Richard Beddard: not an obvious bargain, but a quality package

14th January 2022 14:11

by Richard Beddard from interactive investor

There’s much to be admired about this manufacturing company, but a few things would make it even better, argues our columnist.

To get a long-term perspective on a business, I measure its performance over many years. The number of years depends on the company.

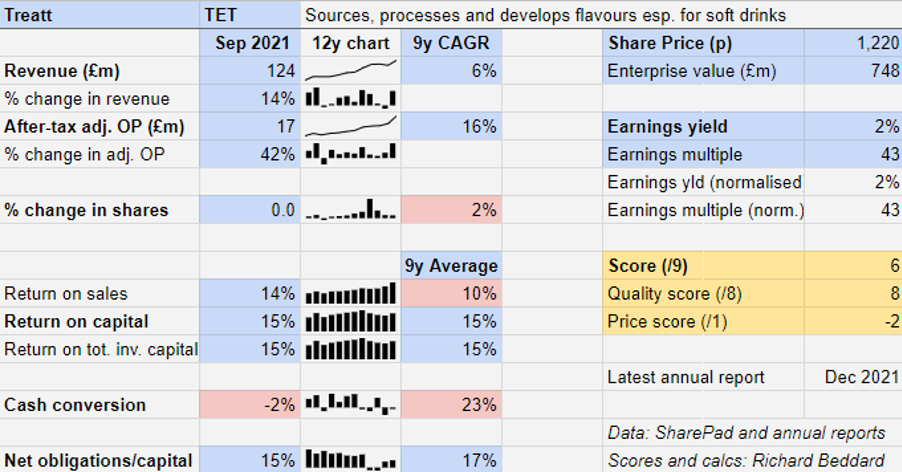

The nine-year period I have chosen for Treatt (LSE:TET) starts with the year to September 2012, one month before Daemmon Reeve became chief executive of the business. Reeve had been promoted under the chairmanship of Tim Jones, who had been appointed earlier the same year.

The new guard favoured a change of strategy, but Jones almost lost his job when a group of shareholders including the former managing director and his family, voted against the chairman’s reappointment at the company’s AGM and won a small majority.

Ultimately, however, the new board prevailed, and Treatt changed tack.

Nine years of progress...

The year to September 2021 will be the last year the three most significant people sitting on that board will run the company together. Reeve and Jones remain chief executive and chairman, but Richard Hope, finance director since 2003, retires in June. The trio can look back on the previous nine years with satisfaction.

Treatt is a supplier of flavours and aromas principally used in drinks. Its largest customers are big businesses, the flavour houses that combine flavours, colours and preservatives into flavour systems for beverage manufacturers such as Coca-Cola and Pepsi, and beverage manufacturers themselves.

As a trader of natural ingredients, principally citrus oils, Treatt had been a perfectly viable business, but it faced challenges. Globalisation was enabling Treatt’s customers to develop direct relationships with growers and cut out traders such as Treatt.

Before Reeve became chief executive, he had run Treatt’s US subsidiary, where the company had developed added value products, using novel methods to extract flavours from the whole fruit, for example. He saw an opportunity to move Treatt up the value chain, by inventing and manufacturing new and more flavoursome natural ingredients, from which it could earn more profit.

- Five AIM share tips for 2022\

- Like AIM and small-company shares? Check out ii’s Super 60 recommended funds

- AIM: new floats aplenty in 2021, and more to come in 2022

With more than a century of experience trading citrus oils, Treatt was in a good position to meet consumer demand for natural ingredients. It focused on improving its citrus flavours and developing novel flavours for drinks, a market that is experiencing sustained innovation as consumer tastes change.

While Treatt still earns the bulk of its revenue from citrus products (43% in 2021), these are more refined, and Treatt is developing a broad range of other flavours. Some are designed to make low-sugar drinks taste more authentic, and others flavour iced tea, cold brew coffee or canned alcoholic drinks (alcopops). All are beverages that are growing in popularity in Treatt’s biggest market by far, the US (where it earns 43% of revenue). Today these products earn the company 38% of revenue. The remaining 19% of revenue comes from synthetic ingredients distributed by Treatt.

We will never know how Treatt would have performed had the boardroom struggle in 2012 ended differently. But we do know how it has performed as a result of the strategy executed since then.

The company has reported record results for the year to December 2021, and it has started to move into a new headquarters with modern laboratories and automated manufacturing capacity that should underpin its ambitions for perhaps a generation.

Treatt has grown revenue at a compound annual growth rate (CAGR) of 6% and adjusted profit at a CAGR of 16% since 2012.

Pink flags

There are a few red flags in Treatt’s financial record, but they all relate to the investment it is making to become a science-led manufacturer of ingredients.

Investment in completely new facilities in the UK and upgraded and expanded facilities in the US means the company has consumed capital in pursuit of growth. Some of this was raised from investors in 2018, requiring Treatt to issue more shares.

An average profit margin of 10% shows Treatt adds value because it can charge significantly more than the cost of supplying the ingredients, but on this basis the company is not exceptionally profitable. Profit margins have steadily risen to 14% in 2021, though, so we can probably expect higher profit margins in future. Treatt reports that 82% of revenue comes from “value added” ingredients in 2021, compared to 56% in 2012.

Because of the heavy investment, return on capital has not increased, although it is a healthy 15%, in line with the long-term average. It is reasonable to expect that a fully invested and more efficient Treatt will be able to improve return on capital in future.

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

- Watch our new year share tips here and subscribe to the ii YouTube channel for free

The woeful level of cash conversion is also explained by investment, and this too should improve as capital expenditure normalises once the new facilities are operating fully in 2023.

While it is tempting to give the three main protagonists in this tale all the credit, they would not do that themselves. To make these changes they needed to mobilise everybody at Treatt. Five years ago, Reeve told an audience of local businesspeople at the Suffolk Chamber of Commerce: “If you concentrate on the numbers in the business, nothing changes. If you focus on the people, everything changes.”

Treatt gives its staff free shares, favours internal candidates for jobs, fosters interesting science-led careers, and thanks to its new headquarters is about to give them great facilities to work in. Its aim is to cultivate an emotional attachment to the firm, and if you have read this article closely you will probably have realised that this strategy extends beyond employees.

All Treatt’s top 10 customers have been customers for more than a decade, and investors, including me, can be captivated by the story, and the numbers too.

Scoring Treatt

Evidence that I am not the only investor to be a fan comes from its share price, which is £12.20. It values the enterprise at about 43 times adjusted profit, and implies shareholders expect Treatt to grow substantially.

This year, the board is proposing to award Reeve a handsome rise in remuneration. It is impossible to determine exactly how handsome the pay rise is, because so much of the package is performance-related and the performance conditions are loosely defined.

What about the structure of the remuneration package? A basic salary of £435,000 in 2023, up to 125% in cash bonus, and up to 150% in free shares, is not atypical of listed companies, and given everything I have said about Treatt’s development it is churlish not to recognise Reeve’s ongoing importance to the business.

- Bull and bear points for major equity markets at start of 2022

- Share Sleuth: here’s how the portfolio could change in 2022

But it disappoints me that Treatt, a company that has developed a singular culture, has been unoriginal in adopting widespread remuneration policies that obscure how much directors are paid and fuel excessive pay. Treatt is, of course, looking for a new chief financial officer, who may well expect similar remuneration.

One of the innovations meant to shine a light on executive pay is a comparison of chief executive remuneration with the remuneration of UK staff. This comparison is only mandatory for listed companies with more than 250 employees in the UK, and the chart does not appear in Treatt’s annual report.

I think a company that in so many ways does the right thing should include this comparison, even if it is not required to.

Does the business make good money? [2]

+ Consistently high return on capital should improve

+ Decent profit margins are already improving

? Poor cash flow should improve when investment normalises

What could stop it growing profitably? [2]

+ Strong finances

+ Commodity citrus oil prices are cyclical, but of less significance

? Customers are big, and some of them (the flavour houses) are competitors as well

How does its strategy address the risks? [2]

ᐩ Develops innovative processes and flavours

ᐩ Investment in facilities and customer relationships

ᐩ Sells direct to customers as well as through intermediaries

Will we all benefit? [2]

+ Experienced management

+ Employee first culture

? Executive remuneration

Is the share price low relative to profit? [-2]

− No, a share price of £12.20 values the enterprise at about 43 times adjusted profit.

A score of 6 out of 9 suggests Treatt is probably a good long-term investment, but the share price means it is by no means an obvious bargain.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Treatt.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.