Richard Beddard: a top 10 stock that’s under-priced

23rd September 2022 14:41

by Richard Beddard from interactive investor

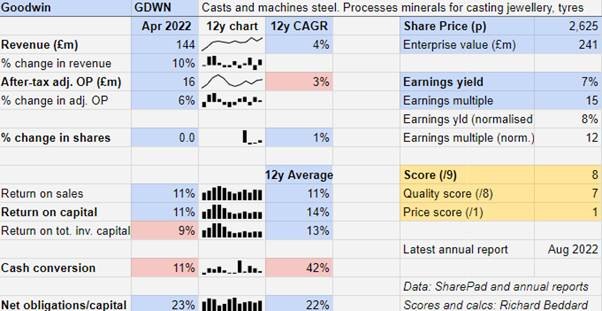

There is an element of belief required to buy into the Goodwin story, admits our columnist, but the business is firing on all cylinders, and he doesn’t think the share price adequately values its endeavour.

Goodwin (LSE:GDWN) is a jam tomorrow company, but it is my kind of jam tomorrow.

Outwardly a dowdy steelmaker, inwardly an innovator, Goodwin makes enough money today to fund investments that may deliver significantly higher returns in the not-too-distant future.

- Read about: Free regular investing | Opening a Stocks & Shares ISA | Cashback Offers

Coping with the energy crisis

Making steel and minerals, Goodwin’s meat and drink, are energy intensive industries. The company contended with £3.8 million in additional energy costs in the year to April 2022, and extreme volatility in nickel and iron prices rendered the variation clauses in the company’s long-term contracts totally ineffective.

Across the board, though, Goodwin says it has successfully renegotiated problematic contracts and demonstrated it is a critical supplier.

Despite these headwinds, Goodwin achieved a 10% increase in revenue and a 6% increase in profit.

Although profitability is subdued compared to the levels achieved nearly a decade ago, the only red flag in the numbers is cash conversion.

Goodwin’s cash inflows in the year to April 2022 were only 11% of adjusted profit. The difference is mostly capital expenditure, an immediate cash cost that is charged against profit bit-by-bit over many years.

The investment has been required to increase Goodwin’s capacity so the company’s foundry can deliver large contracts a long time in the making.

The profit pivot

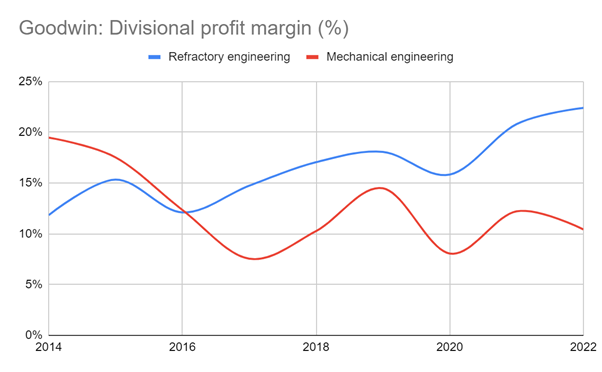

Goodwin has two divisions, Mechanical Engineering, concerned with casting and machining large, specialised steel products for heavy industry, and Refractory Engineering, a business that quarries and manufactures mineral products.

Mechanical Engineering, a decade ago the bigger and much more profitable division, is in transition. It was dependent on revenue from the sale of valves and other products used in oil and gas pipelines, which has contracted.

Slowly, though, the company has enlarged the foundry so it can cast at larger sizes. It has secured accreditations, and won multi-decade contracts to supply the nuclear decommissioning and defence industries.

This year’s annual report highlights a £44 million contract to manufacture 80 spent nuclear fuel can racks (a storage container system) for Sellafield nuclear power station, and possibly a multiple of that number, by 2026.

Manufacturing has started but it will take time to ramp up production because the company’s processes and output are being documented and approved.

Because the amount of work going through the foundry is lower than it used to be, but capacity has risen, Goodwin’s foundry, Goodwin Steel Castings, has been losing money for some time.

In 2021, the company’s accounts showed Goodwin Steel Castings lost £3.5 million, which reduced the division’s total profit to £11 million. Given lower profits from the mechanical engineering division in 2022, the foundry probably lost money in the most recent financial year too (Goodwin Steel Castings’ accounts have yet to be filed at Companies House).

The expectation is that high volumes of new business will return the foundry to profitability, and that will mean more work for the division’s profitable machining business, Goodwin International, too.

Goodwin says: “the next few years should see the Mechanical Engineering Division returning to its former glory with even higher levels of turnover than at the peak of the oil and gas industry in 2014.”

Also inside this division, the company has refocused another business, Easat, which makes radar systems for air traffic control.

During the pandemic, airports have not been investing, which stymied the introduction of a new range of turnkey radar systems. Now the pandemic has abated and flying resumed interest has increased and Goodwin expects in a year or so’s time “there will be workload, the likes of which readers of their [Easat’s] accounts for the past thirty years have never seen.”

While the Mechanical Engineering is making this pivot, the growing profitability of Goodwin’s other division: Refractory Engineering, has kept the group’s numbers respectable.

Source: Goodwin annual reports.

Goodwin Refractory Services manufactures minerals used to cast jewellery and car tyres. Hoben International makes perlite, a mineral used in construction and horticulture. A third company, Dupré Minerals, manufactures vermiculite, a mineral used in insulation, brake linings, fire extinguishers and fire-resistant textiles.

In 2022, Refractory Engineering benefited from a resurgence in construction and rapid growth in new products including AVD, a lithium fire extinguishing agent.

Although Mechanical Engineering remains the biggest division by sales, in 2022, for the first time, Refractory Engineering earned more profit.

The future: decarbonised and plasticised

With one division firing on all cylinders, and the other apparently poised to, writing in the annual report chairman Tim Goodwin is openly bullish.

He says Goodwin will benefit from hedged fuel costs in the year to 2024 and, longer term, having capped the interest cost of £30 million of debt at less than 1% for 10 years, the company is forging ahead with investment.

A £10 million fund earmarked for investment in green energy is beginning the process of decarbonising Goodwin, initially by installing solar panels at each of its facilities, a project that, thanks to the surge in energy prices, will pay back the original investment in one-and-a-half to three years.

Goodwin is increasing capacity at Hoben International, which needs to accommodate growth and restore some redundancy. Despite the heavy investment of recent years, the company is also adding more casting pit space at Goodwin Steel Castings.

The final investment priority is a blue-sky project, Duvelco, a completely new business that will manufacture a polymer resin that can be moulded into parts that withstand very high temperatures.

Goodwin says it has developed a thermoset polymer and process (patent pending) that performs better than the leading product in a market bigger than any Goodwin has supplied before. It expects the first plant to be operational early in 2024 at a cost of £12.5 million. The plant will produce up to £40 million of polymer a year.

Developing the product and building the plant is one thing, but Goodwin is going up against heavyweight incumbents including DuPont, Saint Gobain and Victrex.

Customers will need to be convinced the product is better or cheaper or both.

Scoring Goodwin

There is an element of belief required to buy into the Goodwin story.

The company talked about contracts ramping up in the 2021 annual report, but they were delayed by the pandemic. It is saying the same thing with more conviction about the new spent nuclear fuel container contract.

But I think these orders will come.

They are contracted, and Goodwin’s heavy investment and the fact that customers have few alternatives binds both parties together.

Only a handful of foundries worldwide can cast super-alloys in sizes that Goodwin can, and even fewer have export licences enabling them to supply US firms in sensitive industries.

- Insider: ex-easyJet chief builds stake in two big companies

- 10 AIM shares with eye-catching yields for dividend investors

The company’s self-sufficiency goes beyond the integration of the businesses it operates, for example the company says it is weathering labour shortages because relatively few employees leave, while its apprentice school continues “to feed the Group’s requirements with eager engineers.”

While it must be difficult to run so many businesses, the fact that Goodwin’s two established divisions are closely integrated and have separate representation on the group’s experienced board, probably mitigates the risk.

The board’s chairman and two managing directors, one for each division, are Goodwins, the sixth generation of the founding family that has a controlling share.

Because the Goodwin family owns just over 50% of the shares the company is not widely followed by the financial institutions. Its heritage hides a youthful and inventive company.

No doubt I have been influenced by the untempered confidence of the chairman, but I do not think the share price adequately values Goodwin’s endeavour.

Does the business make good money? [1]

- Decent return on capital

- Decent profit margins

- Dire cash conversion (cash soaked up by investment)

What could stop it growing profitably? [2]

- Recession risk reduced by long-term military and nuclear contracts

- Rare set of capabilities limits competition

- Complexity is mitigated integration and large experienced board

How does its strategy address the risks? [2]

- Innovation

- Vertical integration

- International diversification

Will we all benefit? [2]

- Long-term stewardship of Goodwin family

- Employee training and retention

- Decarbonising

Is the share price low relative to profit? [1]

- Yes. A share price of £26.25 values the enterprise at about £241 million, about 12 times normalised profit.

A score of 8 out of 9 means Goodwin is probably a good long-term investment.

It is ranked 6 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Goodwin

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.