Richard Beddard: A winning stock? You be the judge

12th May 2023 14:55

by Richard Beddard from interactive investor

This UK company has performed as well as Apple over the past five years and now sits near a record high. Our columnist offers his opinion on prospects and gives the business a score.

In the year to December 2022, Judges Scientific (LSE:JDG) made its biggest acquisition by far, which triggered a feeling of anxiety in me.

Judges is the result of 20-odd acquisitions in as many years, and although they have been universally successful, GeoTek is by far the biggest. The £80 million cost was close to the total cost of all Judges’ previous acquisitions.

GeoTek is also perhaps Judges most complicated subsidiary because it provides services as well as equipment.

It manufactures instruments that analyse geological cores. They are bought or rented by universities and oil and gas exploration companies.

- Learn more: SIPP Portfolio Ideas | How SIPPs Work | Transfer a SIPP

Oil and Gas is a cyclical industry, so GeoTek may introduce more volatility into Judges’ results, and difficult though it may be, governments would like to wean their economies off fossil fuels.

Short-term bump

Judges’ track record suggests GeoTek is a good addition, but it is sufficiently different in terms of scale and business model to make me cautious.

No doubt it has resulted in a short-term bump to profit, but it has also left the company with higher bank borrowings than usual, and because Judges had a second instalment to pay at the year-end, the prospect of more cash outflows in 2023.

The value of the company's financial obligations (including leases) net of cash is much more than the value of the tangible capital required to operate the business, which is on the face of it a fearsome statistic.

Indebtedness appears to be so high because Judges does not require much capital to operate. The scientific instruments it makes are very specialised and not made in large volumes in cavernous factories.

Judges has been a very reliable earner and, should it choose to, it could perhaps earn enough cash to pay off all these obligations in three or four years even if it only earned the average of its last five years of free cash flow.

That is probably a pessimistic scenario as the company is a bigger business and cash flow was depressed in 2022 when, like many companies, Judges invested in stock at a time of shortages.

It also financed high levels of receivables after a strong year end and doubled capital expenditure to refurbish two factories, which reduced free cash flow.

Buy and build

Judges acquires manufacturers of scientific instruments. These are niche businesses that supply universities and researchers in industry.

Although these are specialist markets, there is global demand. The company only earns about 12% of revenue in the UK, and the rest is spread fairly evenly between Europe, North America, and the rest of the world.

It targets businesses with owners that want to retire, and managers that can take over.

It continues to operate them as separate businesses with a central finance function that ensures they have capital to grow, gives employees more opportunity for promotion, and creams off surplus cash to repay borrowings and set the company up for the next acquisition.

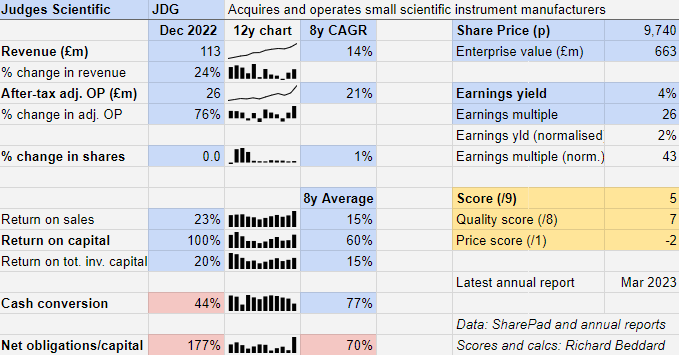

This straightforward, repeatable strategy has enabled Judges to achieve a 14% Compound Annual Growth Rate (CAGR) in revenue over the last eight years, and a 21% CAGR in adjusted profit.

The figures are juiced by revenue and profit due to the acquisition of GeoTek, but before that acquisition its long-term growth rates were comfortably in double digits.

Stressing about debt

Because Judges mostly uses debt to fund acquisitions, the company has been the beneficiary of low interest rates for most of its history. It has been able to borrow at around 3% to fund sometimes uncontested acquisitions in private markets that pay for themselves in only a few years.

How the business model holds up when interest rates are higher, as they may be for some time, is another matter. Judges has fixed the interest rate on its existing debt at 5%, and aims to borrow at between 3% and 6%, but it will find the difference between the returns it earns from acquisitions and the interest it pays to finance them diminishes if it is forced to borrow at higher rates.

If it becomes more difficult to fund acquisitions generally, though, Judges’ competitors in private equity will be suffering more because they rely more heavily on borrowing. Fewer acquirers might force companies for sale to lower their asking prices.

Reassurance may be found in the example of Halma, a larger buy and build business founded during conditions its founder described as the "economic blizzard" of high inflation and high interest rates in the early 1970s.

Somehow Halma managed to juggle the cost of acquisitions with the returns it earned from them to achieve impressive growth, and it is still doing pretty well today.

In any case, although Judges has already made a couple of small acquisitions since GeoTek, it is unlikely it will follow up with another sizable one for a year or two as it has used up some of its firepower.

Reputation, reputation, reputation

Judges has a long history of successful acquisitions, partly because of its reputation for straight dealing.

David Cicurel, its founder, chief executive, and dealmaker, says he never tries to re-negotiate once terms have been agreed, a practice that wastes time and money when deals fall apart.

Although he is well into his seventies, the company has been strengthening the board. Alongside a longstanding chief financial officer, it recruited a chief operating officer five years ago, and a business development director in February.

Both of them were recruited from Halma, so they have seen how the buy and build model works at a company that has done it longer and grown bigger.

Pulling off such a large acquisition, albeit at the upper limit of the company's self-imposed price range (3 to 7 times Earnings Before Interest and Tax (EBIT)) will be a remarkable achievement if it performs as well as the smaller acquisitions.

But it is a risk, and the shares are pricey...

Scoring Judges Scientific

Does the business make good money? [2]

+ High return on capital

+ High Profit margin

+ Strong average cash conversion

What could stop it growing profitably? [1]

? Unusually high level of borrowing currently

+ Niche markets, limited competition

? Rising cost of borrowing

How does its strategy address the risks? [2]

+ Pays down borrowings

+ Targets global niches

+ Unlikely to overpay for acquisitions

Will we all benefit? [2]

+ Experienced owner manager, strong board

+ Executive pay not excessive

+ Reputation

Is the share price low relative to profit? [-2]

No. A share price of £97.40 values the enterprise at about £663 million, 43 times normalised profit.

A score of 5 out of 9 indicates Judges Scientific probably is a good long-term investment, but it is ranked 38 out of 40 stocks in my Decision Engine. There are lots of good companies trading at lower valuations, to invest in.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Judges Scientific

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.