Richard Beddard: many good years lie ahead for this famous firm

15th July 2022 15:38

by Richard Beddard from interactive investor

A gift that keeps on giving and a money printing machine. This company has them both, which our columnist thinks makes it a good long-term investment.

Describing the publishing business in a presentation to investors earlier this year, Bloomsbury Publishing (LSE:BMY) founder and chief executive Nigel Newton explained that it resembles investing.

Like investors, he said, Bloomsbury owns a portfolio. The successes must outweigh the failures, but if there are no failures, the publisher is probably not taking enough risks.

More than books

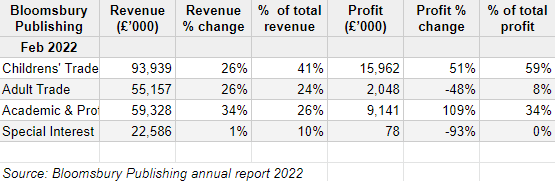

Bloomsbury sells books to consumers, which includes enormously profitable rights to the Harry Potter books, and also to academic libraries and businesses.

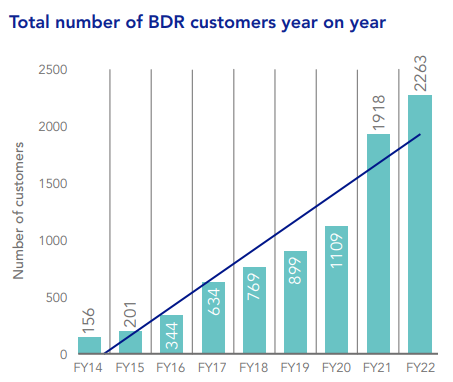

Its non-consumer Academic & Professional division includes Bloomsbury Digital Resources (BDR), collections of primary documents, academic works, textbooks, and audio and visual material, principally in the arts, humanities and social sciences.

The pandemic accelerated the adoption of BDR and encouraged people to read novels and cookery books alike, lifting Bloomsbury’s profit margins in the year to February 2022 into double figures, its return on capital to over 30%, and enabling the company to collect oodles of cash from its customers.

Bloomsbury used its cash flow to avoid print shortages and satisfy demand by stockpiling books.

The two divisions, consumer and non-consumer, earned similar profit margins but both divisions rely heavily on unique properties, the company’s big successes, to support a long tail of marginally profitable or unprofitable also-rans and failures.

The gift that keeps on giving in Bloomsbury’s consumer division is Children's Trade, the company’s biggest sub-division, powered principally by the Harry Potter franchise.

Children's Trade contributed 41% of total revenue in 2022 and 59% of profit, achieving a profit margin of 17%. Over the last seven years, profit margins in this division have ranged from 12% to 18%.

Despite many high-profile authors, the Adult Trade division has nothing to compare to Harry Potter and it contributed only 8% of total profit from 24% of total revenue, a profit margin of 4%.

In the last seven years, Adult Trade has only done better once in terms of margin, in 2021. Then it earned a 9% profit margin.

After a string of losses from the Adult division between 2016 and 2018, I asked Bloomsbury why it bothers with adult books. It replied that it could do better, which it has, and that the reputation of its adult authors is good for Bloomsbury’s reputation (one of its authors, Abdulrazak Gurnah, won the Nobel Prize for literature last year).

Likewise, the non-consumer division, has in Academic and Professional and particularly Bloomsbury Digital Resources, another money printing machine. Powered principally by BDR, Academic and Professional contributed 34% of total profit from 26% of revenue, and achieved a profit margin of 15%.

But the Special Interest division, which publishes Wisden Cricketers’ Almanack and the Writers’ & Artists’ Yearbook, barely broke-even in 2022.

This may be a blip. Special Interest titles have achieved a profit margin of up to 10% in the past, and they are more dependent on print than the company’s other sub-divisions, which affected sales during the pandemic.

Mr Newton is confident about the worrisome near future. He believes the pandemic has revitalised people’s appetite for reading, and although high freight and energy costs will inflate the price of books, they will remain an affordable luxury most people do not forego in recession.

Living with Amazon

The company’s biggest customer, presumably Amazon, brings it £69 million in revenue, which is 37% of the total.

Such concentration is a concern. But Bloomsbury has lived with this risk for decades and grown profitably. Its most reliable source of growth, BDR, is totally unreliant on the ecommerce giant.

It also faces a competitive threat from a rival electronic publishing model, Open Access (OA). The UK state funder of research (UKRI) will soon require research it has funded to be distributed for free.

Currently this impacts a small minority of Bloomsbury research titles, but the number could grow.

Publishers are adapting. They can still profit from OA works by providing editing and peer review services, and bundling free texts with rights they own in collections like BDR. They can also target overseas sales, particularly outside Europe where OA is less popular. Notably, 78% of BDR sales in 2022 were overseas.

The sustainability of BDR revenue growth may also come under threat due to the nature of the contracts that libraries choose.

Bloomsbury sells digital resources to libraries on subscription or with a perpetual licence. The former gives customers access to continually improving products and Bloomsbury a reliable source of income. The latter gives libraries ownership of the product, and Bloomsbury a large one-off shot in the arm.

The company would prefer the recurring revenues of subscriptions, but subscriptions contributed just 38% of revenue in 2022, 1% less than their contribution in 2021.

Gifts that keep on giving

When a writer becomes a star, Bloomsbury shares in their monopoly and the enduring profitability of their imaginary worlds.

Bloomsbury’s job is to keep interest in Harry Potter books alive, by producing box sets, illustrated and pop-up editions for example. This year is Potter’s 25th anniversary, giving Bloomsbury an excuse for a marketing blitz and the publication of an anniversary edition.

The Harry Potter franchise is still growing. In its 24th year, it achieved 5% more revenue than in its 23rd.

Though BDR does not have star power, the collections have similar characteristics. They are of enduring value, and Bloomsbury has targeted the arts and humanities with products aimed at, for example, drama and fashion, niches neglected by other publishers.

In 2022, BDR earned £6.8 million profit from £18.6 million revenue, a profit margin of 37%. It contributed 31% of the Academic & Professional division’s revenue, but 75% of its profit.

Bloomsbury says the profit margin may decline to no lower than 30% as it adds more content licensed from other publishers to its collections, and by setting a target of 50% growth in BDR by 2028, Bloomsbury has calibrated investors’ expectations after six years of rapid growth.

The arts and humanities niche is relatively small, Bloomsbury already sells at least one BDR product to about half of its potential customers, and lots of the licences it has sold are perpetual, which means it must keep finding substantial amounts of new business just to stand still.

The pandemic too brought forward some growth that Bloomsbury previously expected to achieve in the coming years.

The Pandemic accelerated the adoption of digital resources in 2021. Source: Bloomsbury Annual Report 2022

Another way to take risks, apart from finding new authors, is to acquire them.

In Academic & Professional, the company has an opportunity to pay print multiples for publishers and digitise their extensive back catalogues for inclusion in BDR.

In 2022, Bloomsbury paid 1.5 times revenue for ABC Clio, an academic publisher with a large back catalogue and suite of databases, and just 0.3 times revenue for Red Globe, a textbook publisher.

If Bloomsbury can earn 30% plus profit margins when it incorporates their publications into digital collections, they should be excellent investments.

Fairness

The publishing industry has changed as publishers have responded to the challenge of digitisation and Amazon by consolidating and developing new capabilities.

Publishing companies must walk a fine line that allows them to publish politically charged works, while keeping their diverse employees happy.

Not surprisingly, Bloomsbury has made employee engagement and benefits a central plank of its strategy in recent years. In March, the company introduced what it describes as an industry leading group bonus scheme and a 5% pay increase.

Employees are paid reasonably well, median total pay and benefits amounted to just over £38,000 in 2022, although Mr Newton earned nearly 50 times that much: enough to raise both my eyebrows.

The company has introduced a hybrid two day in the office and three day at home week for its predominantly female workforce, and employees can work extra hours to finish early on Friday.

Bloomsbury’s culture, and its guiding principle to publish books of excellence and originality, also appeals to the publishers it seeks to acquire. The founder of book publisher Head of Zeus, acquired in June 2021 by Bloomsbury, said:

“I have known Nigel Newton for more than 30 years. We share many of the same values: creative publishing, unique content and beautiful books. And an entrepreneurial spirit that values innovation above conformity.”

Scoring Bloomsbury Publishing

I like Bloomsbury. One of its early risks was JK Rowling. It picked up the rights to Harry Potter, after the unknown author had been rejected by other publishers.

It has ploughed the enduring profits of that franchise into more risks, diversifying the business and ultimately inventing a new cash cow, BDR.

Most of all, I like the product.

As I compulsively browse in the booksellers of Cambridge, I am often gratified to find works of excellence and originality published by Bloomsbury.

The Harry Potter cash cow is mature, and BDR will mature.

I wonder where in the business there are other gifts that keep on giving in the making.

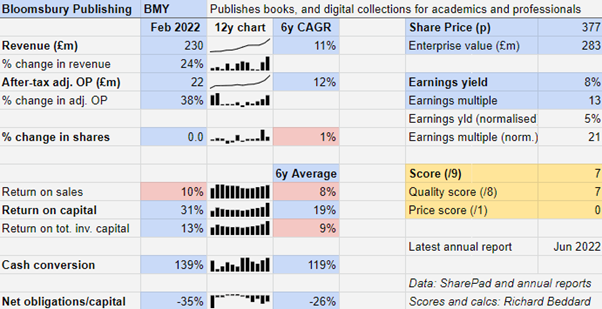

Does the business make good money? [2]

- High returns on capital

- Strong cash conversion

- Improving profit margin

What could stop it growing profitably? [1]

- Strong finances, some resilience to recession

- Competitive threats: Open Access and Amazon

- Failure to convert BDR customers into subscribers

How does its strategy address the risks? [2]

- Development and acquisition of authors and content

- Diversification through BDR

- International sales growth (66% of revenue)

Will we all benefit? [2]

- Experienced, albeit extremely highly paid management

- Employee engagement is core strategy

- Publishes works of excellence and originality

Is the share price low relative to profit? [0]

- The shares are reasonably priced. A share price of 377p values the enterprise at about £283 million, about 21 times normalised profit.

Bloomsbury will do well to ever have another year when it performs as well in terms of growth as it has in 2022. Nevertheless, I believe it will have many good years in future.

A score of 7 out of 9 indicates the company is a good long-term investment.

It is ranked 20 out of 40 stocks in my Decision Engine, all of them decent businesses.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Bloomsbury Publishing.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.