Richard Beddard: it pays to push past the acronyms with this stock

Can this firm prosper if spending goes into a tailspin? Our companies analyst thinks so – and here’s why.

11th September 2020 15:21

by Richard Beddard from interactive investor

Can this firm prosper if spending goes into a tailspin? Our companies analyst thinks so – and here’s why.

Cohort (LSE:CHRT) is finding it more difficult to sell defence technology during the pandemic, but while it’s not growing, it’s not contracting either.

The company is an assortment of acronyms and not the easiest to explain. It is soon to be six businesses, principally supplying defence technology, services and training. Defence and security contribute 90% of revenue, but Cohort also has sidelines in transport (6% of revenue) and subsea oil and gas (just over 2%).

Its latest acquisition, ELAC, supplies sonar systems, but the deal has yet to be finalised by the German government.

Like Cohort’s other recent acquisitions ELAC mostly makes products. Products are easier to export and give the company the means to grow when UK defence spending is constrained.

Buying overseas and export businesses has reduced Cohort’s dependency on the UK Ministry of Defence (MOD) to less than 50% for the first time, something bigger rivals such as QinetiQ (LSE:QQ.) would love to achieve.

- Richard Beddard: QinetiQ looks perfect – but where’s the growth?

- Insider: defence contractor bosses reload shares

- ii view: Babcock scuttles the dividend

In theory, Cohort ought to get stronger as it grows more diverse, bringing the group more customers and more opportunities. SEA, which designs and supplies naval systems, and Chess, which manufactures hardware and software to track and target threats, are working together to invent a naval decoy launcher, for example.

It is a new market for Chess technology, acquired in 2018. Chess’ most eye-catching product is a component of an anti-drone system.

An AUDS counter Unmanned Aerial Vehicle (UAV) system built for battle, but deployed to protect Gatwick Airport within a few days of the drone incursions that caused chaos in December 2018. The system detects, tracks and disables drones. AUDS is a consortium of three companies. Blighter supplies the radar that detects the drones. Chess, a subsidiary of Cohort, provides the video-tracking component. Enterprise Control Systems supplies the Radio Frequency (RF) Inhibitor that disrupts the signals controlling the drone. The system can be deployed on vehicles and used against drone swarms. Source: cohortplc.com

With the help of another Cohort subsidiary EID, SEA has trialled its Krait anti-submarine system with the Portuguese Navy. EID, which was Cohort’s first overseas acquisition in 2015, is a Portuguese manufacturer of tactical (land-based) and naval communications systems.

Cohort expects ELAC, which will be Cohort’s second overseas acquisition, to bring new customers to SEA, and SEA to do the same for ELAC. Since they both equip submarines and surface vessels, there is an obvious overlap.

EID, Chess, and ELAC stand apart from Cohort’s early acquisitions, principally MASS and SEA in that the former two companies are somewhat bewilderingly product, service, and training companies. They do research and development, support military operations with technical personnel, invent products, sometimes funded by the MoD, and sell them.

MASS, a specialist in data and analysis, is a particularly good business. In 2020, as in most years, it was Cohort’s most profitable. It operates under big long-term government contracts that have been renewed for decades, and it supplies the market-leading Thurbon electronic warfare database system.

With the exception of MASS, profitability at Cohort’s subsidiaries tends to be lumpy, which is perhaps not surprising. Often they are supplying big orders for military kit as part of wider programmes, which are subject to delays and result in a reduction in activity once they are fulfilled. Fortunately, Cohort’s subsidiaries rarely flounder together and most years the group progresses.

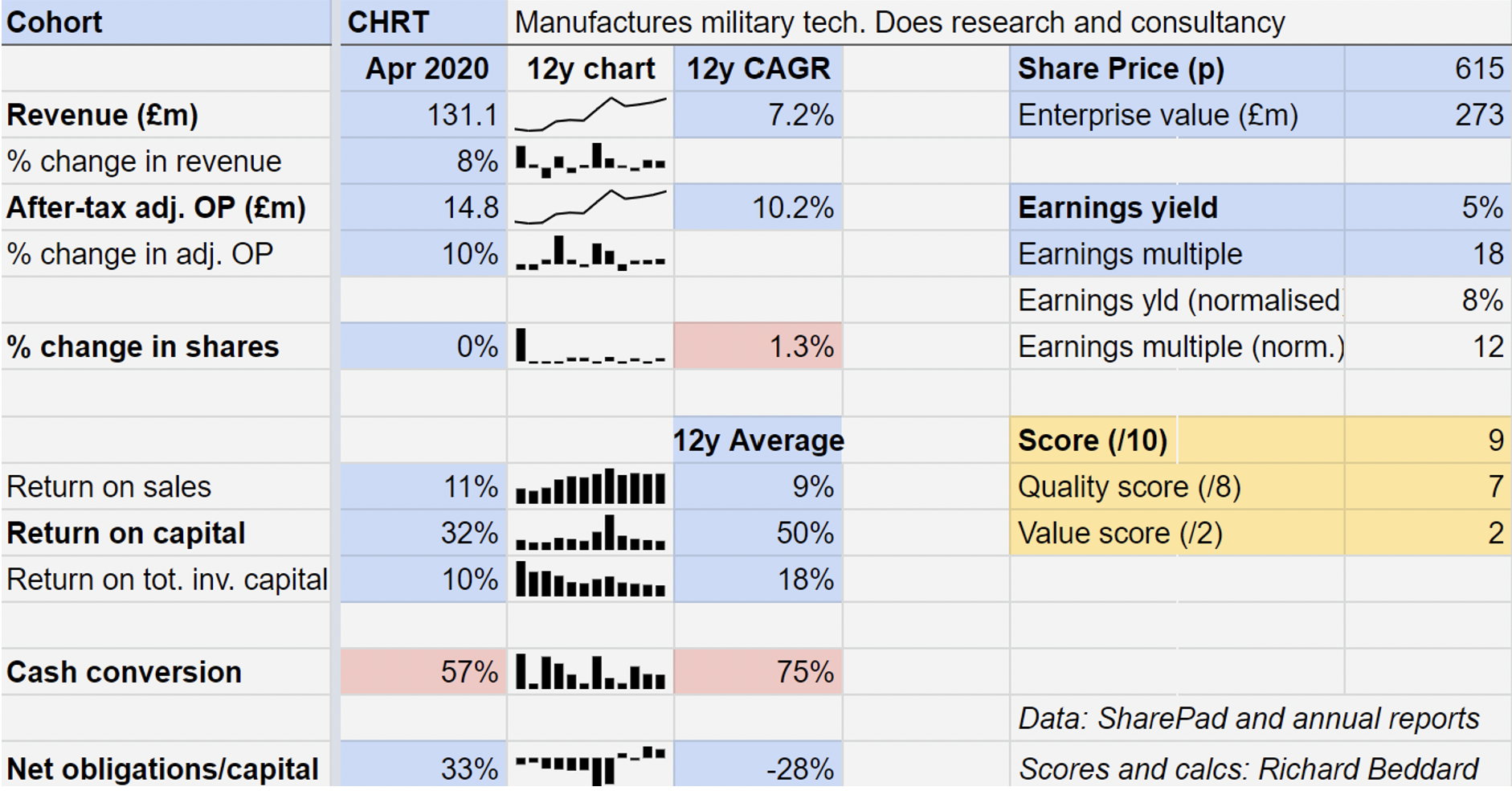

Over the last 12 years, Cohort has achieved a 10% compound annual growth in profit, despite sometimes stomach-churning reversals of fortunes in the individual businesses.

- ii view: BAE reinstates the dividend payment

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Results reflect delays and the pandemic

In the year to April 2020, it was the turn of SEA and MCL to disappoint.

Having experienced years of delays to UK submarine programmes, it was overseas customers for torpedo systems that delayed in 2020, only partly, the company says due to Covid-19.

MCL distributes defence technology, and was unable to replace revenue earned last year from a big MoD order for hearing protection equipment.

Overall, Cohort estimates that it lost £3 million revenue and £1 million profit to Covid 19, but it nevertheless grew revenue and profit in line with the long-term trend thanks to the contribution of Chess, which it acquired in the second half of the previous financial year.

The other businesses achieved 4% less revenue and 2% less adjusted operating profit combined, compared to 2019.

Cash conversion has also been weak for the last two years, which the company partly blames on Chess. It has experienced rapid growth, which has led to high levels of working capital.

Cohort is working with Chess to improve efficiency.

While countries face proliferating geopolitical and terrorist threats, often of a technological nature, it is also possible that governments will have less money to spend on defence owing to their efforts to support the economy and defeat the pandemic.

Cohort says that its responsibility is to prosper whatever the economic and political backdrop. In the short term, that translates into flat revenue, profit and debt in 2021 before the impact of the ELAC acquisition. Reassuringly, the company says it has already received orders for 75% of the revenue expected in 2021.

Long term, Cohort anticipates a return to growth as orders delayed by Covid-19 come through.

Strategic tensions

The company’s strategy is to acquire defence technology businesses and let them innovate by providing money and freedom.

It insists it has a light touch, but an increasing emphasis on sharing technology and customers within the group implies an element of central coordination.

Cohort must manage the potential conflict with its prime directive to maintain the autonomy of its subsidiaries so that they can respond quickly to customers’ changing needs.

The cost of acquisitions may also be troubling.

Cohort acquires companies with niche products, and judging by EID and Chess they do not come particularly cheaply. Shareholders are relying on management’s judgement that these companies will prosper for years to come.

What matters is the returns Cohort earns on the money it has invested. Cohort’s return on total invested capital was 10% in 2020, which is reasonable considering returns will grow over time if the investments are as good as Cohort believed them to be.

The price paid for ELAC is something of a conundrum because full details of the transaction have yet to be confirmed.

Scoring Cohort

I like Cohort. It has grown largely under its own stream from a single training company managed by the current board, starting with flotation of SCS (now defunct) and the acquisition of MASS in 2006. The board’s ties to the MoD and contractors predates Cohort by many years.

The company encourages the experienced managers of subsidiaries it acquires to stay on post-acquisition, which encourages business owners to sell up.

Graham Beall, founder of Chess, remains its managing director today, while António Marcos Lopes, managing director of EID, has worked for the company for 35 years.

Does the business make good money? [2]

+ Return on capital is high

+ Reasonable profit margins

? Variable cash conversion has weakened since acquisition of Chess

What could stop it growing profitably? [1]

+ Low exports to EU and home base in EU means Brexit is low risk

? Potential cuts to military spending if NATO economies decline

? Recent acquisitions have been more expensive than earlier ones

How does its strategy address the risks? [1]

+ Autonomous businesses respond faster to changing customer priorities

? Acquisitions with niche products and export potential should justify higher prices

? Collaboration may foster more growth

Will we all benefit? [2]

+ The company's co-founders are board members and major shareholders

+ Executives are very experienced and not outrageously paid

+ Annual reports explain the business well

Are the shares cheap? [2]

+ A share price of 615p values the enterprise at about £273 million, 18 times adjusted profit in the year to April 2020, a year in which a number of Cohort subsidiaries underperformed.

If military spending goes into a tailspin, we will find out whether Cohort can prosper whatever the backdrop. I think it will, within reason, and a score of 8/10 suggests Cohort is a good long-term investment.

It is currently ranked fifth out of 34 companies in my Decision Engine, which helps assess if this list of firms are cheap or not.

Richard owns shares in Cohort.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.