10 quality shares for contrarian investors

25th January 2023 13:57

by Ben Hobson from interactive investor

Given the cost-of-living crisis, many investors have shunned the retail sector, but stock screen expert Ben Hobson highlights those that could thrive as the economy recovers.

With consumer spending under huge pressure over the past year, it’s no surprise that investors have been spooked out of the retail sector.

But with a number of firms recently reporting better-than-expected trading, could the early winners in an economic recovery already be showing up?

- Invest with ii: Share Dealing with ii | Open a Stocks & Shares ISA | Our Investment Accounts

And after years when online-only retail seemed like the only game in town, are traditional bricks and mortar firms finally finding a way of out-competing the internet? This week’s screen for bombed-out quality retailers suggests they might be.

Hard times on the high street?

Flick through the post-Christmas trading updates from some of Britain’s best-known retailers, and it’s hard to escape the scale of the challenges facing the high street.

Double-digit inflation and rising interest rates are causing a major squeeze on household finances. Throw in fears of recession, rising input costs, supply chain disruption, staff shortages and postal strikes...and you can see why, on paper at least, it’s a sector you might want to avoid.

Yet the story in a number of those recent updates is that some shop chains are doing surprisingly well.

Whisper it, but the narrative of recent years that online-only retail would inevitably eat the high street has gone quiet. For now at least, it’s the established household names that seem to be weathering this storm better than most.

A dramatic three years for retail

Like many sectors, UK retail has had a roller coaster three years. In 2020, high street stores were one of the obvious early casualties of Covid restrictions. According to the Centre for Retail Research, 54 firms failed that year, affecting more than 109,000 employees. That compares to an average failure rate of 39 each year since 2007.

- Investors are buying up these retail stocks

- Six speculative UK share ideas for 2023

- 2023 Investment Outlook: stock tips, forecasts, predictions and tax changes

Failures fell to just 19 in 2021, helped in part by emergency government loans. But some well-known names left the high street for good. Much of the bankrupt Arcadia group and Debenhams were acquired by online fast-fashion retailers, Boohoo Group (LSE:BOO) and ASOS (LSE:ASC).

Last year, failures jumped back to 49, which included stricken quoted companies such as Joules, Eve Sleep, Made.com and McColl’s Retail.

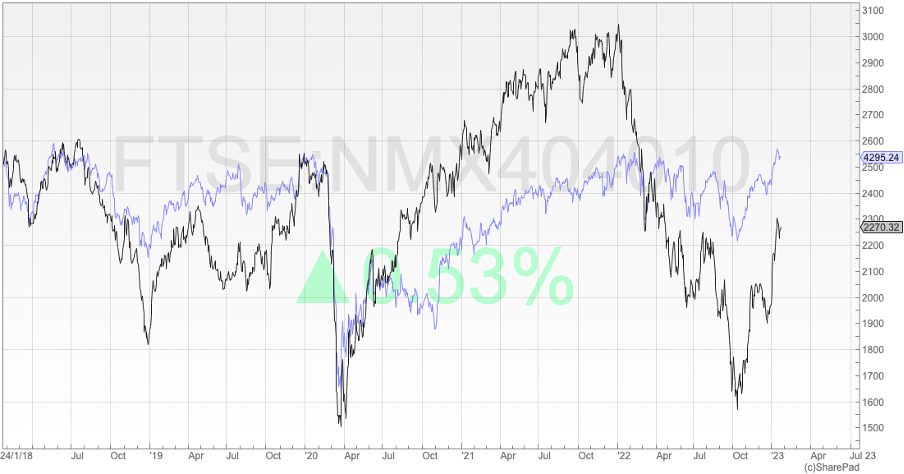

From an investor perspective, the story of the high street in recent years can be seen in the performance of the FTSE 350 Retail index. It soared against the main FTSE 350 in 2020 and 2021 and then collapsed last year:

SharePad: Five-year chart showing the FTSE 350 index (purple line) versus the FTSE 350 Retail Index (black line)

One of the features of that chart is that retail shares seemed to turn a corner in the fourth quarter of last year, and that momentum has continued into 2023.

But with so many mixed signals, it is still very much contrarian territory. Recent economic forecasts have hinted at the early signs of a recovery, but many of these firms are being very cautious about the future - because they simply don’t know.

For investors, it’s worth being cautious too. Retail is a sector that recovers quicker than most when the market begins to price-in rosier economic conditions. But a lot can still go wrong.

Here are some screening ideas worth considering:

- Five-year average operating margins greater than 5% - Recent turmoil has put profit margins under pressure, so looking at medium-term trends makes sense. Five per cent is relatively low, but this is a low margin sector. This is a profitability rule that acknowledges very few firms will shoot the lights out on margins but a trend of decent profitability is a must.

- Turnover forecast to grow in the next one and two years - Sales growth is essential in retail, so this is a rule that strips out firms that are expected to see a fall in sales.

- Forecast price/earnings ratio less than 20x - With share prices falling and earnings holding up better than expected in places, it’s possible that some shares have become under-valued. This rule focuses on a range where the cheapest shares are likely to be found.

Here are some of the shares that pass these kinds of rules:

Name | Market cap £m | Operating margin 5y av. | Forecast sales growth % | Forecast P/E ratio | Relative price strength (3m) | Relative price strength (1y) |

322.8 | 12.4 | 28 | 8.4 | 86.2 | 52.9 | |

140.7 | 7.9 | 7.8 | 10.6 | 49 | -10.4 | |

8,337.10 | 9.1 | 13.5 | 12.5 | 47 | -14.6 | |

297.7 | 8 | 6.7 | 20.2 | 33 | -13 | |

91.8 | 6.7 | 17 | 18.9 | 26.9 | -25.9 | |

2,903.10 | 5.6 | 6.9 | 9.2 | 24.8 | -34.6 | |

2,073.00 | 5.1 | 21.8 | 19.9 | 24.4 | -6 | |

4,383.10 | 10.4 | 6.1 | 12 | 23.7 | -23.5 | |

1,626.40 | 9.9 | 6.1 | 16.1 | 7.8 | -21.4 | |

3,633.60 | 6.7 | 13.6 | 10.1 | 7.3 | 2.9 |

With the exception of greetings merch firm Card Factory (LSE:CARD) and sports and fashion group Frasers Group (LSE:FRAS), all these shares have underperformed the FTSE All-Share on a one-year basis - in some cases very sharply. But the nearer-term three month performances have been much better. For the most part, they are all accelerating away from the market average, which is an eye-catching signal.

Another observation is that with the exception of online bathroom supplies firm Victorian Plumbing (LSE:VIC), which also has the highest PE ratio at 20.2x, they all have a bricks and mortar offering. In a number of cases they’ve developed strong online - or omnichannel - sales platforms, but they all have physical stores one way or another. And in some instances - such as with Marks & Spencer (LSE:MKS) - new store developments are an important part of the growth plan.

- Stockwatch: the yield curve and what it tells us about the stock market

- Six value share tips for 2023 – and beyond

This goes very much against a strong theme in retail in recent years, where many wrote off the prospects of traditional store-based chains. Now, it seems, some like Next (LSE:NXT), JD Sports Fashion (LSE:JD.), Frasers Group (LSE:FRAS)and others, are showing how multi-channel retail may be more appealing to customers than internet-only.

For investors, this is a part of the market that tends to be much more familiar than most, simply because we’re often customers of these companies. We all have opinions and preferences, which makes this an unusually personal place to be investing.

Over the past three years, this sector has experienced some spectacular highs and lows. Anticipation of an improving outlook - whenever that comes - will likely see a resurgence for shares in the sector. Keeping an eye on those that are tapping in to what customers want - and have the financial metrics to prove it - could be one way to play it.

Ben Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.