Richard Beddard: why these shareholders will continue to prosper

This company has been a great investment over the years and the shares recently hit a record high. Our columnist is a firm believer in the business which he thinks remains a good long-term investment.

20th October 2023 15:00

by Richard Beddard from interactive investor

Goodwin makes things other companies would find difficult to do, either because they do not have the resources, because they have not worked out how to, or because Goodwin (LSE:GDWN) already fills the niche.

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

Its foundry is one of only a handful in the West that can cast advanced steel castings in sizes up to 35 tonnes. The submersible pumps Goodwin manufactures in India work in the harshest mining conditions, and the check valves it makes for oil and gas pipelines are patented. It processes minerals into raw materials for jewellery and tyre casting, an industry it dominates.

Numbers do not tell the whole story

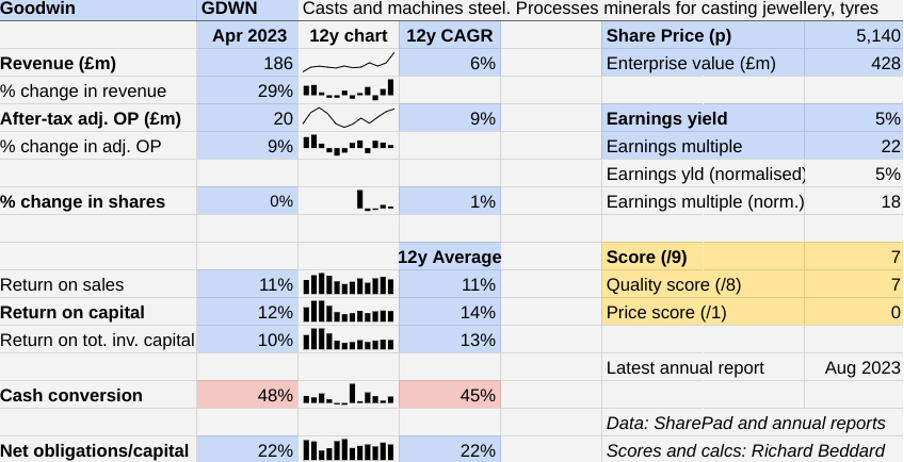

In the year to 2023, revenue and profit increased by 29% and 9% respectively, although 12% return on capital still lags the company's long-term average.

Goodwin was more profitable a decade or so ago when investment in oil production was strong, but those profits slumped after the oil price crash of 2015.

The company has dedicated itself since then to diversifying the steel foundry and machining businesses, developing new products, and starting up new businesses.

Investment is a cost, and over the past decade or so Goodwin has spent an average of nearly 70% of operating cash flow on capital expenditure. Impressively, this has still enabled it to finance a growing dividend.

This investment partly explains Goodwin’s below-average profitability in recent years. The cost hits the cash flow statement immediately but is spread out in the profit and loss account over many years, which explains the company’s weak cash conversion ratio, the only red flag in my collection of statistics.

The Crux

The crux issue for shareholders is whether these investments will pay off.

It seems that increasing the capacity of the foundry, now capable of manufacturing large technically advanced castings of up to 35 tonnes, is already being justified.

In 2023, order intake increased 68%, mostly from new customers in the nuclear and defence industries, although Goodwin Steel Castings also received an uptick in valve orders for Liquefied Natural Gas (LNG) projects.

Goodwin Steel Castings has lost money for much of the last decade, but that may be about to change. The company says its investments “look set to repay the faith the Board has in the company and after a long drought, they should now meaningfully contribute to the Group’s performance...”

- Stockwatch: a near-model growth stock, but for how long?

- Insider: a £1.6m share buying spree after price plunges

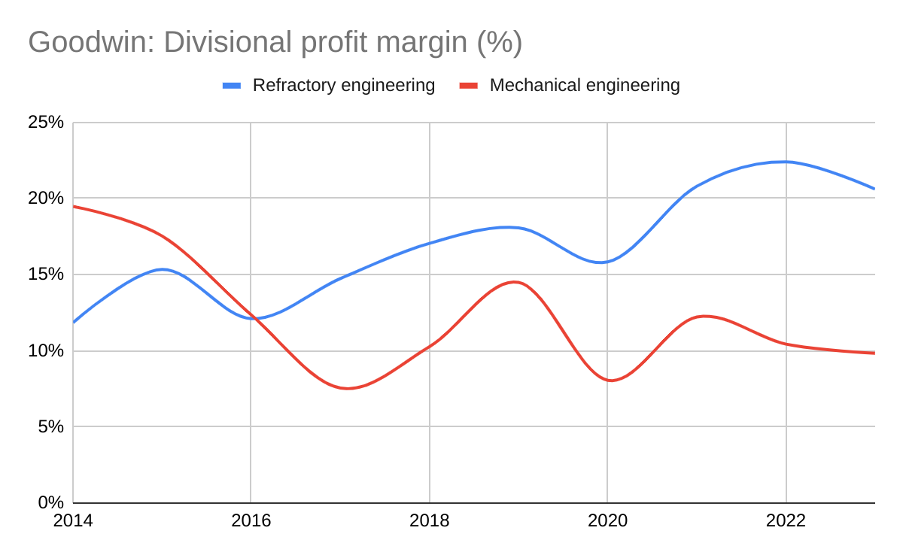

Profit margins in the Mechanical Engineering division that incorporates Goodwin Steel Castings and its sister company Goodwin International, a machine shop, should improve as volumes ramp up. After a near decade-long hiatus, the company predicts Mechanical Engineering will once again displace the growing Refractory Engineering division as the larger contributor to profit.

Refractory Engineering includes the mineral processing businesses.

Source: Goodwin Annual reports

2022’s annual report promised much from EASAT, which also sits in Mechanical Engineering and makes air traffic control systems. It said: “there will be workload, the likes of which readers of their [EASAT’s] accounts for the past thirty years have never seen,” but there is no mention of this activity in the 2023 report.

Goodwin tells me the new orders it anticipated, worth £47 million, have not been lost but neither have they been won yet. It remains “highly confident” that it will land them partly because EASAT is a vertically integrated business, which can produce systems at lower cost than competitors, some of which are systems integrators.

It is also circumspect about its latest, and biggest investment in a new business area, Duvelco, because it is not yet operating commercially. Duvelco will manufacture a polymer that can withstand very high temperatures, and it should be operational on schedule next summer.

Also notable is the growing profit contribution of AVD, a fire extinguishing agent developed in-house and made from vermiculite, one of the minerals Goodwin’s Refractory Engineering division processes.

AVD extinguishes lithium-ion battery fires more effectively than water by smothering them with a vermiculite film suspended in a mist sprayed from an extinguisher or sprinkler system.

- Stockwatch: these shares discount a recession but which one to buy?

- Richard Beddard: a high-ranking stock defending national security

Goodwin reports that now it has achieved certification from Underwriters Laboratory, a testing company, it can sell the product in the USA and some other export markets it previously could not, which has resulted in a surge in orders for AVD and AVD extinguishers in the first two months of 2023.

The company also has high hopes for patent pending X-SIL, an investment powder used in the process of casting moulds for jewellery, that does not contain respirable crystalline silica, a health hazard that requires manufacturers to follow strict dust extraction and respiratory protection protocols.

Goodwin is the global market leader in investment casting powders, but if X-SIL catches on it could increase its market share further.

Scoring Goodwin

Goodwin always appears to be up with events. The company started diversifying before the oil price crash, it fixed interest rates on a large loan while they were historically low, and it has invested heavily in solar as it aims to decarbonise the business by 2035.

The company’s commitment to environmental sustainability is more evidence of a long-term investment-led ethos. The costs of being a big emitter are likely to grow, and seeing this coming Goodwin is investing now. Being more self-sufficient in energy also reduces its exposure to feverish global energy markets.

Goodwin has already achieved a near 25% reduction in its electricity bill through solar installations, and once planning considerations have been overcome, it has the ability to use solar and wind to reduce it much further. By 2035, its operations should be substantially decarbonised, only relying on offsetting for 8% of energy use (by planting trees on land the company has already purchased). The rest will be supplied by solar, wind and hydrogen.

Hydrogen is a potential sticking point. Goodwin needs to replace natural gas as the energy source of the most intensive processes, responsible for about 40% of emissions.

The company says that without government grants to reduce the cost of the electrolysis machines that convert water into hydrogen, hydrogen power is not commercially viable. After two failed grant applications, the project is on hold. Hopefully in time the cost will come down, or government incentives will bridge the gap.

The company’s self-sufficiency goes beyond the integration of the businesses it operates. For example, Goodwin says it is coping with labour shortages because few of its highly trained employees leave, while its apprentice school continues “to feed the group’s requirements with eager engineers.”

Revenue growth has yet to match the growth in the order book, profit growth is lagging revenue growth because of the low volumes going through factories as orders ramp up, and cash flow lags profit growth.

Glass half-full? This is the nature of innovative capital-intensive businesses, and shareholders will continue to prosper from mostly wise investments.

Glass half-empty? Goodwin has raised our expectations but may have invested unwisely.

Everything I know about Goodwin’s long-term ethos, and the fact the Goodwin family has the most to lose as the largest shareholder, means my glass is half-full.

Does the business make good money? [2]

+ Decent return on capital

+ Decent profit margin

? Cash gobbled by investment

What could stop it growing profitably? [1]

? Recession/government spending

+ Rare capabilities limit competition

? Complexity

How does its strategy address the risks? [2]

+ Investment in Diverse customers/end markets

+ Vertical integration and innovation

? Large board, with divisional managing directors

Will we all benefit? [2]

+ Experienced board, incentivised by ownership

+ Loyal workforce

+ Decarbonising

Is the share price low relative to profit? [0]

+ No, it seems fair. A share price of £51.40 values the enterprise at about £428 million, 18 times normalised profit.

A score of 7 out of 9 indicates Goodwin is a good long-term investment.

It is ranked 14 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Goodwin

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.