The ‘standout’ UK fund we own

As other markets hit new highs, returns in the UK have lagged. But Saltydog thinks it has a winner in this fund.

25th March 2024 15:00

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

The UK stock market has been struggling for quite some time compared with other developed markets.

In 2023, the FTSE 100 rose 3.8% and the FTSE 250 made 4.4%. However, elsewhere in Europe the French CAC40 rose by 16.5% and the German DAX did even better, gaining 20.3%.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

In the US, the Dow Jones Industrial Average ended the year up 13.7%, while the S&P 500 made 24.2%, and the Nasdaq rose by an impressive 43.4%. The Japanese Nikkei 225 jumped 28.2%.

This year, all these overseas indices have already gone on to set new records, while the UK markets have yet to reach the highs they made just over a year ago. Fortunately, in the last month we have seen a significant uplift. At the end of last week, the FTSE 100 was showing a month-to-date gain of 3.9%, while the FTSE 250 was up 3.5%.

In February, the Office for National Statistics (ONS) reported that the UK fell into recession in the second half of 2023. A recession is usually defined as a decrease in gross domestic product (GDP) over two consecutive quarters. The UK’s GDP shrank by 0.3% in the final quarter of the year following a fall of 0.1% in the previous three months.

Although disappointing, this downturn was not a great shock. The decline in the last three months of 2023 was driven by decreases across major sectors of the economy: services output decreased by 0.2%, production output fell by 1%, and construction output declined by 1.3%. The overall annual growth for 2023 was estimated at just 0.1%, which is the weakest annual change in real GDP since the financial crisis in 2009, apart from 2020 which was severely impacted by the Covid-19 pandemic.

- Interest rates held again: how does the UK compare to other nations?

- Bond Watch: Bank inches closer to rate cuts with three expected in 2024

- Seven last-minute hacks for tax year end

It was therefore reassuring to see that their latest report, which came out earlier this month, showed that monthly GDP is estimated to have grown by 0.2% in January. Services output grew by 0.2% and construction output by 1.1%. Unfortunately, production output fell by 0.2%. Over the three months to the end of January, GDP is still down 0.1% but at least it is now heading in the right direction.

The Office for Budget Responsibility (OBR) was more encouraging in its latest forecast, which was published alongside the Spring Budget. They pointed out that since the November forecast, inflation had fallen faster than they had expected, which is why markets are now expecting a sharper decline in interest rates. In their executive summary, they said that “this strengthens near-term growth prospects and should enable a faster recovery in living standards from last financial year’s record decline”. It predicted that the UK economy will grow by 0.8% this year, 1.9% next year and 2% in 2026.

There was more good news last week. Inflation in February dropped to 3.4%, down from 4% in January, and interest rates have been kept on hold. Andrew Bailey, the governor of the Bank of England, has said that reductions in borrowing costs “are on the way”.

Perhaps now is a good time to have another look at the funds investing in UK companies.

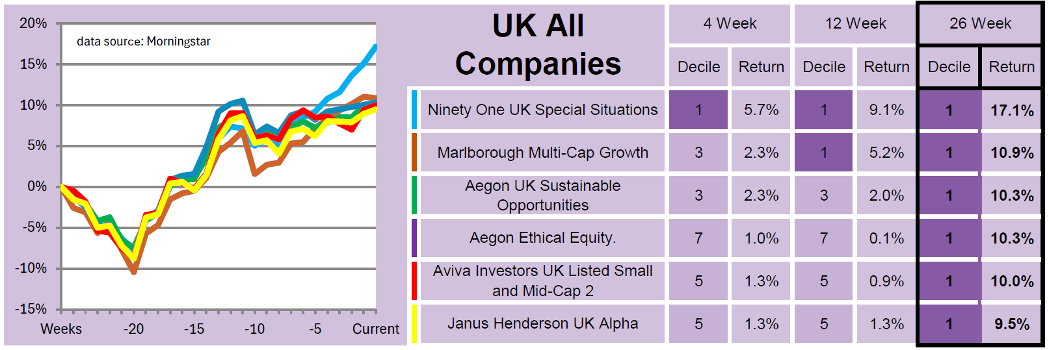

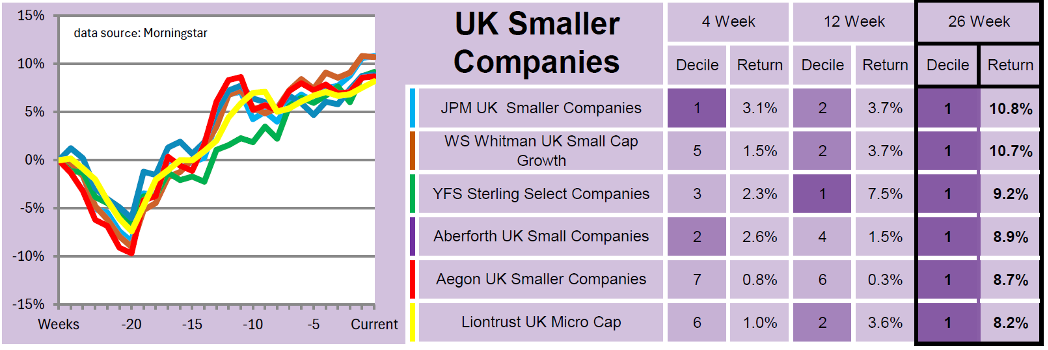

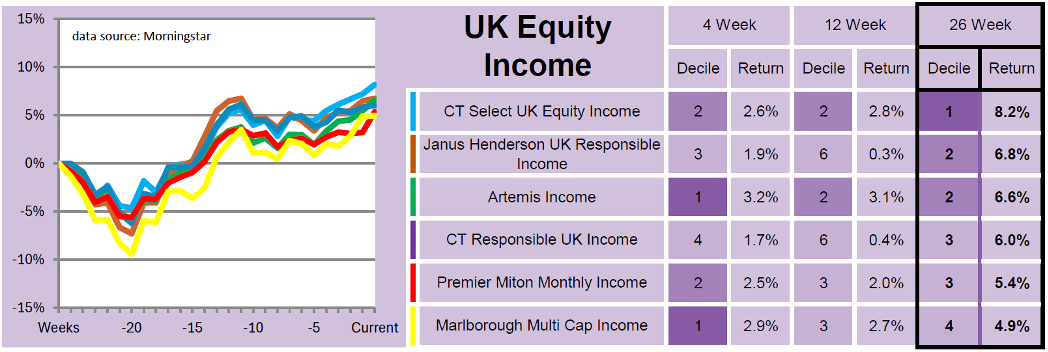

Funds investing in UK equities fall into three Investment Association (IA) sectors: UK All Companies, UK Smaller Companies, and UK Equity Income.

Here are three tables, from last week’s Saltydog performance reports, highlighting the leading funds in each of these sectors over the previous 26 weeks.

Past performance is not a guide to future performance.

Past performance is not a guide to future performance.

Past performance is not a guide to future performance.

We tend to focus on the best-performing funds in each sector because these are the ones we believe our members are most likely to want to invest in. From time to time, it is interesting to see how the worst funds in each sector are doing, just to get a feel for the difference.

Over the same time frame, these were the funds with the lowest 26-week returns:

- In the UK All Companies sector,abrdn UK Value Equity with a 4.2% loss

- In the UK Smaller Companies sector, Premier Miton UK Smaller Companies with a 4.1% loss

- In the UK Equity Income sector, abrdn UK Income Unconstrained Equity with a 6.3% loss.

It just goes to show that although it is important to be invested in the right sectors, you also want to ensure you are in one of the best-performing funds.

The standout fund from these sectors over the last six months has been Ninety One UK Special Situations.

Our Ocean Liner portfolio invested in this fund last year, in early December, and we added to our position in February. Last week, we increased our holding again, and at the same time introduced this fund into our Tugboat portfolio.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.