Richard Beddard: this very reasonably priced tortoise is in my top three

27th January 2023 14:10

by Richard Beddard from interactive investor

It’s a conservatively run business and not very exciting, but everyone knows how the fable ends. Our columnist explains his thinking on this small-cap share.

Dewhurst Group (LSE:DWHT) had more to grapple with in the year to September 2022 than the shortages and inflation experienced by most manufacturers and distributors. Its IT systems were taken down by a cyber-attack.

- Invest with ii: Top UK Shares | Free Regular Investing | Open an investment Account

Lift components, bollards, and keypads

Dewhurst manufactures and distributes lift components and fits out lift interiors. During the year, it supplied pushbuttons and lift position indicators for the new Elizabeth Line, and lift doors and entrances for Chevron’s headquarters in Perth, Australia, as well as more mundane lift installation, maintenance and refurbishment projects, mostly in Australia, North America and the UK.

It operates two smaller businesses - Traffic Management Products (TMP) which makes bollards and other furniture for roads and cyclepaths, and Dewhurst Hungary that makes Automatic Teller Machine (ATM) keypads.

Based on their past performance, neither TMP nor Dewhurst Hungary, niche businesses that together accounted for 16% of revenue in 2022, could be described as growth businesses. The declining use of cash for payments is reducing the need for ATMs, although keypad demand is temporarily rising from extreme lows experienced because of pandemic lockdowns.

- Richard Beddard's six value share tips for 2023 – and beyond

- Richard Beddard: why I remain a believer in this small-cap share

TMP is dependent on local authority and highway authority schemes to improve roads and paths.

The company’s growth engine is a bevy of businesses supplying and installing lift components, an industry Dewhurst has been in for over 100 years. The problem is, right now it is not growing...

Revenue flatlining

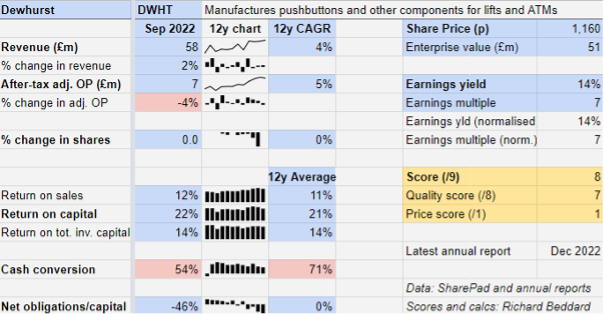

Dewhurst grew revenue 2% in the year to September 2022, but profit fell 4% before the exceptional cost of righting the company’s IT systems. This year, with demand buoyant in North America but easing in Australia, and recession anticipated in the UK, Dewhurst expects sales to be flat.

I had hoped Dewhurst’s cash conversion would improve in 2022 after a period of relative weakness due to investment in a new factory at Dupar, the company’s North American manufacturing operation located in Ontario. But at 54%, cash conversion was weaker than normal. It was reduced by the cost of the cyber-attack, an increase in receivables, an increase in inventories, and the usual payments into Dewhurst’s pension scheme to reduce a deficit.

The news here is mostly benign. Costs relating to the cyber-attack are one-off costs that I have ignored in calculating profit but are included in cash flow. Most of the increase in receivables (money owed by customers) was due to a strong increase in sales in the US near the year-end. Some of it was due to customers taking longer to pay, and Dewhurst taking longer to collect payment due to the lingering impact of the cyber attack.

Reasonably, the company increased stocks of components and raw materials to provide a buffer against shortages and to lock in relatively low prices while they were rising sharply.

Profit growth is a conundrum, though.

- Stockwatch: the yield curve and what it tells us about the stock market

- Six speculative share ideas for 2023

For such a consistently profitable company, Dewhurst’s compound annual profit growth over the last 12 years is a modest 5%. The dividend yield is a little over 1%. Growth and dividends are the two ways a business rewards shareholders, and 6% seems scant.

One reason for weak growth is that the measurement period ends with a down year. Economic conditions were mixed, and although the company’s actions mitigated some of the inflation in component prices, Dewhurst chose not to raise prices sufficiently to preserve profitability. Hiking prices, it says, would have alienated customers.

Dewhurst has also hoarded some of the cash it has earned. It had accumulated £22 million by the year end, equivalent to three years of profit. The company had no bank borrowings and only about £4.5 million of other financial obligations (lease liabilities).

Cash is investment forgone, although it has provided security during difficult times, and gives the company the option to increase returns to investors in future, either by paying a higher dividend, or more likely given Dewhurst’s history, through acquisitions.

Dewhurst’s attachment to the no-growth lift and transport niches is also dragging on growth, and since we do not know how profitable the individual segments are, it is impossible to form a judgement on whether the company is right to persist with them.

It has been prepared to cut loose businesses that were not growing profitably before, though, so perhaps bollards and keypads pay their own way.

Shutting the stable door...

Dewhurst’s risk report reads like a technological dystopia.

Top of the list of risks is cyber attack, but adding it this year is like shutting the stable door after the horse has bolted. The attack in May 2022 forced Dewhurst to revert to manual systems for a month while it brought in specialists to restore its IT systems, which cost £1.5 million. Since the company is more vigilant now, cyber attackers may be deterred and should inflict less damage in future.

Dewhurst also flags technological change as a principal risk. It made its name in pushbuttons, but the way we interact with lifts is changing. Pushbuttons still have a place in lifts, they are resistant to vandalism for example, can be used by the blind, and are perhaps the simplest and most widely understood interface. But touchscreens are increasingly commonplace, and innovation will continue as ways of communicating with machines, like voice and gestures, proliferate.

Dewhurst has covered these developments by becoming an assembler of systems like car operating panels that contain bought in components as well as Dewhurst’s own. It also manufactures a wider range of fixtures, like lanterns.

The acquisition of A&A, a distributor, in 2018, makes Dewhurst even less dependent on specific technologies, as does the acquisition of businesses in Australia that use these components to design and instal lift interiors.

One risk is as old as they come, but Dewhurst’s record shows it is adept at dealing with it. Levels of activity in the construction market fluctuate markedly, but Dewhurst’s profitability is shielded by the more steady repair and maintenance projects it supplies, and by the fact that it is fairly evenly dependent on its three big markets, each of which tends to fluctuate to its own rhythm.

Changing the guard

If it were not for the cyber attack, the biggest news in this year’s annual report would have been the changing of the guard. Last year Richard Dewhurst, the former executive chairman became a non-executive. Then his brother David Dewhurst stepped down as managing director of more than 30 years.

Since October 2022, John Bailey, the former managing director of A&A, and a Dewhurst board member since A&A was acquired in 2018, has been chief executive.

The Dewhurst family, who have a controlling shareholding, have had a good look at Mr Bailey who had been running A&A, a customer of Dewhurst, since 2008.

Scoring Dewhurst

Though I expect growth to pick up again, unheralded Dewhurst is unlikely to set the world alight. It is a conservatively run business that eschews debt as a matter of policy and invests for the long-term.

It is a tortoise, not a hare, but it is a very reasonably priced tortoise, and we know how the fable ends...

Does the business make good money? [2]

+ Good returns on capital

+ Decent profit margin

? Cash conversion could be stronger

What could stop it growing profitably? [1]

+ Strong finances

? Technological change

? Prospects for office space and business travel

How does its strategy address the risks? [2]

? Innovation

+ Geographic diversification

+ Product diversification

Will we all benefit? [2]

+ Experienced management

+ Restrained executive pay

? Annual report could disclose more on segments

Is the share price low relative to profit? [1]

+ Yes. A share price of £11.60 values the enterprise at about £51 million, about 7 times normalised profit.

A score of 8 out of 9 indicates Dewhurst is a good long-term investment.

It is ranked 3 out of 40 stocks by my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Dewhurst.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.