Richard Beddard: my portfolio’s biggest holding gets a maximum score

26th May 2023 14:07

by Richard Beddard from interactive investor

Our columnist owns more shares in this company than any other and gives it full marks after his latest analysis of the business. Here’s why he likes it so much.

Despite all the problems businesses have experienced in recent years, Howden Joinery Group (LSE:HWDN) has continued its remorseless colonisation of our kitchens.

Remarkably, the company is earning even higher returns on capital than it was before the pandemic.

In the year to December 2021, Howdens more than made up for a decline in profitability coinciding with the first year of the pandemic by achieving a 35% increase in revenue and a 105% increase in profit.

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

With rising inflation, it was always going to be a tough act to follow, but the company grew revenue and profit again in the year to December 2022.

Cash conversion was slightly sub-par due to higher levels of more expensive stock, and increased capital expenditure.

So far this year, business has been brisk. In the first quarter, revenue was lower than the first 16 weeks of 2022 ignoring new stores, but flat including them. Sales in the comparative period were very high though, due to the pandemic recovery and a rush of orders ahead of price increases.

Trade-offs pay off

Unlike the rest of the industry, which operated trade counters and retail showrooms, from the early days in the 1990s Howdens decided only to supply builders.

By sacrificing the large retail customer base, it could focus the business on what builders want. They want to be free to decide how much to charge their customers (us), which is much trickier if we can just walk around to the retail showroom and get a quote.

Builders also like credit, so they can finish the job before they have to pay for the materials, and they like products to be available whenever they need, which is why Howdens keeps everything in stock.

Trade discounts, offering free credit and keeping warehouses fully stocked is costly, but the decision to support builders financially, and with design services, are trade-offs.

The builders find the customers, and they come to Howdens to pick up kitchens and components. This enables Howdens to operate from warehouses on the outskirts of towns and cities, rather than expensive showrooms, and means Howdens needs to spend less on advertising.

- The FTSE 100 dividend stocks handing £10bn to shareholders in June

- 10 great UK shares that Warren Buffett would pick

- 10 quality mid-cap shares with promising momentum

It focuses on designs that are not only popular with homeowners and landlords, but easy for builders to fit. For example, the company’s patented cabinet legs are made from recycled plastic, so they are strong enough to be dragged across the floor. Also, they can be adjusted from inside the cabinet without tools.

Some components, like electricals, are sourced centrally and cheaply because of Howdens’ size.

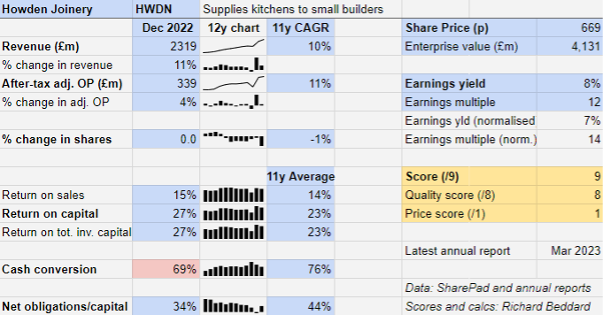

Evidently, Howdens’ trade-offs are profitable. The company’s average return on capital is 23%, and it has grown revenue and profit at a compound annual growth rate (CAGR) of about 10% for many years.

Howdens believes its addressable market in the UK, which includes a lower share of trade joinery and hardware markets, is £11.5 billion, giving it room to grow revenue from its current level of just over £2 billion.

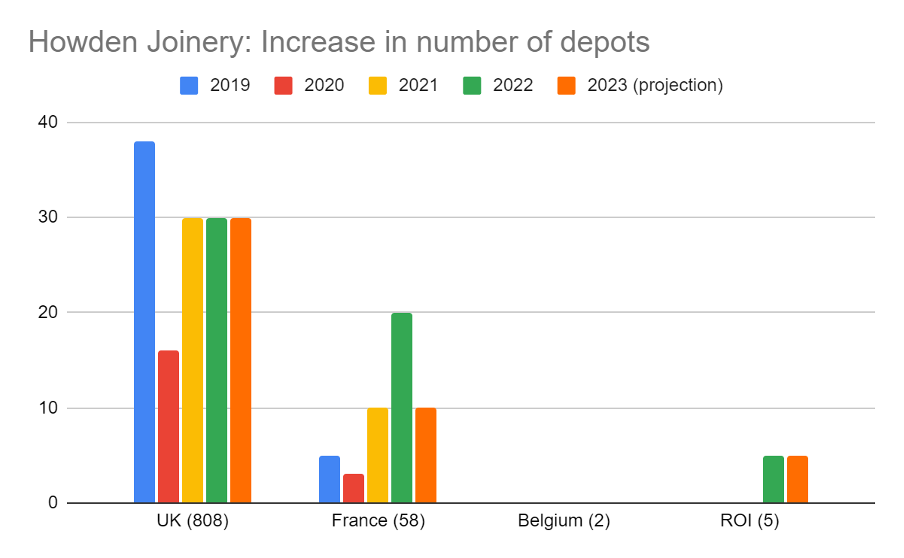

The company operated 808 depots in the UK at the year-end and, as it often does, increased the number it thinks it can operate here to around 1,000. Some of the new openings are smaller depots in more rural areas, an indication that saturation may be beckoning, though.

While it capitalises on its competitive advantage here, Howdens is trying to create competitive advantage in France, where it says the market is similar to the UK in the 1990s. Most French households do not have fitted kitchens but the market is shifting towards them, and there is no dominant supplier.

Source: Howden Joinery Annual Report 2022. The numbers in brackets refer to the number of stores in the territory at the year end. The 2023 projection is planned openings.

Last year, Howdens accelerated overseas openings, operating 25 more depots at the end of the year, 20 in France and its first five depots in the Republic of Ireland. A total of 25 additional overseas depots was not far shy of the increase in the UK count to 30. In 2023, however, it plans to add the same number of new UK and Irish depots (30 and five), but only half as many French ones (10). There should be 20 more in 2024 though.

Howdens is focusing depot openings and marketing spend on Paris, Lyon and Marseille, where custom can grow by word of mouth, but the network is still small and the cost of the roll-out means the French operation is unprofitable. Howdens says it will not spread into additional European countries until it has proved itself by earning positive cashflow in France, so perhaps it is taking a breather while it works that out.

- Listen to our podcast: Susie Dent: The ii Family Money Show

- 10 momentum plays in the UK technology sector

The Irish roll-out, which is supported from the UK, is going very well.

Apart from the roll-outs, Howdens is growing by expanding its ranges, revamping depots to make them more efficient, investing in next day delivery to the depot, and in February 2022 it acquired Sheridans, a modest sized business that makes kitchen worktops.

The company is pragmatic about which kitchen components it makes, and which it buys in, but there is a strong element of vertical integration.

Howdens manufactures all of its own cabinets, has increased its capacity to manufacture cabinet doors, and believes the increased worktop manufacturing capacity Sheridans gives it will allow Howdens Work Surfaces (HWS) to become the market leading worktop supply and fit business.

Since Howdens is the dominant fitted kitchen supplier in the UK, vertical integration seems like a sensible way for it to achieve efficiencies, differentiate the product from smaller competitors, and reduce its dependence on European imports post-Brexit.

While recession could reduce profitability, Howdens’ competitive and financial strength indicates it should thrive over the long-term, especially if it succeeds in France.

Worthwhile for all concerned

By focusing on a single type of customer, Howdens can serve them better, but the company was founded on the principle that this would be “Worthwhile for all concerned”.

The beneficiaries are customers, who get a great service, shareholders, who not only own shares in a business that performs well but also explains itself well, and depot managers (and executives), who earn handsome bonuses if their depots perform strongly.

I think it includes society too. Howdens factories are carbon neutral and send zero waste to landfill (the depots send only 0.3% of waste to landfill). Reducing emissions from suppliers is now a factor in determining executive pay.

A major recruiter of apprentices itself, Howdens also funds construction apprenticeships in small businesses across the UK.

Although Matthew Ingle, the company’s founder and the architect of its strategy, retired in 2018, his successor, Andrew Livingston, has picked up where he left off.

In Livingston’s time at the company, Howdens has introduced digital accounts and an app for customers, refocused the international strategy on France and Ireland, and invested in manufacturing and distribution.

Mr Livingston inherited a business culture and strategy capable of growing itself, and he is developing it to be more digital and international.

Scoring Howdens

I like Howdens. When I read the annual report, the elements cohere. It is the biggest holding in the model Share Sleuth portfolio I manage here on interactive investor.

Does the business make good money? [2]

+ High return on capital

+ Decent cash conversion

+ Good profit margin

What could stop it growing profitably? [2]

+ Strong finances

+ Dominant supplier in UK

? French expansion not yet profitable

How does its strategy address the risks? [2]

+ Avoids drawing on bank facility

+ Vertical integration

+ Measured city-based roll-out in France and Ireland

Will we all benefit? [2]

+ Management building on strengths

? Does not publish employee engagement/turnover stats

+ “Worthwhile for all concerned”

Is the share price low relative to profit? [1]

+ I think so. A share price of 669p values the enterprise at about £4.1 billion, 14 times normalised profit.

A score of 9 out of 9 indicates Howdens is a good long-term investment.

It is ranked 2 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Howdens.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.