Richard Beddard: a good long-term investment eyeing the 'big one'

Our companies analyst discusses whether a larger acquisition will transform this business.

24th July 2020 15:39

by Richard Beddard from interactive investor

This company has benefited from small acquisitions, but our companies analyst discusses whether landing a big one will transform the business.

Listening to Solid State (LSE:SOLI) bosses talk about the year to March 2020 is an uplifting experience. The company, which manufactures and distributes electronics, exited lockdown on the front foot, much as it entered it.

Unlike some competitors, Solid State did not furlough its field sales team. It used the pandemic to streamline, selling online instead of face to face and negotiating better terms with Asian suppliers as it built up stock levels to ensure it could continue supplying customers. It has accelerated product development in anticipation of government stimulus programmes, and largely maintained investment. With a debt free balance sheet and committed banking facilities, it may acquire weaker businesses towards the end of the year, once the Government has withdrawn support.

During the first quarter of the new financial year, April to June - peak pandemic, the company maintained sales at much the same level as the previous year, but order intake was 15% lower. In the new normal, Solid States expects to benefit if manufacturers source components closer to home in response to the pandemic and deteriorating international relations, although its customers may lose business if trade frictions intensify.

As usual, Solid State is tilting towards markets likely to grow, including 5G, industrial automation, and the specialised electric powertrains of submersibles and other vehicles while it waits for markets like oil and gas and commercial aviation to recover.

Doing difficult things

Solid State says it does the difficult things smaller companies can’t do and bigger companies don’t want to do.

The manufacturing division, Steatite, designs and manufactures bespoke products like rugged computers for warships, battery packs for robotics and antenna systems for the Met Office.

The Value Added Division (VAD) is two companies. Solid State Supplies distributes electronic components and Pacer distributes opto-electronics: displays, sensors, LED’s and other light-based components and systems.

Pacer designed and sourced the components for a Video Assistant Referee (VAR) monitor used at football matches and manufactured by a Taiwanise partner. Source: Pacer

Pacer, acquired in November 2018, illustrates both the traditional strengths of Solid State’s acquisition strategy, improving the performance of the acquired businesses and broadening its supplier and customer bases, and a newer ambition to get its subsidiaries working more closely together.

Like most of Solid State’s prior acquisitions, Pacer was a good business that brought new customers in a new market (medical). But Pacer needed investment, principally to allow it to supply more components from stock and reduce the length of time it took to fulfil orders. Having made the investment, Pacer’s operating profit margins have increased by 3%.

The distribution division adds value in a number of ways, pre-loading software onto components so they can go straight on to customers’ production lines for example. But Solid State is also turning customers of its distribution division into customers for systems manufactured by Steatite. Pacer supplies displays for trackside horse racing betting terminals, but Steatite expects to supply the whole ruggedised system from this year, turning a £250 display into a £4,000 sale.

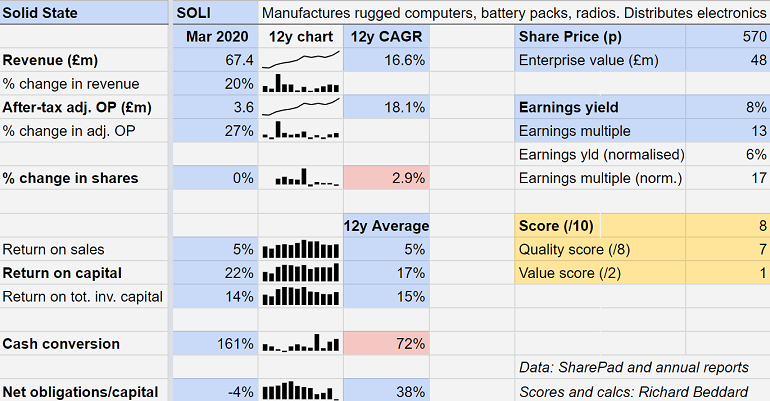

Another good year

Helped by the acquisition of Pacer in the prior year, revenue and profit in the year to March 2020 increased by 20% and 27% respectively, faster than the average, which is itself impressive.

Even more impressive was cash conversion. Cash flow was 60% higher than adjusted profit, although such cash inflows are unusual. They are partly the result of better terms with Asian suppliers and government measures to help companies through the pandemic. Solid State deferred its VAT payments and furloughed about 10% of staff.

Return on capital was high, both in terms of capital required to operate the business and, vindicating the acquisition strategy, total invested capital including the cost of acquisitions.

Profit margins (before interest but after tax at the standard rate) were stuck at 5%. Relatively thin margins can be extinguished in downturns, but Solid State has been a pretty consistent performer over the years. Predictably, it recorded its lowest return on sales of 4% in 2008 and 2009 during the financial crisis.

The big one...

Most years, I write an article about Solid State, and most years my editor and I have the same conversation about the company’s ambition to make a big acquisition. We’ve both seen the gleam in chief executive Gary Marsh’s eye when he talks about it.

I’m nervous, big acquisitions can transform companies in all the wrong ways, but my editor is relaxed. The acquisitions have been getting bigger, Pacer cost £3.8 million, but at roughly a year’s profit for Solid State it is still the kind of investment that augments a company nicely without disrupting it.

My editor thinks the big one has been hanging in the air for so long now, Solid State might never do it. I’m sure it will, but I’m also coming round to it. Solid State is the successful product of many small acquisitions. It’s circumspection suggests it is not lowering its standards for a big acquisition. As long as it’s not huge, maybe it can handle it.

Scoring Solid State

Does the business make good money? [2]

+ Yes, Solid State has profited through thick and thin

+ Improving cash flows

? Operating profit margins not rising

What could stop it growing profitably? [1]

+ Strong financial management, broad customer base

? Big acquisition that goes wrong

? Brexit and China trade frictions may impact customers

How does its strategy address the risks? [2]

+ Targets markets that have not been commoditised

+ Tilts business to growth industries

+ Bespoke work fosters long-term partnerships

Will we all benefit? [2]

+ Experienced chief executive is significant shareholder

+ First element of strategy is to invest in people and know-how

+ Executive pay not excessive

Are the shares cheap? [1]

+ 565p values the enterprise at £48 million, 13 times adjusted profit

? 2020 was a particularly good year

? Normalised PE ratio is about 17

A score of 8/10 indicates Solid State should be a good long-term investment.

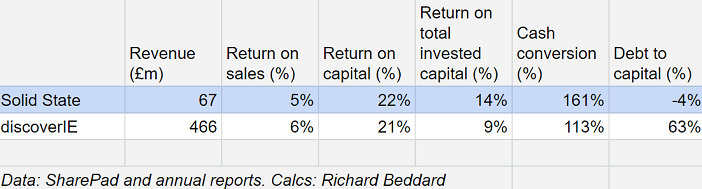

Solid State versus discoverIE

For a small business, Solid State is pretty complex. Since scale often increases complexity, there’s a risk that the company might become less efficient as it grows. One thing that gives me confidence is the performance of a bigger rival, discoverIE (LSE:DSCV). discoverIE (formerly electronics distributor Acal) has spent most of the last decade buying up manufacturers of electronic components. The company, which has also recently published its annual report, makes an interesting comparison.

Apart from its size, the main difference in the numbers is the debt it has used to acquire companies and the drag its more aggressive acquisition programme is having on Return on total invested capital:

Richard owns shares in Solid State.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.