Stocks already benefiting from a green industrial revolution

Learning from politician, lawyer and philosopher Cicero may accelerate investment into clean energy.

8th June 2020 13:05

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Learning from Roman politician, lawyer and philosopher Cicero may accelerate investment into clean energy.

Plans for a cleaner future

I recently came across a list of quotations made by Cicero in the year 55 BC, and I was struck by how relevant some are today, especially while we are immersed in the coronavirus pandemic.

- “The safety of the people shall be the highest law.”

- “Gratitude is not only the greatest of virtues, but the parent of all others.”

- “If you are fortunate enough to have a garden and a library, you have all you need.”

This final one is more relevant as we emerge from the crisis.

- “The budget should be balanced, and the treasury should be refilled. Public debt should be reduced, and the assistance to foreign lands should be curtailed, lest Rome become bankrupt. People must again learn to work, instead of living on public assistance.”

In one of his first speeches as new MP, Rishi Sunak said,

“Under this government Britain will live within its means. No more irresponsible borrowing, no more spiralling debt at the taxpayers’ expense, no more passing the debt to the next generation.”

He could never have imagined that less than five years later he would be the Chancellor of the Exchequer, announcing record levels of government spending to support the country through lockdown.

More money will be required to kickstart the economy, but where’s the best place to spend it?

Last week, The Times reported that he “is planning a ‘green industrial revolution’ to help to create jobs for people who are made redundant because of the pandemic.

The chancellor is preparing to bolster the government’s investment in clean energy as part of an economic stimulus package next month. There could also be a fund to help to ‘reskill’ workers so they can get green jobs in areas such as insulation upgrades, offshore wind and carbon capture.”

This would seem to make sense. The government would have the opportunity to help people who have lost their jobs, invest in infrastructure and at the same time meet some of its manifesto promises. It’s already committed to generating two million jobs in clean energy over the next ten years, and it could now go even further.

Last year, the UK passed a law saying that we would have ‘net zero’ carbon emissions by 2050. The right decisions now could make that task a lot easier.

At the end of January, I wrote about a couple of innovative companies involved in the production of hydrogen and its conversion into energy.

They had made astronomical gains over the previous twelve months and I asked the question as to whether the “boat had sailed” for making investments into businesses involved in the production and conversion of “waterfuel” into electricity.

- Two AIM stocks, funds and a ground-breaking technology

- Want to invest ethically? ii’s ACE 30 list of ethical investments can help

Recently I have read about further developments in this technology.

I knew that one island in The Orkneys was using tidal energy and electrolysis to convert seawater into liquid hydrogen, and that all the government vehicles and buildings ran on hydrogen. Now, this approach is being moved to the other islands and is now available for use in private housing.

An obsolete North Sea oil rig has been converted to do a similar thing and the hydrogen is pumped ashore down an existing oil pipeline.

There is also a steel mill in Sweden that has converted from petroleum gas to hydrogen gas, and the Australian National bus company is converting all its vehicles to run on hydrogen.

Last week, the Nikola (NASDAQ:NKLA) was listed on the Nasdaq. This company has ambitious plans to develop and manufacture hydrogen-powered electric trucks.

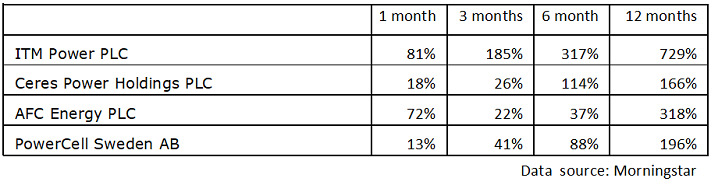

I now follow the progress of a number of companies working in this area and the table below shows their recent performance up until the end of May.

At Saltydog, we do not invest into individual stocks in our portfolios, but stick to funds where the risk is spread among many companies.

Hopefully, the technology funds that we report on are up to speed with the future changes to energy production, as we come towards the end of the era of oil and carbon-based fuels.

Also, we have not done any further checks on the companies listed above and this should not be seen as a recommendation. However, I do hold some of these companies in my personal portfolios.

Source: TradingView. Past performance is not a guide to future performance.

Source: TradingView. Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.