Richard Beddard: price drop offers chance to own this small-cap

The shares are rarely cheap, but price weakness pushes this stock up the Decision Engine’s ranks.

9th April 2021 19:36

by Richard Beddard from interactive investor

The shares are rarely cheap, but price weakness pushes this stock up the Decision Engine’s ranks.

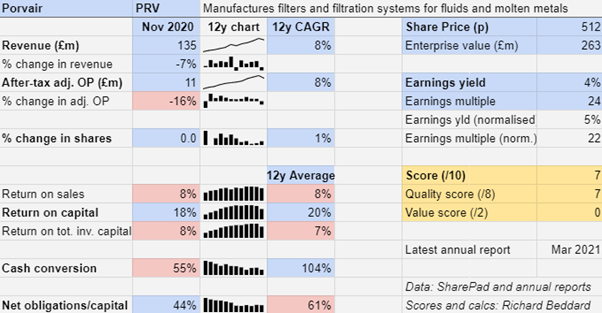

I have written about Porvair (LSE:PRV) every year for many years, but never added it to the Share Sleuth portfolio. It is a good gaggle of businesses, but the share price has been hard to swallow.

The pandemic may be changing that.

Porvair manufactures filters that protect expensive equipment or the environment from impurities. They remove contaminants from molten metal in foundries, they remove petrochemicals from ballast released into the sea by ships, and they keep the oil in aircraft hydraulic systems clean. They reduce downtime and maintenance costs and reduce pollution.

The filters are consumables, and must be replaced in accordance with mandatory maintenance schedules or, for example in water and metal filtration, whenever the filter is used. This gives Porvair a reliable source of repeat business.

- Read more of Richard Beddard's articles and his Decision Engine here

- Discover our Terry Smith interview here

- Your chance to win £1,000: take part in the Great British Retirement Survey

Porvair also supplies laboratory equipment, principally for analysing water quality. After the year-end it shuffled Kbiosystems into its deck of businesses.

Kbiosystems makes automated microplate handling equipment. The microplates, which Porvair subsidiaries also supply, are flat plates with many small wells, used as mini-test tubes. Naturally, Porvair supplies porous plastic water filters too and it has been acquiring and developing robotic automation capabilities for some years.

A tale of three divisions

A 16% decline in adjusted operating profit from a 7% decline in revenue sounds reasonably robust during a pandemic, but revenue in the year to November 2019 was augmented by the acquisition of a Dutch supplier of filtration products and services to the oil and gas industry in September 2019.

Royal Dahlman contributed £11.3 million to revenue in the year to November 2020 compared to £2.5 million the previous financial year and Porvair says it traded well. Underlying revenue declined 13%.

The company says it competes on technical differentiation not price. Profit margins of 8%, on the other hand, suggest some pricing power, but not a lot. This figure, though, hides a wide variation in profitability.

Selee, a large subsidiary, earns the lowest profit margins. It is the biggest supplier of porous ceramic filters to aluminium cast houses, and demand is sensitive to the US auto industry and other cyclical customers.

In 2020, revenue fell 15% at Porvair’s Metal Melt Quality division, which incorporates Selee, but unlike during the Great Financial Crisis, profits held up and the division contributed 18% of Porvair’s total profit from 24% of its revenue.

Unsurprisingly perhaps, it was the company’s largest division, Aerospace and Industrial, that suffered most during the pandemic, particularly the aerospace bit due to an 85% reduction in global flying hours and a 30% reduction in aircraft production in 2020. The company shed 21% of the workforce from this division, and its adjusted profit fell 26%, contributing 40% of Porvair’s profit from 45% of its revenue (after adjusting profit to exclude the cost of redundancies and reconfiguring plants).

Source: Porvair

Even though water testing laboratories closed in the early days of the pandemic, the Laboratories division did best as laboratory supplies were in high demand due to Covid-19. Overall, revenue shrank slightly and profit increased marginally, contributing 43% of profit from 32% of revenue.

At 55% of adjusted profit, operating cash flow minus capital expenditure was well below Porvair’s 12-year average cash conversion ratio of 104% and the trend is downwards. The average cash conversion ratio in the second half of that period, the last six years, was 76%.

We do not need to be alarmed though, 76% is a decent average for a company that is investing, and capital expenditure has been substantially higher in recent years. Operating cash flow was reduced in 2020 due to working capital movements and bigger contributions to plug the deficit in a modest defined benefit pension scheme.

- Open an ISA with interactive investor. Simply click here to find out how.

- Six things you must do before buying any share

- Golden rules for ISA investors: before you invest, pass these tests

Porvair’s acquisitive strategy has achieved an 8% compound annual growth in revenue and profit over the last 12 years, and reassuringly this has been sustained from the company’s own resources and a level of debt that has reduced in relation to operating capital.

However, Porvair is only earning an 8% after tax return on total invested capital (including the value of acquisitions at cost), which suggests it is paying a high price for acquisitions, presumably in the expectation of higher returns in future.

Scoring Porvair

Clearly, parts of Porvair are vulnerable to recession, but the group as a whole has remained profitable through two crises now, a financial one, and a public health one. That’s because it supplies diverse markets with vital components that keep equipment operating as well as more variable demand from manufactures of new planes and cars, for example.

That said, the company believes the aerospace market will take some time to recover and its outlook remains unpredictable.

Does the business make good money? [2]

+ High return on capital

? Profit margins indicate some pricing power

? Cash conversion not as strong as it used to be

What could stop it growing profitably? [1]

+ Proven strategy over nearly two decades

? Industrial markets are capricious

? Long-term demand in some markets may be reduced by the adoption of cleaner technologies

How does its strategy address the risks? [2]

+ Manufactures bespoke, differentiated, sometimes patented consumables

+ They are designed into systems, requiring periodical replacement

? Acquisition strategy brings new niches, but it is pricey

Will we all benefit? [2]

+ Chief executive Ben Stocks has guided Porvair since 1998

+ He owns 1.5% of the company

+ Porvair responds to investor queries and explains itself well

Is the share price low relative to profit? [0]

? No. But it is not high either. A share price of 512p values the enterprise at £263 million, about 22 times normalised and adjusted profit

My annual appraisal has come at a good time. Price weakness means Porvair has risen up the Decision Engine’s ranks. A score of 7 out of 9 suggests it probably is a good long-term investment.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.