Richard Beddard: ownership uncertainties, but still an impressive business

12th November 2021 16:19

by Richard Beddard from interactive investor

Our columnist is relieved this champion manufacturer couldn’t find a buyer, but suspects it’s only a matter of time.

Good, if somewhat old news. Renishaw (LSE:RSW), a champion British engineering company, put itself up for sale earlier in the year, but announced it could not find a buyer in July.

That means we can still invest in it.

Renishaw makes tools incorporated in machines and production lines, making manufacturing more precise and productive.

A smaller part of the business makes analytical instruments and medical devices, such as surgical robots and 3D printers configured for the volume production of dental structures including bridges, crowns and dentures. Now profitable, this division has a high proportion of products in the early stages of commercialisation.

Manufacturing technology is Renishaw’s meat and drink, though. It brought in 93% of revenue and 95% of profit in the year to June 2021. These tools are demanded in increasing numbers, due to the high precision of modern manufacturing and a shortage of skilled workers.

This trend is driving automation, which is facilitated by Renishaw’s probes and gauges, tools that measure components as they are being machined or transitioning from one stage of manufacturing to another. It also increases demand for encoders that measure the position of machine tools and robots. Knowing their position is an essential aspect of controlling their motion.

Sale scuppered

Potential buyers reportedly baulked at the asking price, and at some of the strings that would be attached as the company strove to satisfy all stakeholders. Renishaw, which is controlled by its founders, Sir David McMurtry and John Deere, wanted its new owner to respect its near 50-year commitment to research and development, its culture, and the loyalty of staff, customers, suppliers and the communities it operates in.

These are exactly the criteria I look for when scoring companies for fairness, but I and other long-term investors might not be able to profit from Renishaw’s enlightened policies if it were sold off.

Acquisitions are a routine activity on the stock market, but to my mind one of the attractions of Renishaw was the founders’ commitment to independence. The prospect of a sale has receded, but the luxury of the founders’ protection can no longer be taken for granted.

They say they have no plans to sell their shares for the foreseeable future, but both men are in their 80s, so their definition of foreseeable may not be as far in the future as ours. Beyond that, they are promising an “orderly process”.

Renishaw recovering

A cynic might also connect Renishaw’s desire to find a buyer with its dramatic improvement in performance. The notion that it might cut costs, boost profit and attract keener buyers is blasphemous, though, considering its historical commitment to the long-term.

A recovery in most of its markets was the major factor in the upturn in performance, and although it did cut costs, this was probably a course correction to help the company navigate the pandemic profitably and come out leaner.

Many of Renishaw’s big customers are semiconductor and consumer electronics manufacturers in Asia, and once their factories reopened they boomed due to an increase in demand for products such as games consoles and laptops from populations cooped up at home.

- Your vote counts: Wetherspoons among firms facing shareholder revolt

- ii COP26 hub: see tips, news, comment and analysis from our experts

- Get £100 cashback when you switch to an ii ISA in November. Terms apply

Renishaw has high fixed costs, a huge factory and research and development facility, and sales offices dotted around the world, so we should expect an increase in revenue to produce a proportionately greater increase in profit.

But profit was also boosted by rationalisation, and in particular the streamlining of Renishaw’s Additive Manufacturing (3D Printing) business, in 2020.

In 2021, its copious spending on research and development fell as it focused on ‘flagship’ products – those that will earn revenue fastest and those of the highest strategic importance. The Additive Manufacturing business is concentrating on customers of its RenAM 500Q platform, for example, which is designed for volume production. That is potentially a big market.

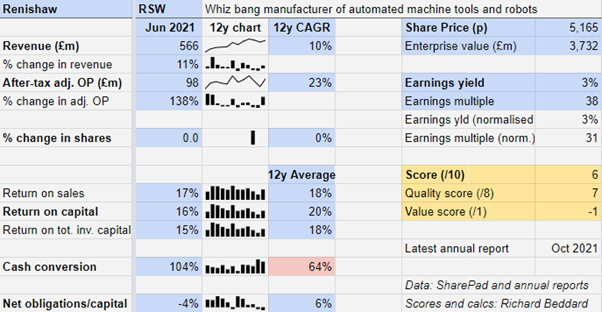

Revenue increased by 11% (13% in constant currency) and adjusted profit increased by 138%. For the second year running, cash conversion was greater than 100% and the company had more cash than debt and other financial obligations.

Renishaw’s admittedly short order book in October was at record levels, and it should be able to fulfill the orders. The company says it is coping well with supply shortages. A 16% return on capital is still below its illustrious average though, probably because some big customers, in aerospace particularly, are still in recession.

Meanwhile, due to Renishaw’s new focus, research and development spending fell from 13% to just over 10% of revenue. In 2019, research and development spending was 18% of revenue.

Ten per cent is still an impressive commitment to innovation, but since constant invention is one of the cornerstones of Renishaw’s strategy, this decline is a trend that hopefully should stabilise or reverse in 2022.

Strategic shimmy

The pandemic has resulted in a strategic rethink. As well as the focus on flagship products, Renishaw says it is reviewing its sales network.

The company is vertically integrated. It manufactures products using its own tools and sells them through a network of 79 offices in 37 countries.

This network contributes to Renishaw’s fixed cost base, which had the opposite effect on the company’s results in 2020 to the turbo-charging of profit in 2021, causing profit to plunge much further than revenue.

Renishaw says it is working with third parties to streamline the sales network. I am not sure what that means. The company has not said it plans to close any sales offices, but it may be increasing the amount of selling it does through distributors rather than directly to the end customer.

- Jeff Prestridge: 25 good reasons to buy the UK stock market

- Stockwatch: winter Covid fears cast shadow over this pair

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Integrating tools into the manufacturing process is complex, and customers often need support before parting with their money, so a step back might be concerning.

But Renishaw puts heavy emphasis on the importance of sales and engineering support in its annual report, so, sticking to the course correction narrative, it is probably just planning to make use of distributors where that makes sense.

Scoring Renishaw

Renishaw has always been an acquired taste.

Profit growth comes in giant leaps followed by painful contractions due to the company’s high fixed costs, and the fact that many of its customers and manufacturing partners supply cyclical markets. Uncertainty about its ownership and strategic shimmies add to shareholders' doubts.

But for investors prepared to look through the cycles it is an expert in metrology (measurement), constantly bringing advanced patented products to market, commercialising promising technologies in more stable markets like science and healthcare, and earning impressive returns.

Does the business make good money? [2]

+ High average return on capital

+ High average profit margins

? Cash flow improving, but partly due to reduced investment

What could stop it growing profitably? [1]

+ Strong finances underwrite resilience and investment

+ Technically advanced products are differentiated from competitors’

− Capricious markets

How does its strategy address the risks? [2]

+ High spending on research and development

+ Vertical integration brings it closer to customers (at a cost)

+ Scientific and medical products are less cyclical and may make a bigger contribution in future

Will we all benefit? [2]

+ Long-term commitment to staff, customers and community

+ Very experienced directors, chief executive Will Lee joined graduate scheme in 1996

? Continuing uncertainty about future ownership of business

Is the share price low relative to profit? [-1]

− No. A share price of nearly £52 values the enterprise at £3.7 billion, 31 times normalised profit.

A score of 6 out of 9 means Renishaw probably is a good long-term investment. My Decision Engine ranks it 23 out of the 40 shares I follow.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Renishaw.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.