Richard Beddard: my savage derating of this popular FTSE 100 share

16th June 2023 14:48

by Richard Beddard from interactive investor

Without a viable strategy, our columnist cannot continue giving this complex company top marks. Here’s why he’s downgraded the third-biggest company in his portfolio.

Is Next (LSE:NXT) a mature business? In its annual report, Next describes this as “the big question”, and answers it. Next has the potential to grow more rapidly, but the transition to online retailing, a pandemic, and the cost-of-living crisis, have made it look like a mature business.

The big question

The company expects to make less profit in the year to January 2024 than it did in 2023 because people are likely to spend less as the cost-of-living increases and the company’s own costs are rising.

- Invest with ii: Share Dealing with ii | Top UK Shares| Cashback Offers

If Next’s forecasts prove correct, it will have increased earnings per share by 5.4% over the previous eight years. That is much slower growth than earlier this century, and only somewhat better than average inflation of 3.5%.

By my calculation, adjusted profit in the year to January 2023 was flat compared to 2016, suggesting that the earnings per share growth has come from financial engineering in the form of share buybacks rather than trading.

Although profit is unchanged over many years and Next’s shops have their familiar timeless facades, the business is in some ways unrecognisable from Next in 2016.

It has gone from selling mostly Next branded products through physical stores and mail order to a mostly online seller of a multitude of brands with a growing international business.

This description risks overstating the change. Next still runs profitable stores in almost all the UK’s major high streets and shopping centres. They mostly sell Next branded products, which on and offline contribute more revenue and even more profit than all other brands combined sold through its website.

Falling retail sales have been a drag on Next’s online growth, while investment in reconfiguring the business and stubbornly high rent and rates have stalled profit growth, but the company says: “As it stands today the Group has far more ideas and opportunities for long term growth than it has had for some time.”

The Next brand remains the company’s top priority, the cash cow that funds newer opportunities. It lists four newer growth opportunities:

- Total Platform, Next’s ecommerce platform for partner retailers

- Investments and acquisitions

- New brands and third-party licences

- Developing the Next brand overseas

Growth can resume, Next says, once, like the pandemic before it, the cost-of-living crisis has passed.

In search of coherence

The first occurrence of the word strategy in the annual report is on page 78, in the principal risks and uncertainties section, where the company is required to link risks to the strategies that address them.

Curiously, the strategic points it links to are not strategy as I think of it, which is to define what a company does and does not do - what makes it special.

Instead, the risks Next addresses relate to how well the nuts and bolts of the business are managed. It must design good products, manage suppliers effectively, operate shops, warehouses and logistics efficiently, invest in IT and warehouse capacity, shut stores that do not make enough money, and maintain its financial strength.

Whatever challenges a retailer faces, and whatever opportunities it thinks it has, it should be doing these things well.

This may come across as nit-picking. Next is not short of ideas and they are explained elsewhere in the annual report. Some of them are very successful. Its growing online business makes more money than the stores. But I think Next’s lack of emphasis on the word strategy is deliberate.

Next’s guiding principle is to try different things, and continue those that generate the required return, a 15% return on invested capital. In other words, it plans to evolve.

- ii view: is management caution at Next a buying opportunity?

- Share Sleuth: why I picked this share out of eight contenders

- Richard Beddard: business is buoyant at one of my favourite companies

One of the company’s mantras is “Change is everyone’s job”, another is “there is no ‘business as usual’”, but embracing change is not a strategy. All companies must adapt to new circumstances to survive. A strategy must tell us how.

If, as the director of a pottery once told me, the strategy is to throw clay at the wall and see what sticks, we cannot know where the business is going or form an opinion on whether it will get there.

The way I form my opinion is to find coherence in strategies. The textbooks are full of examples of how companies develop capabilities that reinforce each other, making the business stronger, and its intertwined capabilities harder to replicate.

In the past, I have found coherence. Next converted its mail order business into an internet business and used its retail stores to support it. Realising it could not compete with the vast choice of fashion on the Internet by itself, it started selling rival brands. To be their most profitable route to market it had to develop efficient infrastructure, which of course was profitable for its own brand too.

Then Next realised it could sell other aspects of the infrastructure as a service to other retailers, allowing them to focus on their product and brands, and Next to put even more volume through its warehouses, process even more returns through its stores, reuse its IT, and handle even more call centre calls. Scale drives efficiency, and again I saw coherence.

But the longer Next evolves, the more thinly it seems to spread itself.

The revelation in this year’s annual report that it is considering wholesaling, franchising, and licensing its brand in far flung territories in Asia and the Americas where it currently does very little business, seems far removed from the vertically integrated platform it has been building.

- The FTSE 100 dividend stocks handing £10bn to shareholders in June

- The Income Investor: buy these unpopular shares for high yield and growth

The service model of Total Platform has evolved too. It is not economic for startups and small businesses, so Next is targeting larger businesses, and taking equity stakes in them.

It has acquired the languishing UK franchises of lingerie brand Victoria’s Secret and fashion brand GAP, and bought stakes in upmarket Reiss, Laura Ashley, and maternity and baby brand JoJo Mamon Bébé. It acquired a 74% stake in cheerily bucolic Joules, after that company went into administration.

On the face of it this is coherent. Plugging these companies into Next’s Total Platform infrastructure may make them more successful and then Next benefits twice, from the fees it charges them and their growing profits. But acquisitions and turnarounds are not one of Next’s core competencies. In starting a new investment division, it is trying to create one.

Experimenting with new concepts is an essential part of strategy, but it cannot replace it and since my approach to investing requires me to score strategy, I cannot continue giving Next top marks when I do not believe it has one.

Creative culture

As initiatives proliferate and the business becomes more complicated, the onus is on management to kill off failed experiments quickly and keep the company focused.

Here, Next scores more highly. Its eminent chief executive, Lord Wolfson, has run the business for over 20 years, and he is one of four executive directors who joined the company as employees more than 25 years ago and were subsequently promoted to the board. This bolsters its claims to have a good track record of promoting from within and engaging employees at every level.

They have created an adaptive culture. That is a good thing. I think that is what Next would say makes it special.

Scoring Next

Scoring Next has been an ordeal this year!

Investors commonly prefer to invest in businesses of a certain size. Some prefer large-caps, big businesses such as Next that are perceived as successful and dependable. Others prefer small-caps because smaller companies have more potential to grow. Investors in mid-caps think they are getting growth and dependability.

I am blind to size. Big companies can grow bigger and small companies can shrink. Next is only the third-biggest company in the portfolio after Garmin Ltd (NYSE:GRMN) and Bunzl (LSE:BNZL), but unlike those two businesses, I am finding it increasingly difficult to see the wood for the trees. Size may not be a problem for me, but complexity is. It can bog down companies, and the investors who try to understand them.

Next is bogging me down, and that has resulted in a savage two-point derating of the strategy score compared to the score I gave it last year.

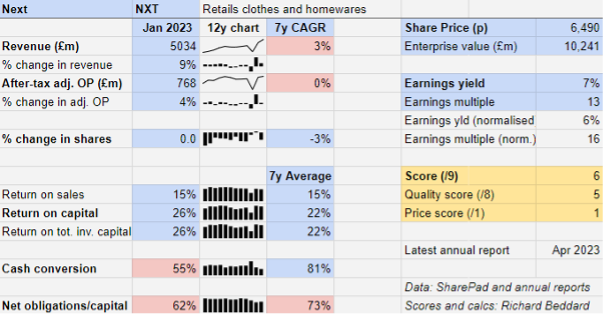

Does the business make good money? [2]

+ High return on capital

+ Good profit margin

+ Decent average cash conversion

What could stop it growing profitably? [1]

? Financial obligations

? Strong competition online

? Complexity

How does its strategy address the risks? [0]

- Evolution is not a strategy

Will we all benefit? [2]

+ Very experienced management

+ Self-reliant culture

? Executive remuneration

Is the share price low relative to profit? [1]

+ A share price of £64.90 values the enterprise at just over £10 billion, about 16 times normalised profit.

A score of 6 out of 9 indicates Next may be a good long-term investment, but my confidence in it has diminished.

It is ranked 33 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Next

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.