Still time to buy these two dividend-paying energy rivals

18th May 2022 07:02

by Rodney Hobson from interactive investor

They’ve been backed here before, but energy stocks could generate even better returns for shareholders thinks our overseas investing expert. There’s an update on Peloton Interactive too.

Soaring fuel prices, pressures to produce greener energy and an inflationary squeeze on consumers have made life difficult for regulated electricity suppliers. Duke Energy Corp (NYSE:DUK) and Evergy Inc (NYSE:EVRG) have come through the first quarter of 2022 relatively well but the full crunch has yet to be felt.

Duke’s total revenue rose 16% to $7.1 billion compared with the same three months of 2021, beating expectations, with regulated electricity, which accounts for more than four-fifths of the business, increasing revenue by a commendable 13.7%. The number of customers edged up 1.8% and Duke sold 5.9% more electricity over the quarter. The biggest revenue boost came, unsurprisingly, from the natural gas business which saw wholesale prices soaring.

Alas, operating expenses were also ramped up mainly by the higher cost of fuel used to generate electricity, coming in 24.6% higher at $5.9 billion. Interest charges were also higher, an ominous warning of things to come given that debt edged up to $62 billion in the quarter.

- How high could US interest rates really go?

- Recessions are becoming more likely – here’s how to invest

- Warren Buffett: stocks I’m buying and AGM comments

The outcome was a disappointing fall in net income from $953 million to $818 million, leaving a question mark over the company’s assurances that it would still meet its earlier earnings forecast for the year.

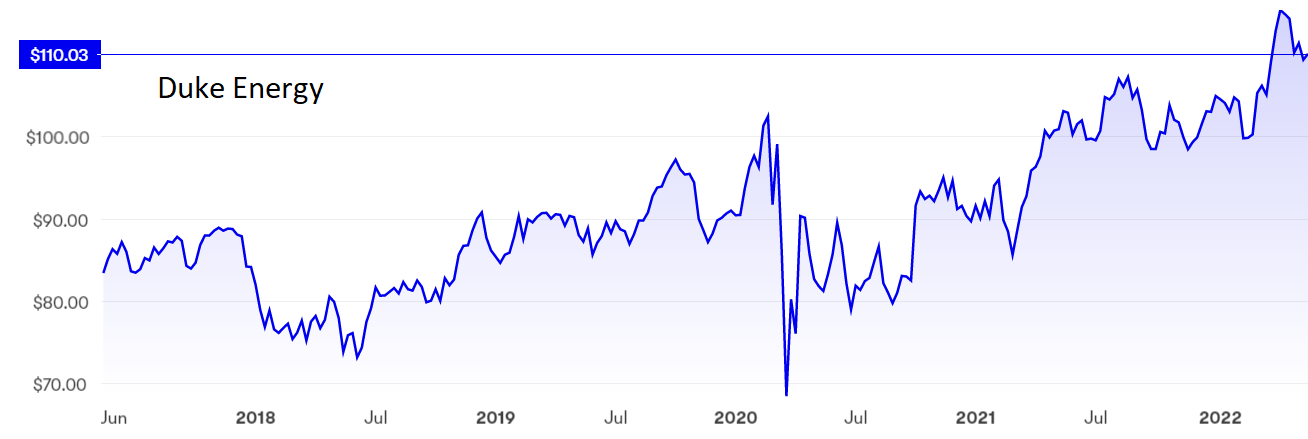

The shares slipped on the figures from a peak of $115 but are still holding up well around $110, where the yield is 3.6%.

Source: interactive investor. Past performance is not a guide to future performance.

Rival Evergy actually saw revenue drop 24% to $1.22 billion in the quarter, but operating expenses were down 25%, so adjusted profits were up 5.5% as margins improved. In another favourable contrast with Duke, debt and interest paid on it was slightly lower.

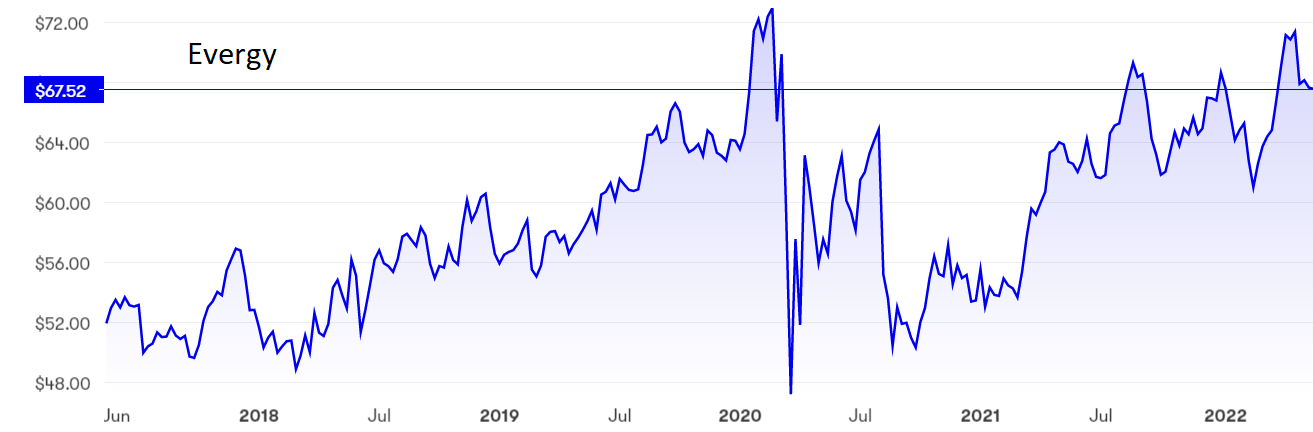

Evergy now stands at $68 compared with a peak of $73 set just over two years ago. The yield is 3.3%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I first recommended Duke at $87 back in May 2019 and have retained the buy stance several times since. Despite the difficulties, this stock has defensive qualities and pays a decent dividend. It is still a buy. So is Evergy, which I suggested buy below $65 just over a year ago. Since then there has been a small but useful share price gain plus the worthwhile dividend.

Update: From one form of energy to another. Customers of exercise equipment maker Peloton Interactive Inc (NASDAQ:PTON) have to pedal fast to go nowhere but that is a better performance than the company itself, which is spinning backwards at an accelerating speed. Total revenue slumped 24% year-on-year to below $1billion and net losses multiplied alarmingly from $8.6 million to $757.1 million.

Most of the decline has come in the sale of new equipment, which is piling up in the warehouse, but there has been a sharp slowdown in subscriptions to fitness programmes. Don’t count on even the meagre 1% rise in subscriptions that the company expects in the current quarter, which is likely to see another 25% fall in total revenue.

The cash pile has shrunk to $879.3 million, hardly enough to cover a quarter’s net losses, and new chief executive Barry McCarthy has quickly borrowed $750 million to buy more time. He hopes selling off the stored inventory will help to ease cash flow.

- Chart of the week: a cyclical sector to outperform technology

- Want to buy and sell international shares? It’s easy to do. Here’s how

If there was any doubt about whether Peloton was a pandemic fad, it is now crystal clear that this was indeed the case. The shares have lost 90% of their value since they peaked at $180 in December 2020. They look set to continue careering downhill.

I warned investors three months ago to avoid Peloton and that the only hope for existing shareholders was a takeover bid. With no such bid having emerged, sell.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.