Richard Beddard: much to admire about this export powerhouse

11th November 2022 15:10

by Richard Beddard from interactive investor

Its product might be mundane, but this company makes very healthy profits and sits on a huge cash pile. Does a fall in share price make this a stock to buy?

James Halstead (LSE:JHD) is one of the most reliably profitable shares on the stock market, but something has spooked investors, and its annual report will not help them sleep more easily.

The shares are down 40%, begging the one question long-term investors cannot duck: is this a wobble, or are we witnessing something more fundamental?

The report starts with a eulogy to Queen Elizabeth ll, who as an ambassador for Britain, helped turn James Halstead into the export powerhouse that it is. Then it becomes more sombre.

- Find out about: Trading Account | Share prices today | Top UK shares

The manufacturer of vinyl flooring is famous for its ability to generate impressive returns on capital and eke out growth.

In the year to January 2022, it experienced a decline in underlying profit for the second consecutive year, and it has gone to extraordinary lengths to ensure it can continue to supply vinyl over the winter.

The company’s recent performance and emergency preparations for a bleak winter probably explain why its share price is testing the levels it fell to during the pandemic, levels it has not traded below since 2015:

Not good, not awful

In fact, the results for the year to June 2022 were not bad, they just were not very good.

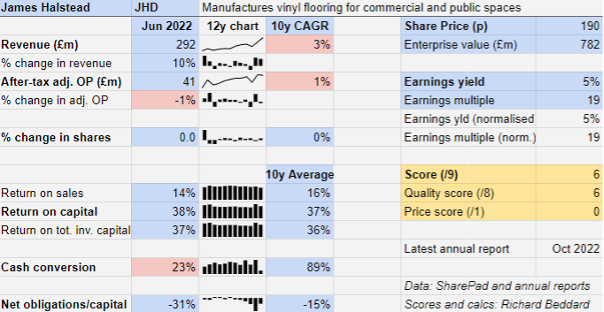

Revenue increased 10% and profit declined by less than 1%. Return on Capital of 38% was average for James Halstead, which is to say extraordinary for almost any other business.

Profit did not increase despite an increase in revenue because of increases in the cost of transport, fuel, energy and raw materials, which James Halstead did not pass on in full to customers, in the main distributors.

The problem James Halstead faced was holding on to specifications during the months between quotation and delivery. When costs are rising, it is tempting to renegotiate, but the customer can always go somewhere else.

Sometimes James Halstead chose not to renegotiate, sometimes it successfully agreed a new price, and sometimes it lost the business.

The numbers more likely to concern long-term shareholders are the 10-year growth trend in revenue and profit, which is not growth at all in real-terms, and very weak cash conversion of only 23%.

That is unprecedented in the numbers I have compiled going back to 2010:

To take the second number first, the weak cash conversion is due to a near doubling of stock. At the end of its financial year in 2021, James Halstead had just over £60 million of stock. In June 2022, it had more than £112 million.

Buying more raw materials and turning them into more flooring has an immediate impact on the cash flow statement, but it will not be recognised as a cost in the income statement (which determines profit) until it is recognised as revenue when it is sold. This explains much of the discrepancy between profit and cash flow.

The risk, when stock increases so dramatically, is that not all of it will be sold and therefore converted into profit.

James Halstead says this stockpiling is a choice it has made out of necessity. Vinyl is made from PVC, and the raw materials come from oil refineries and petrochemical companies in Europe. They are dependent on Russian oil, the supply of which is more uncertain due to the war in Ukraine.

- Share Sleuth: two cheap shares on my radar, but there’s a problem

- Explore more of our content on UK shares

Perhaps the possibility of power outages this winter due to gas shortages is also a concern. Whatever the pressures, James Halstead is afraid it might have to halt production.

That is why it stockpiled. To avoid having more vinyl on its hands than it can sell, James Halstead may have to significantly reduce production even if the threat does not materialise, just to get rid of the surplus it has already generated.

A febrile pricing environment and an unpredictable production schedule creates inefficiencies. It seems likely that 2023 will be a third consecutive year of profit contraction, although maybe James Halstead will return to eking growth.

Although some costs continue to rise, demand is strong and the company is raising prices.

Short-term bad, long-term good?

In the short-term James Halstead is having to work hard to contract slowly, but perhaps not in the long term.

It has been able to stockpile because of its extremely strong balance sheet, which funded the increase in stock while depleting its net cash position only by about a half.

Stockpiling creates oversupply, putting pressure on prices at the same time manufacturers need to increase them due to cost inflation. While James Halstead has been able to absorb the cost, one competitor has already gone into receivership trying.

“What does not kill you, makes you stronger,” is an old saying, but probably an apposite one. James Halstead’s financials, and its reputation, put it at the top of the list of companies likely to survive and emerge from the current situation in a stronger position relative to competitors than it was before.

That reputation is based on years of specialisation. It does not do anything else apart from manufacture and sell vinyl flooring, which is why it is so efficient.

The company’s ability to supply distributors when others may not be able to, will enhance already strong relationships developed since its main brand Polyflor was launched in 1950.

James Halstead is a valuable supplier because its sales offices support distributors around the world and bring them new business.

The growth question

One of the reasons for James Halstead’s security is its huge cash pile, and one of the reasons it has amassed so much cash even after paying out a substantial proportion of free cash in dividends, is that it has not invested it.

Although the company is increasing warehouse capacity in the UK, its factories have surplus capacity, and it has not bought other companies or diversified outside vinyl flooring.

This resilience is proving indispensable, and once conditions normalise we can surely anticipate recovery, but it is difficult to assert the company will grow strongly over the next 10 years, when growth over the last 10 has been so modest.

- Stockwatch: is this ex-growth stock now attractive for income?

- 10 great shares with profit margins to survive recession

In recent years, the company has touted an increased focus on residential flooring, but there is no mention of it in this year’s annual report.

James Halstead is also expanding in South-East Asia, where it has opened a sales office in Malaysia, and is taking on sales representatives in Vietnam, Thailand and the Philippines.

Alhough James Halstead reports strong growth, it must be from a small base. The company has longer established offices in Australia, New Zealand and China, and the whole Australasia and Asia region contributes just 13% of revenue.

I wonder if this expansion is enough to increase James Halstead’s growth rate meaningfully. Closer to home in the UK and Europe it earns 79% of revenue.

Scoring James Halstead

There is much to admire about James Halstead. It makes very healthy profits from a mundane product, mostly by keeping things simple. The founder’s motto was “Quality is when the customer comes back, not the product”.

Chief executive Mark Halstead is a descendent of the founder, and the board is very experienced.

Staff too are loyal. James Halstead closed its defined benefit pension scheme, which is of modest size, to new entrants 20 years ago, yet 20% of the current UK workforce are members, implying they have worked for the company at least that long.

Threatening that goodwill is a dispute over pay. Members of the GMB union have been on strike intermittently since September and today the two sides entered into arbitration talks brokered by ACAS. Reportedly, the union has rejected an 8% pay offer.

Does the business make good money? [2]

+ High return on capital

+ Good profit margin

+ Strong cash conversion (this year excepted)

What could stop it growing profitably? [1]

+ Very strong finances

+ Strong competitor

− Lack of growth opportunities?

How does its strategy address the risks? [1]

+ Specialisation

+ Supports distributors

− Sales push in South-East Asia

Will we all benefit? [2]

+ Very experienced board, family owned

+ Employees stay

? Ongoing strike action over pay

Is the share price low relative to profit? [0]

+ No. A share price of 190p values the enterprise at about £782 million, 19 times normalised profit.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

A score of 6 out of 9 indicates James Halstead may be a good long-term investment, but muted growth prospects and a fullish price suggests the market valuation is closer to fair value than cheap.

It is ranked 34 out of 40 stocks b my Decision Engine.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.