Saltydog Investor ventures into this China fund

Saltydog analyst sells a tech fund from his demonstration portfolio and invests the proceeds in China.

13th July 2020 13:42

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog analyst sells a tech fund from his demonstration portfolio and invests the proceeds in China.

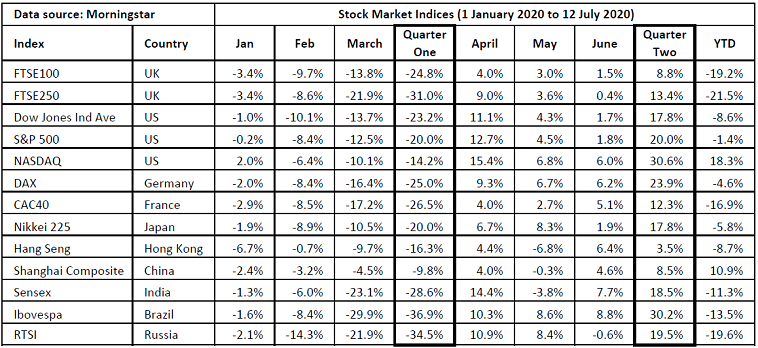

Last week we looked at a selection of indices showing the performance of global stock markets during the first half of the year. It wasn’t a pretty sight.

Between 1 January 2020 and 30 June 2020 only one was showing a gain, the Nasdaq Composite which was up 12.1%. The worst was the FTSE 250, down 21.8%, and the FTSE 100 had not fared much better, losing 18.2%.

I have now updated the table to cover the first 10 days of July.

Past performance is not a guide to future performance.

Unfortunately, the FTSE 250 is still showing a drop of over 21%, and the FTSE 100 has fallen a further one percent.

However, there is now another index that is ahead of where it was at the beginning of the year. Since 1 July 2020, the Shanghai Composite Index has gone up by over 13% and is now the highest that it has been all year.

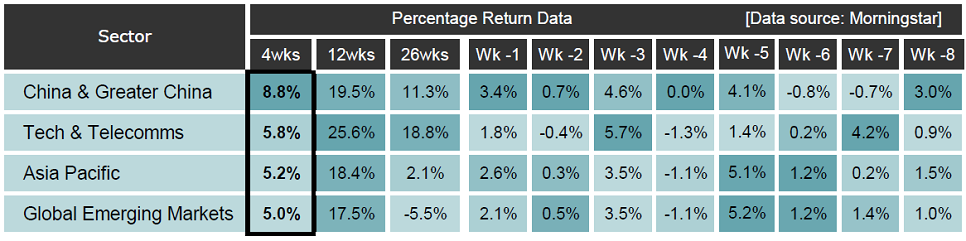

In our weekly analysis we look at the relative performance of the Investment Association sectors. In the aftermath of the stock market crash at the end of February/beginning of March, the Technology and Telecommunications sector was the first to recover. Over the last couple of months, we have also seen the Chinese and the Emerging Market sectors starting to perform well.

When we analysed our reports last week, the China and Greater China sector was actually ahead, based on its return over the last four weeks.

Past performance is not a guide to future performance.

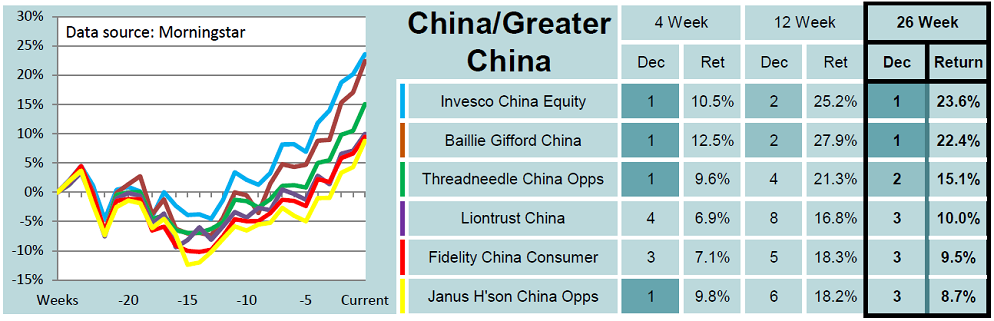

In our demonstration portfolios we invested in a couple of funds from the Technology and Telecommunications sector during April. Last week both holdings were showing gains of more than 15%.

We have now sold one of these funds and invested in a fund from the China & Greater China sector.

Past performance is not a guide to future performance.

The leading fund over 26 weeks was Invesco China Equity, but in the end, we opted for the Baillie Gifford China fund, which has done slightly better over 12 and 26 weeks.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.