Richard Beddard: this company could clean up in the US

25th November 2022 14:10

by Richard Beddard from interactive investor

There’s a big opportunity for international growth in America and the NHS is buying its products again. The shares aren’t cheap, but our columnist thinks this remains a good long-term investment.

You might have thought Tristel (LSE:TSTL) would have had its day during the pandemic, but not so.

Although the company makes a high-level disinfectant capable of killing Covid 19 in half a minute, it actually experienced less demand from hospitals.

That is because Tristel makes most of its revenue and profit from disinfectants for simple endoscopes and ultrasound probes used in routine outpatient procedures.

- Read about how to: Open a Trading Account | How to start Trading Stocks | Top UK shares

During the pandemic, hospitals diverted resources to the influx of Covid patients, took longer to treat patients, and cancelled appointments because staff were off sick or working from home.

Now hospitals are returning to normal, demand for Tristel’s disinfectant is normalising too, which should mean big profits because its disinfectant has unique qualities.

High level disinfection is required for instruments that enter the human body, and Tristel’s chlorine dioxide chemistry is the only one that can be used to clean heat-sensitive medical devices manually, a process that is quick and effective.

Rival disinfectant chemistries like peracetic acid and hydrogen peroxide can only safely be used within machines which are expensive to buy and maintain.

These qualities mean Tristel is the dominant medical device disinfectant in ENT, Cardiology and Ophthalmology and other outpatient departments in the UK, and it is increasingly popular overseas.

Stymied by Brexit too

In the year to June 2022, Tristel made less profit than it did the year before when the pandemic impact was greatest.

Part of the problem was stockpiling in 2021 by the NHS, the company’s biggest customer, in response to Brexit. This masked a bigger underlying decline in profit due to the Covid-19 pandemic that year, but delayed some of the pain into 2022 when sales were stymied as the NHS released its stockpile to hospitals.

- The 50% Club: these bombed-out cyclicals repay investors with massive rally

- Investment forecast for 2023: hot sectors, income and growth

Costs increased as the company hired more quality assurance and compliance staff to progress regulatory approvals overseas and manage diverging regulatory regimes in the UK and Europe.

The company also lost revenue because it discontinued a number of low-margin disinfectant products for veterinary surgeries and clean rooms, although this had no impact on profit.

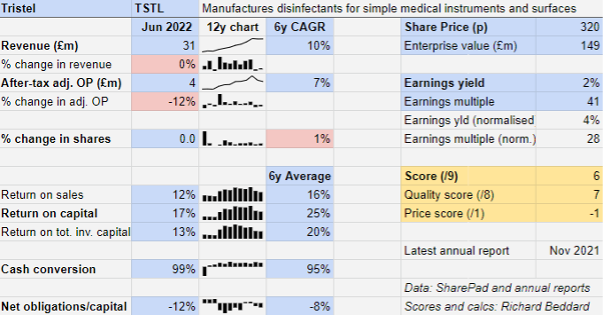

The net result was a below par but far from alarming year in terms of profitability. Par, a six-year average 16% adjusted operating profit margin and 25% return on capital, is impressive.

The good news is that the NHS’ buying pattern has returned to normal and Tristel expects the resumption of revenue and profit growth in the year to June 2023 and beyond.

As it has before, Tristel is targeting 10 to 15% annual revenue growth, which it has just about achieved over the last six years, and 25% EBITDA margin (excluding share-based payments). EBITDA is a measure of profit (not a particularly useful one, in my opinion!).

Its ambition to grow pre-tax profit every year has been dropped though. Perhaps it is just being realistic given recent experience.

Big opportunities

Tristel's biggest opportunity for international growth is in the US.

After three years of toing and froing between Tristel and the US Environmental Protection Agency (EPA), the company’s US distributor, Parker Laboratories launched Tristel’s first US product in September.

It is DUO, an intermediate level foam disinfectant for general medical surfaces including ultrasound transducers, which come into contact with the skin but do not enter the body.

The big news shareholders have been waiting for, though, is approval from the US Food and Drug Administration (FDA) for a high-level disinfectant. Tristel has been gathering data in support of its submission for more than five years, much longer than originally anticipated.

It made its first submission for DUO ULT in June. This is a high-level disinfectant for intra-cavity (i.e. invasive) ultrasound probes. The FDA has requested more information and Tristel anticipates a decision by June 2023.

The process has been protracted partly because this is the first time the FDA has ruled on a high-level chlorine dioxide disinfectant. Subject to its approval, the company believes further product approvals will be much quicker.

While Tristel dominates the decontamination of a small subset of medical devices, the opportunity for its newer hospital surface disinfectant brand Cache could be much bigger.

Cache is made from the same chlorine dioxide chemistry as Tristel, its eponymous medical device disinfectant brand.

The company hopes to displace rival lower-level disinfectants, which kill bacteria and other microbes but not their spores, which can later germinate.

Cache also has an environmental edge over pre-wetted disinfectant wipes because they contain plastic, which maintains their integrity and lengthens their shelf lives.

In contrast, Cache is applied with a dry cloth or paper towel.

Aided by a renewed emphasis on hygiene because of Covid-19, Tristel expects Cache's superior sporicidal capabilities to create a new category of surface disinfection it can dominate.

While the potential is larger than for medical device disinfectants, the probability of success may be lower.

Through a combination of registering more products in more territories and taking direct ownership of distributors, Tristel has proved it can grow rapidly overseas.

It has lifted the proportion of sales generated outside the UK from 47% in 2017 to 65% five years later in 2022. This has not only increased revenue, but dramatically reduced the company’s dependence on the NHS to about 20% of total revenue.

But sales of surface disinfectants are a modest 10% of total revenue. Although infection control officers in hospitals may take a different view when human lives are at stake, Tristel was unable to persuade vets and clean rooms to use more expensive chlorine dioxide instead of lower-level disinfectants.

Tristel may also face an environmental hurdle. Unlike Cache, its phenomenally successful Trio system incorporates a pre-wetted wipe. It appears to have the answer in DUO, which is applied with a dry wipe.

Scoring Tristel

The attraction of Tristel is the strength of its competitive position, which the company trumpets in its annual reports.

A copycat would have to recreate 20 years of know-how and documentation and secure countless regulatory approvals and device certifications. Then it would have to get around over 100 patents relating to the manufacture and packaging of chlorine dioxide.

While success in the US and for Cache is not certain, Tristel is doing pretty well as it is, especially when you consider it has borne the cost of securing EPA and FDA approvals for many years but has yet to report any sales from the US.

Does the business make good money? [2]

+ High return on capital

+ Decent profit margin

+ Good cash conversion

What could stop it growing profitably? [2]

+ Strong finances

+ Limited competition

+ Dependence on NHS reduced

How does its strategy address the risks? [2]

+ Focus on chlorine dioxide

+ Overseas expansion

? Creating a new category of surface disinfectant

Will we all benefit? [1]

+ Founder, ceo Paul Swinney is very experienced

+ Good communication with shareholders

˗ Convoluted executive pay

Is the share price low relative to profit? [-1]

+ No. A share price of 320p values the enterprise at about £149 million, about 28 times normalised profit.

A score of 6 out of 9 indicates Tristel is a good but somewhat pricey long-term investment.

It is ranked 33 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Tristel

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.