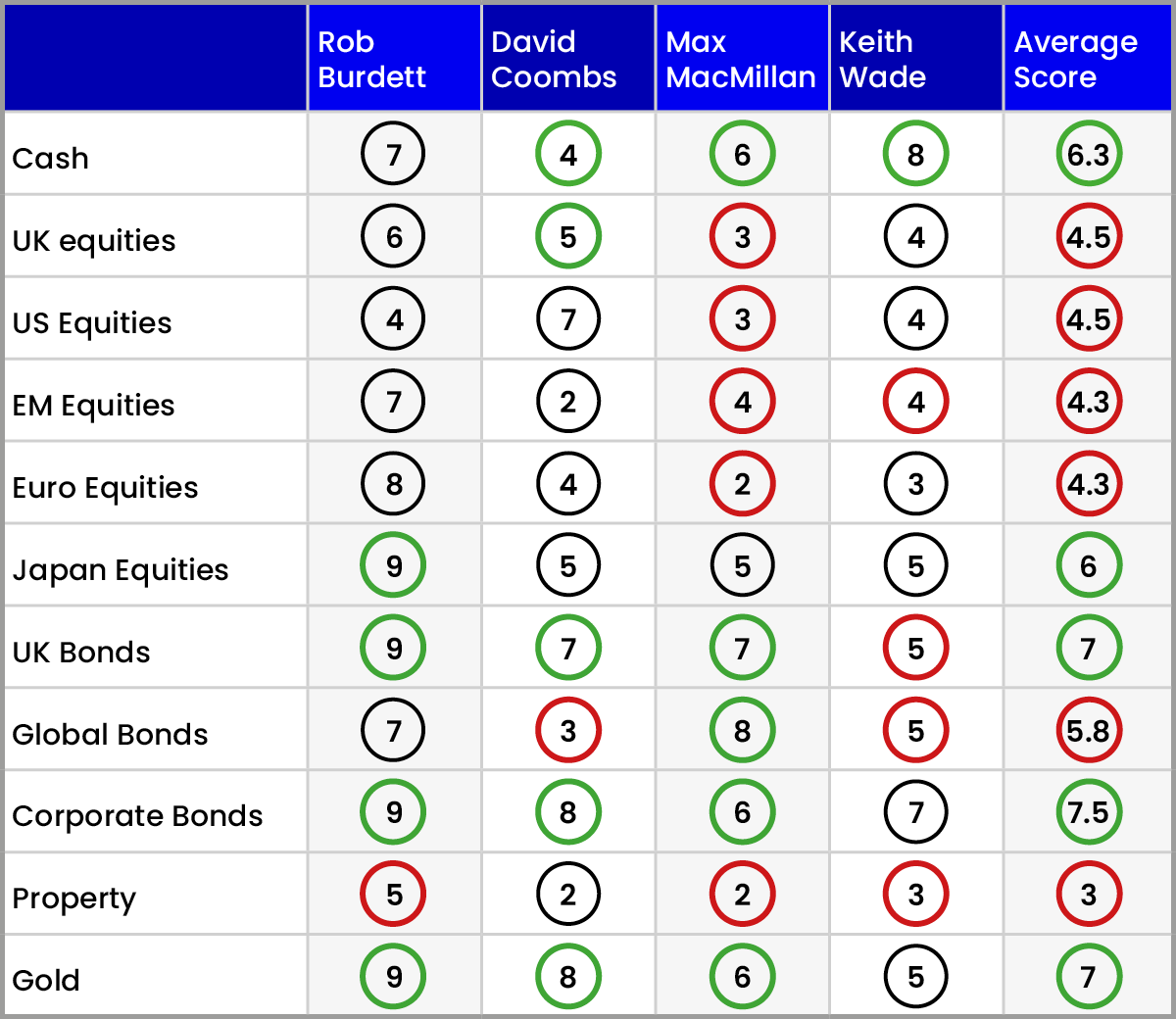

Our four panellists are finding better value in bonds, with most equity regions given the thumbs down. Here’s their latest views on all the major asset classes.

Turbulent times mean tough times for our asset allocators. The last three months have seen all asset classes drift lower in value. As Rathbones’ David Coombs points out: “The only asset to have gone up has been the dollar. Cash in dollars has been the best investment. There has been nowhere for us to hide in the last three months.”

The situation has led to some dramatic changes in the asset allocation strategies of our panel of four fund managers. Rarely do they “sing from the same hymn sheet” when it comes to their treatment of a particular sector. But this time around they are all drastically reducing their exposure to the property sector, which they consider very vulnerable to the rise in interest rates.

“The residential property market is about to have a heart attack,” says Max Macmillan who takes over from Richard Dunbar at abrdn as one of our four panellists. Macmillan says that a combination of rising interest rates and recession threaten both valuations and rental income growth in all parts of the commercial property sector.

- Discover our resources on: Buy Bonds | Free regular investing | General Investing with ii

Meanwhile, all panel members have also raised their scores for cash to reflect the uncertainties in global financial markets. But all see the recent relapse in the corporate bond market as a buying opportunity for the medium term.

Rob Burdett at Columbia Threadneedle highlights British American Tobacco (LSE:BATS)’s 30-year bond on a yield of 9.5%. The panel now rate corporate bonds more highly than any other sector giving it an average score of 7.5.

Gilts a buying opportunity

Attention is also naturally much focused on the state of the UK bond (gilt) market - the epicentre of the UK’s current crisis. Three of the panel - Burdett, Coombs and Macmillan - all see the current febrile state of the gilt market as a unique buying opportunity.

On the face of it this may seem foolhardy. “As a fund manager I have to focus on the horizon rather than the minefield in front of us,” David Coombs explains. “In the midst of the crisis I have been buying gilts aggressively. It is certainly a minefield, but I believe this is a good entry point for investing for the next three to five years because I believe inflation will come down.” He raises his score for UK bonds from 3 to 7.

Burdett has also turned more positive on UK bonds, upping his score from 7 to 9. He says: “I have never seen the kind of moves we have had in bond funds in the last three months. Gilts are weak because of a technical situation - not because anyone thinks the Bank of England is not going to pay out on UK bonds.”

He takes the view that the deadly combination of the Covid pandemic and the war in Ukraine persuaded central banks to allow interest rates to remain low for longer than they should have done.

- Benstead on Bonds: there’s finally an alternative to stocks

- Sterling hits record low: the bond and stock market winners and losers

- Record amount exits equity funds, with investors favouring bonds

Burdett adds: “That makes the transition to normal interest rates more difficult. The artificial phase is now coming to an end and that is a good thing - except in the short term. So quite a few fund managers are getting very excited about the opportunities this dislocation is throwing up.”

Macmillan also ups his score for gilts, from 5 to 7. But his keenness for US government bonds is even greater. “I give global bonds an 8 because the real rate of interest in the US is now 2%, whereas the growth in the US economy is less than 2%,” he says.

Schroders’ Keith Wade is the odd one out on gilts. He would rather be on the sidelines, and notably raises his cash score from 5 to 8, while lowering his scores for both gilts and global bonds from 6 to 5.

“I think we will soon get some stability in the government bond markets, which is what my neutral scores are implying” he says.

“However, neither the government nor the Bank of England are coming out of this crisis well.”

Equities downgraded, but Japan bucks the trend

Enthusiasm for equities is now very patchy. Average scores are underweight in all equity sectors except Japan.

The word recession is “used freely,” Burdett points out. He adds: “And it still feels as though equities might lose a bit more ground. They are already down between 10% and 20% this year depending on which market you are in.”

But that does not stop Burdett staying overweight in all sectors except the US. “There are some very cheap companies around and every day is a good day to invest in equities if you take a five-year view.”

Burdett’s optimistic stance is not shared by MacMillan. “We think we may be near the peak of the pain for interest rates and for government bonds,” he says. “But we also think equity markets have not started to price in the effect of the recession on projected earnings. When earnings start to fall, share prices fall by a similar proportion as earnings.” While doubling his cash score from 3 to 6 MacMillan has cut scores for UK and US equities to 3.

He adds: “Europe may be hardest hit by the recession. Headwinds there include the price of natural gas, which is 10 times higher than it is in the US.” He cuts his European equities score from 5 to 2.

- Funds and trusts four professionals are buying and selling: Q4 2022

- The bombed-out cyclical shares the pros are buying

Wade supports this bearish view on equities. “I still feel earnings expectations are too high across the board,” he says. He stays underweight in the US, UK and emerging markets and scores only a 3 for Europe. However, he is raising his cash score from 5 to 8 on the belief that a further downward adjustment in equity markets cannot be far away.

“Once the earnings adjustment has been factored in then equities will be the place to be,” he says.

Pros expect recession to be short-lived

How deep and how long will the recession be? Here Wade provides a glimmer of hope: “The US Federal Reserve, which has been leading the way higher with interest rates will probably go up another 0.75% in early November, but then it will probably leave rates on hold at that level throughout next year and possibly start cutting them by this time next year.”

That implies hopes for a recession that is mild and short-lived and helps explain why all the panel like the idea of parking funds in the corporate bond markets where decent returns are to be had and the risk of defaults may not be that great.

On US equities, Coombs is the odd man out keeping his score at 7, while the rest are underweight with Macmillan scoring only a 3.

Coombs says: “Average price earnings ratios in the US are twice those in the UK, but the US is where I am going to find my quality companies. The US is energy self-sufficient and I think inflation there will come down quite quickly.”

Burdett is the odd man out on European equities with a score of 8, while the rest of the panel stay well underweight on those recessionary fears. With earnings multiples projected on average to be in single figures for European stocks, Burdett feels these fears are already discounted.

- Listen to out latest On the Money podcast episode: Learn from the biggest investment mistakes

- Top-performing fund, investment trust and ETF data: October 2022

Japan has long been Burdett’s favoured sector and this market has held up well in the last three months. Now he raises his score to 9, while the other panel members stick to neutral scores of 5. It still makes Japan the most favoured equity sector with a score of 6. “Japan does not have the inflation problems we have in the West and Japanese companies are not burdened with debt problems, while the recent weakness of the Japanese yen has made the country’s manufacturers competitive with its Asian neighbours in China and India,” Burdett points out.

Finally, gold is back in favour as three panel members raise their scores. “Gold is typically linked to the performance of inflation-linked bonds and it performs when those bonds start to perform,” says Macmillan. And a belief that US interest rates are near their peak prompts Coombs to lift his gold score from 7 to 8.

Panellist profiles

Rob Burdett is co-head of multi-manager at BMO Global Asset Management and a research team leader.

David Coombs is head of multi-asset investments at Rathbones.

Max Macmillan is head of strategic asset allocation at abrdn.

Keith Wade is chief economist and strategist at Schroders.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.